Inflation eased in India last month, while the rupee fell to a new record low, giving the central bank a reason to remain dovish even as most analysts expect interest rate cuts from February.

Article content

(Bloomberg) — Inflation eased in India last month, while the rupee fell to a new record low, giving the central bank a reason to remain dovish even as most analysts expect interest rate cuts from February.

Article content

Article content

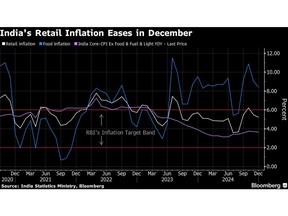

Data from the Ministry of Statistics showed on Monday that the Consumer Price Index rose 5.22% in December from a year earlier, remaining well above the Reserve Bank of India’s target of 4%. The median forecast in a Bloomberg survey of economists was for inflation to slow to 5.3% from 5.48% in November.

Advertisement 2

This ad has not loaded yet, but your article continues below.

Article content

The yield on 10-year government bonds rose seven basis points to 6.85% earlier Monday, and remained unchanged after the inflation data.

Moderating inflation has fueled expectations that newly appointed Governor Sanjay Malhotra will cut interest rates in February to support the slowing economy. The Reserve Bank of India has kept interest rates unchanged for nearly two years.

However, geopolitical factors, including rising oil prices and the US dollar, make it difficult to predict the direction India’s monetary policy will take in the coming months. The rupee has fallen to record levels in recent weeks, falling past the key psychological level of 86 rupees to the dollar on Monday.

Besides the weaker currency, Asia’s third-largest economy, which imports nearly 90% of its oil, is also waiting for energy prices to rise, which could push up its import bill. Strict sanctions imposed by the United States on the Russian oil industry may force India to source more expensive crude from the Middle East, West Africa or North America.

Food inflation

Food prices, which make up about half of the consumer price basket, rose 8.39% from a year earlier, after rising 9.04% in November. Vegetable prices rose by 26.5% compared to the previous year, compared to a rise of 29.3% in the previous month.

Advertisement 3

This ad has not loaded yet, but your article continues below.

Article content

Excluding volatile food and fuel prices, the core measure of inflation fell 3.64%, compared to 3.72% in the previous month, according to Bloomberg Economics calculations.

Aditi Nayar, chief economist at ICRA Ltd, said that with Monday’s reading, the likelihood of a rate cut in February “definitely declined”. However, lower vegetable prices may convince some MPC members to “consider an early cut”. She added: “At the next meeting, with the aim of supporting growth.”

What Bloomberg Economics says

In our view, the central bank needs to cut interest rates significantly to start supporting growth. We expect the RBI to follow up with a 50 basis points rate cut in February, followed by further easing of 100 basis points until 2025. This would raise the interest rate to 5.0% by the fourth quarter of this year.

Abhishek Gupta, Indian economist

For the full report, click here

-With assistance from Ruchi Bhatia and Subhadeep Sircar.

(Updates with market reaction and more details from third paragraph)

Article content