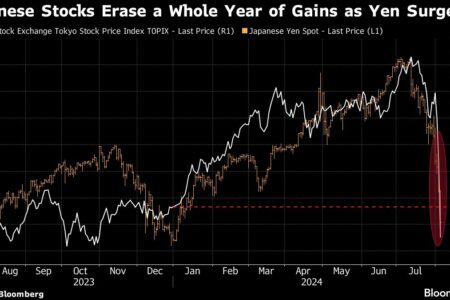

(Bloomberg) — The turmoil in Japan’s financial markets came to a head on Monday, with the yen rebounding about 14% against the dollar from a July low and stocks plunging into a bear market. Yields on benchmark Japanese government bonds fell the most in more than two decades.

Most Read from Bloomberg

The rapid moves continued to surprise investors, hurting everyone from stock and currency traders to hedge funds and big institutions. The plunge in bond yields weighed on bank profits, sending shares of Mitsubishi UFJ Financial Group, the country’s biggest lender, tumbling a record 17%.

The sharp rise in the currency’s value, which has gained momentum since the Bank of Japan raised interest rates on July 31, is also reverberating through global markets as it upends countless investment strategies built on cheap yen borrowing.

“The tricky situation facing Japanese policymakers is that easy monetary policy kills your currency, and the slightest hint of tightening will wreck the stock market,” said Charu Chanana, head of currency strategy at Saxo Markets. She added that the yen could hit 140 against the dollar sooner rather than later if concerns about the risk of a US recession persist, which would add pressure on Japanese stocks.

The Nikkei stock volatility index rose to an all-time high based on data compiled by Bloomberg since 2001. The shakeout reflects a buildup of selling leading to more selling, according to Takehiko Masuzawa, head of equity trading at Philip Securities Japan.

All 33 industry groups represented in the Topix have declined since the Bank of Japan raised interest rates. After falling into a correction on Friday, with a drop of more than 10% from its peak in July, the index has entered a technical bear market and is now down about 24%.

“The decline in stock prices means that companies’ business performance is expected to deteriorate in the future, and if the economy weakens, credit spreads may also face increasing pressure,” said Noritaka Oda, head of the debt distribution division at SMBC Nikko Securities.

The benchmark 10-year Japanese government bond yield fell 20.5 basis points to 0.75%, the highest level since 1999, according to data compiled by Bloomberg.

But the risk-off sentiment isn’t entirely from Japan. The rally in global bond prices that has pushed yields lower largely reflects concerns about the U.S. economic outlook. Concerns are growing that the Federal Reserve is behind the curve on policy support and that global investors are dumping risky assets and heading for safe havens.

The rapid decline in the Japanese stock market is likely to have triggered a massive wave of forced selling among individual investors, deepening the decline.

Marginal long positions among retail investors rose to an 18-year high in late July, even as the Nikkei index slipped from its record peak.

“We are seeing what appears to be forced selling by retail investors. They seem to be getting hit,” said Takatoshi Itoshima, a strategist at Pictet Asset Management. “While it is possible that we are reaching a short-term sell-off, I can’t be sure.”

– With the assistance of Ayai Tomisawa, Aya Wagatsuma, Hideyuki Sano, and Mari Kiyohara.

(Update prices)

Most Read from Bloomberg Businessweek

©2024 Bloomberg LP