US Dollar, Japanese Yen, USD/JPY and Bank of Japan – Talking Points:

- The Bank of Japan kept its loose policy settings unchanged, in line with expectations.

- US dollar / Japanese yen It rose slightly in reaction to the status quo on politics.

- What are the expectations for American dollar/JPY What are the signs to watch for?

Recommended by Manish Grady

How to trade the US dollar/Japanese yen

The Japanese yen fell slightly against the US dollar after the Bank of Japan (BOJ) maintained very loose policy settings, especially the closely watched Yield Curve Control (YCC) policy, in an effort to support the nascent economic recovery and sustainably achieve inflation. Goal.

The Bank of Japan was widely expected to maintain its ultra-easy monetary policy at Friday’s meeting after BoJ Governor Kazuo Ueda said last month that the central bank would “patiently” maintain current policy as there was still some way to achieve a target. Inflation is at 2% stably and sustainably. The central bank said on Friday that uncertainty about Japan’s economy is “extremely high.”

5-minute chart of the USD/JPY pair

Chart created using TradingView

Ueda also said that the central bank expects inflation to slow to less than 2% in the middle of the current fiscal year and then rebound thereafter. Ueda added last week that the price-setting behavior of companies in the country is showing changes that may lead to higher inflation than expected.

Japan’s core inflation rate was 3.4% in April, well above the BoJ’s target of 2%, and it will only be a matter of time before the BoJ adjusts policy. The Bank of Japan reversed its long-term forward guidance at its April meeting while responding shrewdly to developments in economic activity and prices. This makes the July 28 meeting “alive”.

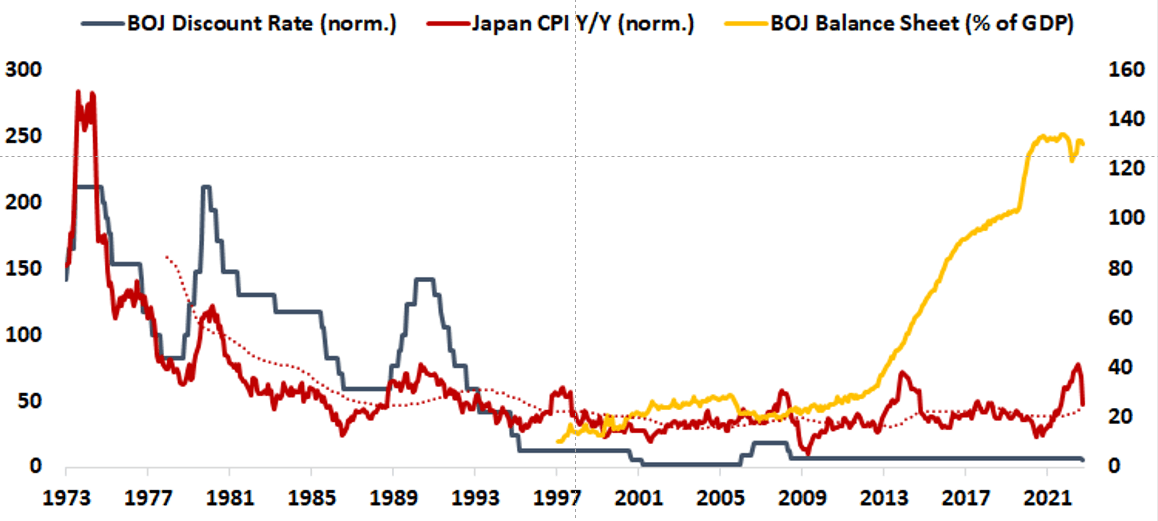

Inflation in Japan and the balance sheet of the Bank of Japan

source Data: Bloomberg. Chart created in Microsoft Excel

For the low-yielding yen, longer US rate hikes, easing US hard landing fears, and still hawkish global central banks are fueling the broader bearish setup. For more details, see “JPY Falls After FOMC: Rate Settings in USD/JPY, AUD/JPY, GBP/JPY,” posted on June 15.

However, the weakness of the yen appears to be more pronounced against currencies where central banks are in a hike mode, including the Reserve Bank of Australia, the Bank of England, the Bank of England and the European Central Bank, but to a lesser extent that central banks have paused (the Federal Reserve) or where they have indicated Central banks to those prices at the peak (NZD). For further discussion, see “Making Sense of the Japanese Yen’s Final Tranche: Is It the Beginning of a Renewed Leg Lower?” , posted on June 1, and “JPY Week Ahead as Fed Crossing Growth: USD/JPY, EUR/JPY, and AUD/JPY,” published on June 5.

USD/JPY daily chart

Chart created using TradingView

On the technical charts, USD/JPY has been flirting with a very converging resistance: the upper edge of the rising channel from early 2023, coinciding with the year-end high of 142.25, not too far from the mean line of the pitchfork channel. From January (about 143.75).

The bearish inverted hammer candlestick pattern on the daily candlestick chart on Thursday raised the bar for an imminent break above the key resistance. However, as shown in the previous update, the pair will need to break below the early June low of 138.50 for the bullish pressure to fade.

Trade Smart – Subscribe to the DailyFX newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to the newsletter

– Posted by Manish Grady, Strategist for DailyFX.com

Connect with Jaradi and follow her on Twitter: @JaradiManish