Two large entities for companies pour large money in cryptocurrencies, and companies rise to Bitcoin It does not seem to slow down. Thanks to the bitcoin of 1 billion yen ($ 6.7 million), a Japanese game producer ten It is the creation of waves. Meanwhile, the Kulr Technology Group also grows already large cryptocurrencies.

The way traditional companies imagine digital assets has changed significantly as a result of this rise in institutional interests.

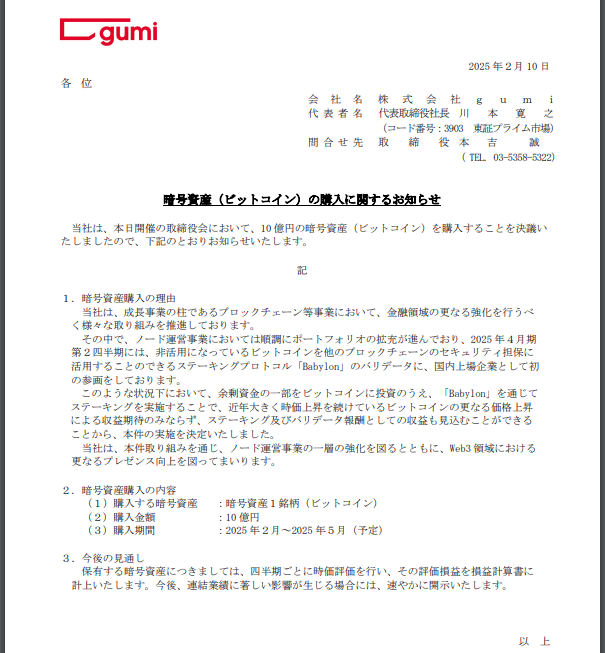

The Japanese GUMI PC publisher (3903, MKT CAP $ 150M) announces a plan to buy 1B Yen from Bitcoin.

It becomes the first company listed in Japan (World?) To participate in Bitcoin Stokeing Babel as a auditor. pic.twitter.com/37nhunaiix

Matthew Sigge, CFA Restore (Matthew_sigel) February 11, 2025

Japanese giant giant jumps a historical jump in encryption

Rubber open Her intentions for Bitcoin sharing via Babylon’s protocol, a bold step that attracts attention in the Japanese business community. The company uses bitcoin instead of just buying it.

Gumi will systematically buy Bitcoin 1 billion yen between February and May 2025, to become the first Japanese entity to be circulated publicly to participate in Encryption. This calculated step shows how corporate encryption efforts have become more complicated.

Storage for spanning: Development of the bitcoin strategy for companies

The days of companies are simply fading bitcoin in their bonds quickly. It is better to appear this new strategy by the Kulr Technology collection, which has Bitcoin’s possessions increased To 610 amazing symbols, or more than 60 million dollars.

The bold plan of the company to invest up to 90 % of its extra cash reserves in Bitcoin by 2024 has resulted in a wonderful way. The company warns of investors not to use this number as a direct measure of financial performance, but its report, which has been reported by 167 % of BTC, provides a convincing story for achievement.

The renaissance of encryption in Japan

One can describe the current status of affairs in the emerging sun as an encrypted awakening for companies. After revealing GUMI, Metaplanet, often known as “Japanese Microstrategy”, revealed a bold mission to buy 21000 Bitcoin by 2026.

The work is not thinking small; She currently has 276 billion yen, and plans to issue approximately 116.65 billion yen. This will be the largest stock of Bitcoin in Asia so far.

Beyond generating the return

The transition from the basic Bitcoin ownership to the complex yield generation plans is what makes these developments interesting. Companies find new ways to increase the performance of cryptocurrencies using platforms such as Babylon.

The “purchase and pregnancy” approach is evolving directly to the adoption of bitcoin currencies for companies. Companies are currently looking for a number of strategies to increase profits while maintaining their long -term exposure to the potential growth of the best encryption assets in the world.

Distinctive image from Gemini Imagen, the tradingvief chart