the American dollar Keep spinning (USDIndex at 101.65) hotter UK inflation The data adds to more global concerns that underlying price pressures remain too high and that… beige book It did not provide evidence that credit conditions are being tightened significantly enough to get the Fed off the hook to take further action. The Federal Open Market Committee, the European Central Bank and the Bank of England Everything is about to rise in May, will the divergence follow in summer? Stores It was generally flat again, with some solid earnings (Abbott Labs +7.82% IBM, TSMC, and WAL +24.12%(some mixed (Morgan Stanley) some missed)#TSLAAnd -6% After hours). Asian markets fell as the People’s Bank of China left interest rates unchanged and New Zealand dollar Poor performance Inflation also cools significantly. Fed williams & Goolsby They reiterated that inflation remains “very high” and that the FOMC “will act.” European Central Bank Knot “It is too early to talk about a halt in raising prices.”

Overnight Reserve Bank of New Zealand Inflation measure For the first quarter of 2023 5.7% vs. 5.8%, German He walks PPI -2.6% against -0.5%.

- FX – USD spinning in 101.65And euro holds in 1.0970 And jPreparatory Year pushed to more 135.00 before he refuses 134.50. sstunned Got a big boost from inflation data and trades in 1.2470.

- Stores – US markets closed flat again (-0.23% to 0.03%) #US500 closed at 4154. – 500 USD futs in 4167 And below the main resistance at 4175.

- Goods – Lycel oil – Futures fell in $78.35 Today, after a 4.6 million barrel drop in inventories and weakness in Asian markets, gold – Keep sliding and testing $1,970yesterday before recovering to trade at 2000 dollars.0

- Digital currencies – BTC refuse who $30 kilos Yesterday’s level, broke 29 thousand dollars today.

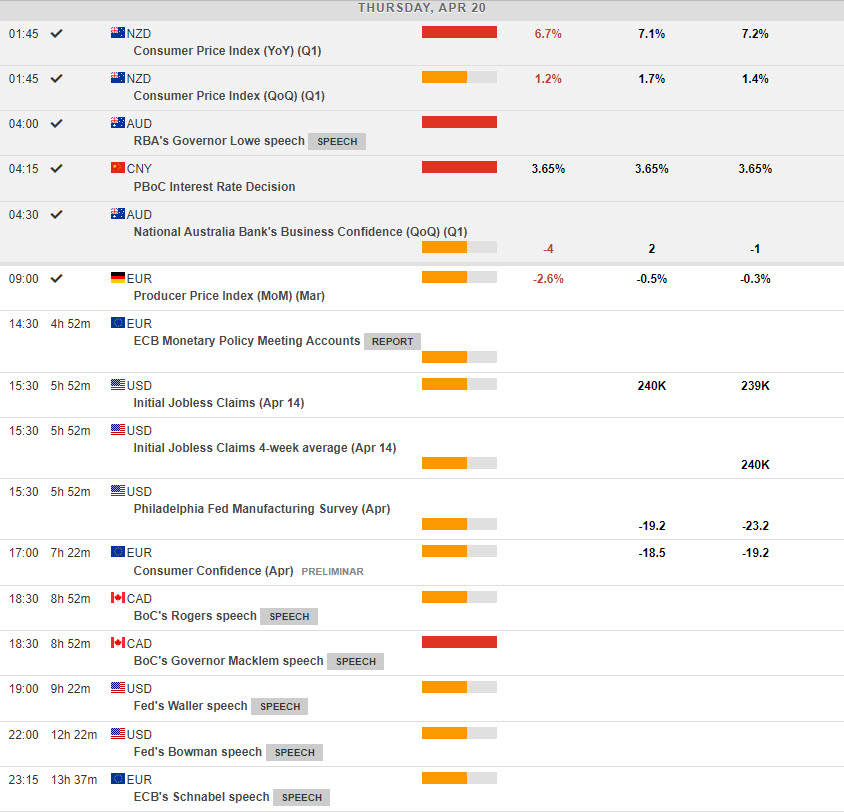

today – US Weekly Claims, Existing Home Sales, Eurozone Consumer Confidence, ECB Meeting Minutes, Letters from Williams, Waller, Mister, Bowman & Bostic, ECB Lagarde Schnabel. gains Philip Morris, AT&T, American Express, Publicis, EssilorLuxottica, Renault and Nokia.

The largest forex engine @ (06:30 GMT) NZDCHF (-0.75%). It was breached from its highest level in two days 0.5580 yesterday to 0.5513 its lowest today. The moving averages aligned downwards, the MACD histogram and the signal line are negative and bearish, the RSI is 33.28 and level, H1 ATR 0.00101 daily ATR 0.00530.

click here To access our economic calendar

Stuart Coyle

Principal market analyst

Disclaimer: This material is provided as general marketing communication for informational purposes only and does not constitute independent investment research. Nothing in this communication contains, or should be deemed to contain, investment advice, investment recommendation or solicitation for the purpose of buying or selling any financial instrument. All information provided is collected from reputable sources and any information containing an indication of past performance is not a guarantee or a reliable indicator of future performance. Users acknowledge that any investment in leveraged products is characterized by a certain degree of uncertainty and that any such investment involves a high level of risk for which the Users are solely responsible. We accept no liability for any loss arising from any investment made based on the information contained in this communication. This communication must not be reproduced or further distributed without our prior written permission.