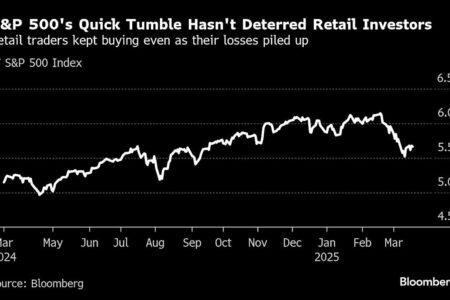

(Bloomberg) – In the stock market was beaten due to commercial turmoil and increasing concerns of economic slowdown, retail investors double, unlike their losses.

Most of them read from Bloomberg

Trading trading data from JPMorgan Chase & Co. Individual merchants made more than $ 12 billion in American stocks in the week ending March 19. The purchase pace was much higher than the average of 12 months for the group, according to Emma Wu, an expert in the bank's international stock derivatives.

Market monitors closely monitor retail traders because they are often the last to reduce their exposure to shares, and therefore the last of an aggressive purchase of investors from the mother and pop may indicate that the shares have not yet found the bottom.

Wu said that the last behavior of individual investors is a “bottom” public feature in the stock market. It was also seen in 2022. This is when the stock standard sank 19 %, and it is the only only year from the past six. Wu said: “This is a distinctive feature of the” purchase “mindset.

WU estimates that the group is now losing a 7 % loss for this year, while the S&P 500 decreased by 3.7 % until Thursday. The standard decreased by 1.1 % by 11 am on Friday in New York, after the expectations of some major American companies such as Fedex Corp. And Nike Inc. And Micron Technology Inc. And Lennar Corp. To the broader uncertainty about customs tariffs and economic growth.

When the broader market began to sell sharply in late February, retailers remained thirsty buyers, which represents a sharp difference from institutional buyers, who revolve from American stocks at a record pace.

On Friday, issued by Bank Of America Corp, found that both institutional and private customers bought the shares at a rapid pace per week until Wednesday, as global stock funds recorded about $ 43.4 billion in flows – the largest amount this year.

The signal of the rash mobilization permeates the growing view that Wall Street takes. Goldman Sachs Group Inc. Strategies. And Citigroup Inc. And HSBC Holdings Plc are all in their expectations for American stocks in the past two weeks. Michael Wilson told Morgan Stanley on Thursday that there would be no levels of new levels of the US stock market in the first half of the year.

There are signs that individual investor morale has been weakened in recent weeks. A widespread follower of the American Association of Individual Investors showed that upward views were less than 20 % for a three consecutive brand, as they rose slightly in the week ending March 19.

For some, this trend is worth watching.

“This indicates that what people say and what they are doing have been removed,” said Mark Hackett, the chief market strategy of NATORWIDE, referring to how retail investors continue to pour money in American stocks.

(The latest index moves in the fifth paragraph adds data from Bank of America on the seventh.

Most of them read from Bloomberg Business Week

© 2025 Bloomberg LP