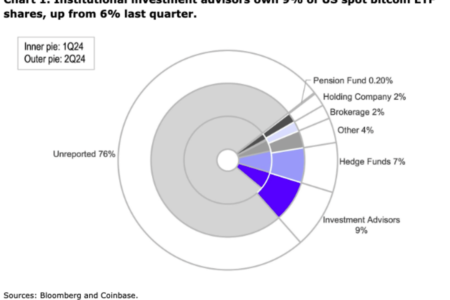

Coinbase has Reported Updated 13-F filings for Q2 2024 indicate a significant increase in institutional inflows into U.S. Bitcoin ETFs, which the firm sees as a “promising indicator” for the Bitcoin market. The 13-F filings, released on August 14, reveal that institutional ownership of these ETFs grew from 21.4% to 24.0% between Q1 and Q2 2024.

Notably, the proportion of ETF shares held by the “Investment Advisors” category rose from 29.8% to 36.6%, indicating increased interest from wealth management firms. Notable new shareholders include Goldman Sachs and Morgan Stanley, which added $412 million and $188 million worth of shares, respectively. Despite the decline in the price of bitcoin during the quarter, net inflows into spot bitcoin ETFs reached $2.4 billion.

“The ETF pool saw net inflows of $2.4 billion during the period, despite total Bitcoin ETF AUM declining from $59.3 billion to $51.8 billion (due to Bitcoin’s decline from $70,700 to $60,300),” Coinbase said. “We believe that continued ETF inflows during Bitcoin’s weak performance could be a promising indicator of sustained interest in cryptocurrencies from new capital pools that ETFs provide access to.”

Coinbase expects this growth to continue as more brokerages complete due diligence on Bitcoin ETFs, particularly among registered investment advisors. However, the report also notes that short-term flows may be moderate due to seasonal factors and current market volatility.

“In our view, we are likely to see continued growth in the proportion of investment advisor holdings as more brokerages complete due diligence on these funds,” the report said. “We may not see immediate large inflows in the near term, as attracting clients may be more difficult during the summer, when more people are on vacation, liquidity tends to be thinner and price action may be volatile.”“.”