(Bloomberg) — Intel Corp. shares fell more than 19% after delivering a slew of dizzying news, including a bleak growth outlook and plans to cut 15,000 jobs, in the latest sign the chipmaker is ill-equipped to compete in the age of artificial intelligence.

Most Read from Bloomberg

The company said Thursday that current-quarter sales would be between $12.5 billion and $13.5 billion. Analysts had expected $14.38 billion on average, according to data compiled by Bloomberg. Intel will lose 3 cents a share, excluding items, compared with expectations for a profit of 30 cents.

Intel said it plans to cut more than 15% of its workforce of about 110,000 employees. It will also suspend dividend payments to shareholders starting in the fourth quarter and will continue to do so until “cash flows improve to sustainable levels,” according to the statement. The company has paid a dividend since 1992.

“I have no illusions that the road ahead will be easy. Nor should you,” CEO Pat Gelsinger said in a memo to employees, calling the moves “some of the most significant changes in our company’s history.”

Despite the company’s massive spending plan to restore Intel to industry leadership, Gelsinger is struggling to improve the company’s products and technologies fast enough to retain customers. The results underscore the steep decline of Intel, which dominated the semiconductor industry for decades and is now having to tout cost-cutting measures and offer reassurance that it can fund growth plans.

“Revenues aren’t where we want them to be, the financials aren’t where we want them to be,” Chief Financial Officer Dave Zinsner said in an interview. The job cuts were necessary “to get us to a place where we have a more sustainable business model for the future.”

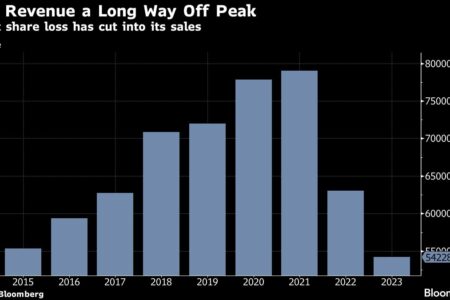

In the second quarter, the company earned 2 cents a share, excluding some items, on revenue of $12.8 billion, down 1%. Analysts had estimated earnings of 10 cents a share and sales of $12.95 billion. Wall Street expects a modest increase in total sales this year from 2024, leaving the company more than $20 billion below its peak in 2021.

AI rivals have won over some of Intel’s customers. Nvidia Corp. now has quarterly sales that are more than double those of its former rival. Advanced Micro Devices, once a struggling competitor, has been valued at $100 billion by investors, and Taiwan Semiconductor Manufacturing Co. is widely recognized as the industry’s best producer.

Gelsinger remains confident that Intel is on the right track in the long run. He argues that Intel’s critical manufacturing business is on track to catch up with and overtake rivals, which will attract customers from abroad and justify the new factories Intel is building. He believes Intel has paid its fair share of the industry’s costs and can now focus on its finances.

Some of Intel’s best chips are made by other companies. Over time, the company hopes to shift more of its chip manufacturing to its own factories, which are being upgraded. The company is also accelerating improvements in chips for AI-powered computers. But for now, the expense is squeezing its overall profit margins, Zenzner said.

Gross profit margin, or the percentage of sales remaining after deducting the cost of production, was 35.4% in the quarter. That metric will remain flat in the current quarter. At its peak, Intel posted a gross profit margin above 60%.

The company is cutting its spending on new plants and equipment in 2024 by more than 20%, and its budget now stands at $25 billion to $27 billion. Next year, spending will be between $20 billion and $23 billion.

Intel shares fell in extended trading after the announcement, after closing at $29.05 in New York. The company has fallen more than 42% so far this year. It is the second-worst performer on the Philadelphia Semiconductor Index this year.

Gelsinger told employees that most of the job cuts, which are also necessary to remove bureaucracy and speed up decision-making, will be completed by the end of the year.

“Our costs are too high, and our margins are too low,” he wrote, saying he would answer employee questions at an internal meeting. “We need bolder action to address both — especially given our financial results and outlook for the second half of 2024, which are more challenging than previously anticipated.”

Intel Corp. was forced to cut its sales forecast for May after the U.S. government revoked its license to supply chips to China’s Huawei Technologies Co., part of Washington’s efforts to cut off business with the company over alleged national security risks.

The chipmaker reported earnings for the second time under a new business structure that shows the financial performance of its manufacturing operations. Gelsinger said the restructuring was a necessary step to make operations more efficient and competitive.

The company reports that revenues are distributed between product groups and manufacturing operations, with factories undergoing a massive modernization and development program that significantly impacts profits.

The company’s revenue is improving in what it calls its Foundry unit, up 4% year-over-year to $4.32 billion. PC chips also grew 9% year-over-year.

Sales of the crucial data center unit, once the most profitable, fell again, down 3% to $3 billion. That unit has yet to achieve anything like Nvidia’s market presence in accelerator chips used in artificial intelligence systems. AI has proven to be a gold mine, undercutting spending on the kind of processors Intel makes.

(Adds comments from CEO from paragraph 9, details of margin erosion.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg LP