Economy

Kenya’s economy is slipping into dangerous territory

Monday, July 17, 2023

Graphics | GENNEVIEVE AWINO | NMG

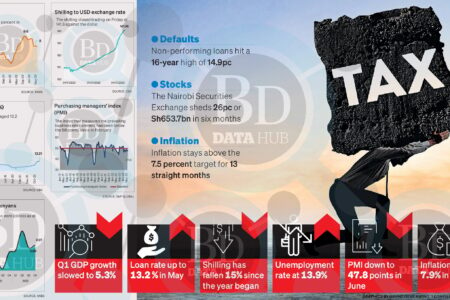

Economists and analysts have warned that a country seriously addicted to debt as it grapples with relentless inflation, a weaker daily shilling, tax deficits and soaring interest rates could push Kenya’s economy to the brink.

While East Africa’s largest economy reversed seven consecutive quarterly growth declines to grow by 5.3 percent in the first quarter of the year, economists warn policymakers not to be drawn into an inaction bubble.

Inflation-adjusted wage cuts are making Kenya’s middle class even poorer while companies default on loans after interest rates reached levels last seen seven years ago.

Half a month into the new fiscal year, the government is still waiting for the court to decide whether to be allowed to implement a raft of new tax measures, including doubling the value-added tax on fuel and a 1.5 percent deduction for workers. Low cost housing finance gross pay.

The delay in implementing the measures in the Finance Act 2023 is a test for President William Ruto’s government to deliver on campaign promises he made to Kenyans.

Public policy analyst Robert Shaw says that “the tough economic times will only get tougher” unless the government plans and implements bolder policy to prevent the economy from derailing.

is reading: The companies count the losses as the sting of the anti-government protests

“Everything is pointing in the wrong direction now,” Xu says. “We have a government that has a huge appetite for collecting more but at the same time, an appetite for spending more. It’s like a self-inflicted wound.”

The court case and now the protests are a concern. The protests are affecting economic activities and the economic recovery will be at risk. Continuing protests will see investors back off.”

Even in the absence of politicians, Shaw warns, mass action can “take on a life of its own” as people use this to amplify their frustration with the rising cost of living and rampant unemployment.

The government has tasked the Kenya Revenue Authority (KRA) to raise Sh2.57 trillion to help fund a Sh3.58 trillion budget for the fiscal year that began on July 1.

The outlook now looks bleak for the KRA after it missed its revenue collection target by Sh107 billion in the fiscal year ending June 2022, due to the harsh economic environment.

The taxman raised Sh2.166 trillion, with a performance rate of 95.3 per cent. The target was Sh2.273 trillion. Lower tax collection could lead the government, which already holds Sh9.63 trillion in debt through the end of April, to borrow more or cut development spending in a move that would hurt growth.

It comes as Kenya’s Sh280 billion Eurobond payment is fast approaching for the first time.

The Treasury expects Kenya’s economic growth to expand by 5.5 percent in 2023 from 4.8 percent last year, but is aware of the fact that more citizens are now facing increasingly higher prices for basic commodities, especially food, energy and transport.

Treasury Secretary Nguguna Ndongo recently said that the sharp rise in food insecurity and the rising cost of living will require “urgent and decisive interventions,” especially on the supply side.

However, the return of opposition-led street protests and threats of an extended period of civil disobedience will see more dark clouds over the economy, according to Ken Gichinga, chief economist at Mentoria Economics.

Expectations are for a slowdown because we are witnessing several levels of tightening, not only on the monetary side but also on the fiscal policy side. “When you throw political risk into the equation, it clouds the outlook even more,” Gichinga said.

Political unrest and al-Shabaab-related terrorist attacks in northern Kenya have in the past seen foreigners cut off or freeze further investment.

The Nairobi Stock Exchange lost 26 percent, or Sh653.7 billion, of investor wealth in the first half of the year.

Protesters are expressing, among other things, concerns about the cost of goods such as sugar and fuel and the planned implementation of new taxes.

Cost-of-living pressures in Kenya are proving broader and more persistent than expected, with June inflation of 7.9 percent outside the government’s target range of between 2.5 percent and 7.5 percent for 13 consecutive months.

With Kenya reliant on rain-fed agriculture, a scarcity of rainfall could undermine Dr. Ruto’s plan to increase production by subsidizing farmers.

Official data shows that Kenya’s food import bill in the first quarter of the year was Sh80.2 billion nearly matching the KSh87.5 billion earned from food export, jeopardizing the country’s status as a net food exporter.

This means that Kenya remains vulnerable to price movements of foodstuffs such as rice, wheat and maize in import markets, with potential pressure on foreign currency and lost taxes in the form of exemptions granted to importers.

Banks also warn of slower growth, with weaker purchasing power expected when the fiscal bill kicks in.

Yvonne Mango, chief economist at the Equities Group and director of research, says that the new tax measures speak of a tightening of fiscal policy, which when added to the continuous rise in interest rates will dampen economic growth.

“A higher tax burden means that households will have less income. So what we expect is a slowdown in spending and that has implications for GDP growth. In terms of business, it means there will be a slowdown in retained earnings available for reinvestment and that will ultimately undermine Growth prospects,” Ms Mhango said during a recent stock meeting with investors.

Banks have been increasing their appetite for government paper given the steady rise in yields on treasury bonds and treasury bills.

A new five-year paper, for example, had a coupon rate of 16.84 percent, a rate that is risky for individuals and companies chasing bank loans.

Commercial banks have been raising their lending in line with the central bank rate which is now at 10.5 per cent – the highest point in nearly seven years.

Gichinga expects banks to pay more attention to the government at the expense of the private sector as the non-performing loan ratio hit a 16-year high of 14.9% in May.

And as interest rates on government paper rise, he says, investors will at some point start to wonder if the Treasury can raise the money to pay them on time.

“Over time, using risk models, investors will start to wonder how the government can raise revenue for the debt recovery service when the companies that are supposed to raise those revenues are struggling,” says Gichinga.

is reading: How markets ignore opposition-led protests

The government has struggled to pay civil servants on time and release funds for other key activities such as running districts, paying pensions to retirees, and paying hospital bills for people insured by the National Health Insurance Fund (NHIF).

→ (email protected)