Trading was cautious as the March jobs report and the Easter weekend approached. Most global markets will be closed Good Friwith much of Europe also locked down Easter Monday. Wall Street will not be trading today, but the Treasury market will be open for a brief session due to the employment report. the American dollar recovered from its lowest point, Stores Slightly closed up and yields Back again (U.S. 10 years at 3.288%). Gold has been tested down to 2000 dollars before settling a 2007.82 dollarsAnd & USOil locked in $80.70.

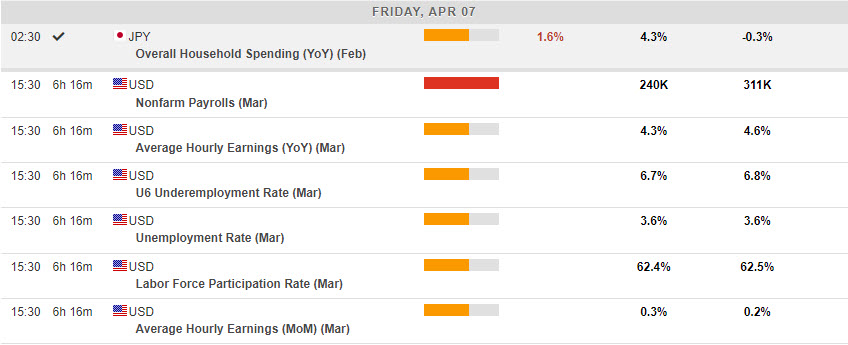

Overnight: Japan – February family spending (weaker) +1.6% vs. +4.3% & leading indicator indicator It rises to 97.7 from 96.5 last time.

- FX – USD slide into 101.06 Yesterday and remains below 102.00 today in 101.50. euro slid under 1.0900 Yesterday but it is trading in 1.0920 now. JPY I found a floor in 131.00 this week but it’s still under 132.00 For the fourth day. sTurling Refuse from the key 125.00 holds in 1.2440, Next support 1.2425.

- Stores – US markets closed mixed, led by technology stocks yesterday (+0.76% to -0.03%) #US500 locked in 4105 – 500 USD FUTS is also higher at 4128.

- Goods – Lycel oil – Futures are the key $80.00 And a new balance after OPEC Production cut at the end of last week. gold – Tested in 2000 dollars Again, before settling the 2007.82 dollars

- Digital currencies – BTC It keeps spinning on what has become the key $28k once again.

today – most trading posts closed to good friday, US Nonfarm Payrolls

The largest forex engine @ (07:30 GMT) AUDJPY (+0.31%). Fall break for 3 days of testing 90.00 The area earlier in the week, is recovering 88.00 today. Moving averages align up, MACD histogram and signal line turn positive and bullish, RSI 59.35 and bullish, H1 ATR 0.103, daily ATR 1.089.

click here To access our economic calendar

Stuart Coyle

Principal market analyst

Disclaimer: This material is provided as general marketing communication for informational purposes only and does not constitute independent investment research. Nothing in this communication contains, or should be deemed to contain, investment advice, investment recommendation or solicitation for the purpose of buying or selling any financial instrument. All information provided is collected from reputable sources and any information containing an indication of past performance is not a guarantee or a reliable indicator of future performance. Users acknowledge that any investment in leveraged products is characterized by a certain degree of uncertainty and that any such investment involves a high level of risk for which the Users are solely responsible. We accept no liability for any loss arising from any investment made based on the information contained in this communication. This communication must not be reproduced or further distributed without our prior written permission.