As the US presidential election approaches, it’s worth examining how previous elections have impacted the price of Bitcoin. Historically, the US stock market has shown notable trends during election periods. Given Bitcoin’s correlation with stocks, most notably the S&P 500, these trends could provide insights into what might happen next.

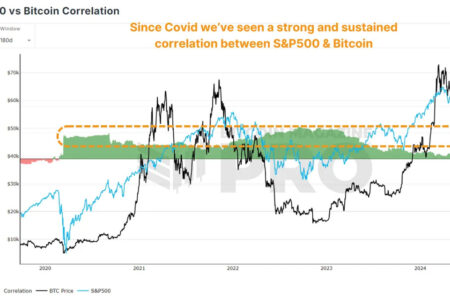

S&P 500 Index Correlation

Bitcoin and the S&P 500 have historically held a Strong connectionespecially during Bitcoin bull cycles and periods of risk-off sentiment in traditional markets. This phenomenon may come to an end as Bitcoin matures and “decouples” from stocks and becomes a speculative asset. However, there is no evidence yet that this is the case.

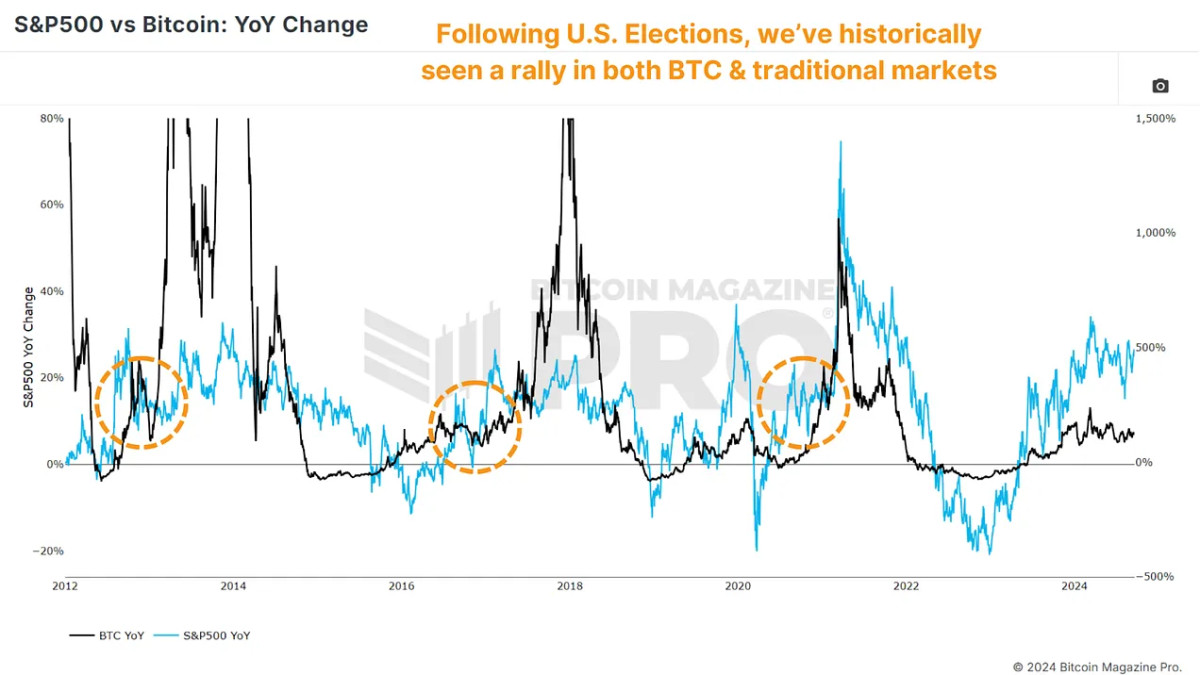

Outperforming after the election

The S&P 500 reacted generally positively to the U.S. presidential election. This has been a consistent pattern over the past few decades, with the stock market often seeing big gains in the year following an election. S&P500 vs Bitcoin Year-on-Year Chart We can see when the election will take place (orange circles), and the price action of BTC (black line) and the S&P 500 (blue line) in the following months.

2012 Election: In November 2012, the S&P 500 saw an annual growth of 11%. One year later, that growth had risen to about 32%, reflecting a strong post-election market rally.

2016 Election: In November 2016, the S&P 500 was up about 7% year-over-year. A year later, it was up about 22%, again showing a big post-election boost.

