Despite a strong US Purchasing Managers’ Index (PMI) release on Friday, the Fed’s money market bets were little changed.

Federal interest rate forecasts

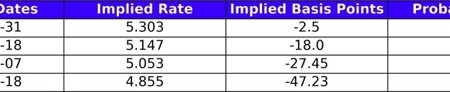

Expectations in the data were for a decline of about 47 basis points by the end of the year, and expectations remained very close to that despite the pace.

It is important to keep in mind that there has been a disconnect between soft data (surveys such as PMIs) and hard data for a while now, and hard data continues to show moderation in growth and inflation.

Therefore, it is not too surprising to see markets sticking to their vision of cutting twice by the end of the year when looking at the bigger picture.

It’s hard to see Friday’s personal consumption expenditures data generating any meaningful buzz unless we see some truly shocking deviations.

With all the political risk premiums in the mix, the dollar wasn’t too fazed, with the DXY dollar index trading very close to the psychological 106.00 level after Friday’s data.