Bitcoin shows resilience after a volatile week marked by an uncomfortable market. Holding strong above the $104,000 level, the leading cryptocurrency appears to be well positioned for continued growth. Despite the volatility, Bitcoin’s ability to maintain this support has boosted confidence among investors, many of whom expect more upward momentum in the near term.

Key data from Cryptoquant highlights an interesting trend: Big investors, often referred to as “smart money,” are driving BTC’s price gains since the US election. Their increased activity indicates a strategic accumulation phase, indicating expectations of a big move in the coming weeks. This is in line with BTC’s historical behavior, where institutional interest often precedes major price storms.

As Bitcoin consolidates above $104K, market participants are watching closely for signs of the next breakout. With big investors leading the charge, the crypto’s growth potential remains strong, even amid uncertainty in the broader market. Whether BTC can capitalize on this momentum and push towards new highs will depend on its ability to maintain current support levels and overcome key resistance points.

Bitcoin dynamics indicate steady growth

Bitcoin has seen significant growth over the past year, increasing its status as the leading cryptocurrency. Its impressive performance has attracted the attention of large investors, indicating strong market confidence. Current market dynamics indicate that BTC is poised for further growth, providing significant opportunities for investors. The stage seems set for a big move that could bring big gains.

Recent data from Cryptoquant It confirms this trend, revealing that big investors have been a driving force behind Bitcoin’s price gains since the US elections. During this period, BTC Holdings among major players increased from 16.2 million BTC to 16.4 million BTC, showing a clear pattern of accumulation. This activity highlights strategic positions for institutional and high net worth investors anticipating continued upward momentum in the price of Bitcoin.

In contrast, small investors reduced their stakes from 1.75 million BTC to 1.69 million BTC, indicating a level of hesitation or profit-making among retail participants. This dynamic confirms that retail investors have yet to re-enter the market, suggesting the potential for greater upward pressure on Bitcoin’s price once they do.

As large investors continue to pile in and retail interest begins to grow, the outlook for BTC remains very optimistic. Institutional confidence and untapped retail demand could fuel a huge rally, pushing BTC to new levels in the coming months. Right now, Bitcoin’s strong fundamentals and growing investor interest point to a bright future for the cryptocurrency.

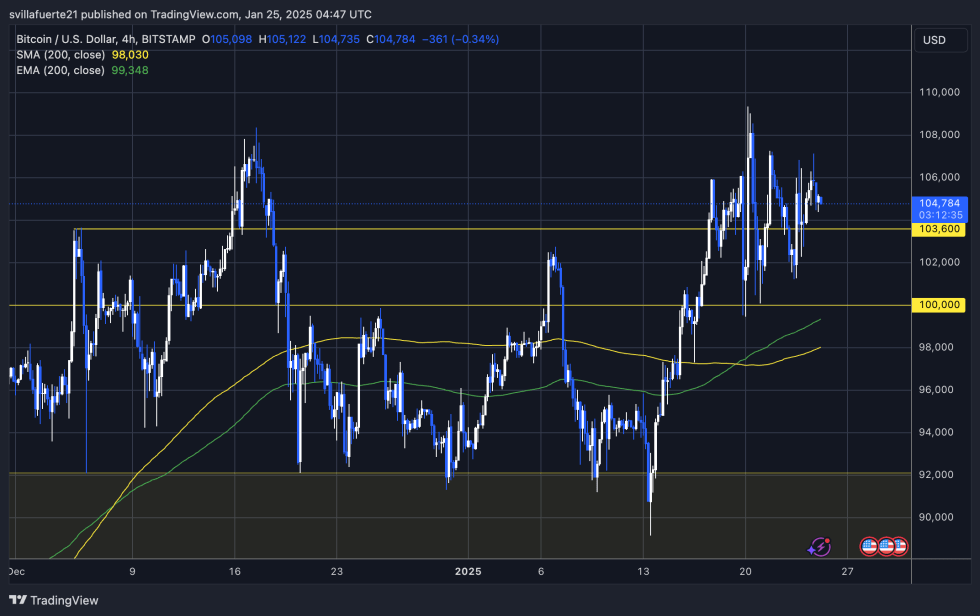

BTC Price Analysis: Holding steady above $100k

Bitcoin (BTC) is currently trading at $104,700, navigating through a period of massive market volatility and uncertainty. The price has been fluctuating within a range, rising between its all-time high (ATH) and the $100,000 support level. This lack of clear direction has left both bulls and bears on edge, with traders closely monitoring key levels for potential signals of the next big move.

For Bitcoin to confirm the bullish breakdown and maintain its upward trajectory, the price must decisively push past the $107,000 mark. A break of this resistance could potentially pave the way for a rally in price discovery, where Bitcoin could make new highs. Such a move would boost confidence in the market and attract new buying interests from both institutional and retail investors.

On the downside, missing the $100,000 support level would signal weakness and could lead to a deeper correction. A sustained breakout below this psychological level would likely increase selling pressure, possibly testing lower demand areas and delaying Bitcoin’s next attempt at a breakout.

As BTC consolidates, the coming days will be pivotal in determining its short-term trajectory. Traders and investors are closely monitoring these critical levels, as the outcome will shape Bitcoin’s performance in the near future.

Featured image by Dall-E, chart from TradingView