2020 Election: The pattern continued into 2020. The S&P 500 was up around 17-18% in November 2020; by the following year, it had risen to nearly 29%.

A modern phenomenon?

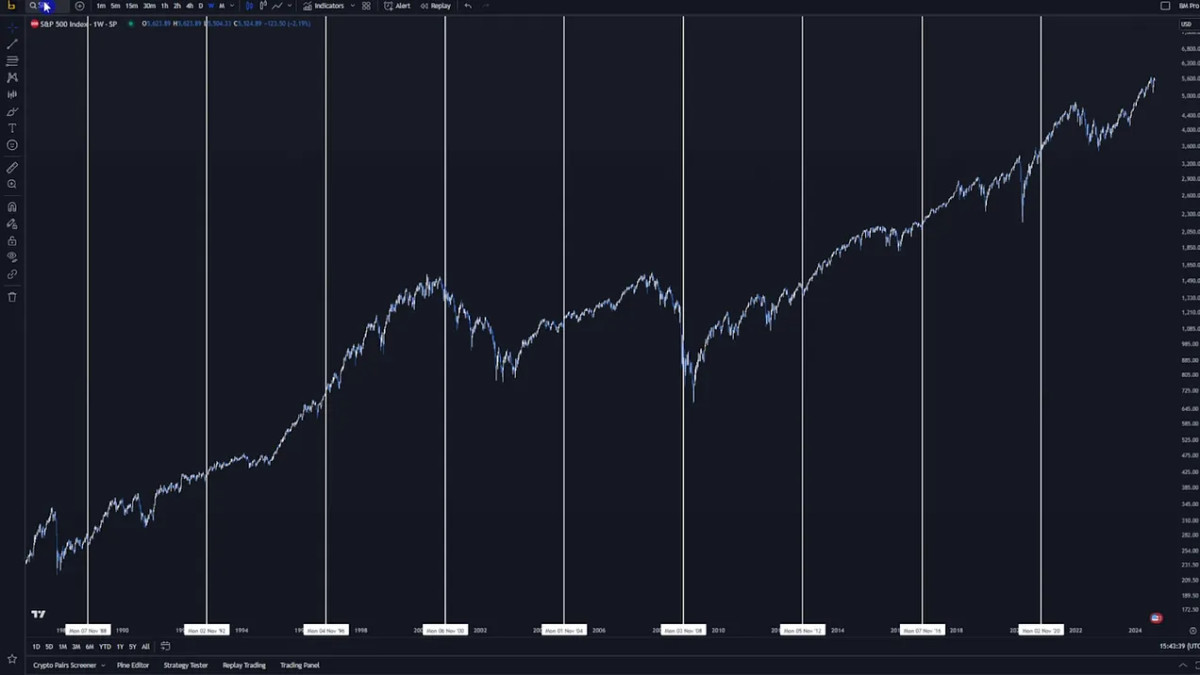

This isn’t limited to the past three elections when Bitcoin was around. For a larger data set, we can look at the previous four decades, or ten elections, of S&P 500 returns. There has only been one year that saw negative returns twelve months after Election Day (2000, when the dot-com bubble burst).

Historical data suggests that the winning party, whether Republican or Democrat, does not significantly impact these positive market trends. Instead, the upward momentum is more about resolving uncertainty and boosting investor confidence.

How will Bitcoin react this time?

With the 2024 US presidential election approaching, it is tempting to speculate on the potential performance of Bitcoin. If historical trends continue, we could see significant price increases. For example:

If we see the same percentage gains in the 365 days after the election as we did in 2012, Bitcoin could go to $1 million or more. If we see the same as the 2016 election, it could go to around $500,000, and in 2020 we could see Bitcoin at $250,000.

It is interesting to note that each event resulted in a drop in returns of about 50% each time, so perhaps $125,000 is a realistic target for November 2025, especially since this price and data are in line with the mid-ranges of Rainbow price chartIt is also worth noting that in all of these cycles, Bitcoin actually continued to experience higher cycle peak gains!

conclusion

Data suggests that the period following the US presidential election is generally bullish for both the stock market and Bitcoin. With less than two months to go until the next election, Bitcoin investors may have reason to be optimistic about the coming months.

For a more in-depth look at this topic, check out our recent YouTube video here: Will the US Election Be Positive for Bitcoin?