On-chain data shows that the Bitcoin network is finally seeing a significant influx of new users after hitting multi-year lows earlier this year.

New Bitcoin addresses have reversed direction since June lows

According to data from market intelligence platform In the massBitcoin has been seeing a growth in the number of new addresses per day lately. A “new address” is, of course, an address where a transaction was made on the network for the first time ever.

When new addresses appear on the blockchain, there could be several primary reasons for this. One is the influx of new users, as new investors open new addresses to participate in trading activities. Another reason could be that existing users create multiple wallets for purposes such as privacy.

In general, both factors play a role to some extent whenever the metric is rising, so it can be assumed that some net adoption is taking place. Adoption is usually bullish for the price of any cryptocurrency in the long run.

Now, here’s a chart showing the trend in new Bitcoin addresses over the past decade:

Looks like the value of the metric has turned itself around in recent weeks | Source: IntoTheBlock on X

As shown in the chart above, new Bitcoin addresses have been trending downward this year, but the metric finally bottomed out in early June, albeit just after hitting multi-year lows.

One reason behind the decline may have been the launch of exchange-traded funds (ETFs), investment vehicles that provide an alternative way to gain exposure to cryptocurrency price movements.

Spot ETFs operate on traditional exchanges, so new investors may prefer to invest through them, rather than venturing into the unfamiliar territory of digital asset wallets and exchanges.

But since the bottom in June, the number of new daily addresses on the Bitcoin blockchain has shown a reversal. The metric is still far from returning to the same levels it was at before this year’s drop, but it has still managed to rise by 35%.

If this new upward trajectory is the beginning of a larger trend, the cryptocurrency’s price may naturally benefit from the renewed influx of new investors.

In other news, long-term Bitcoin holders have been increasing their supply recently, as revealed by the latest weekly report from glass knot.

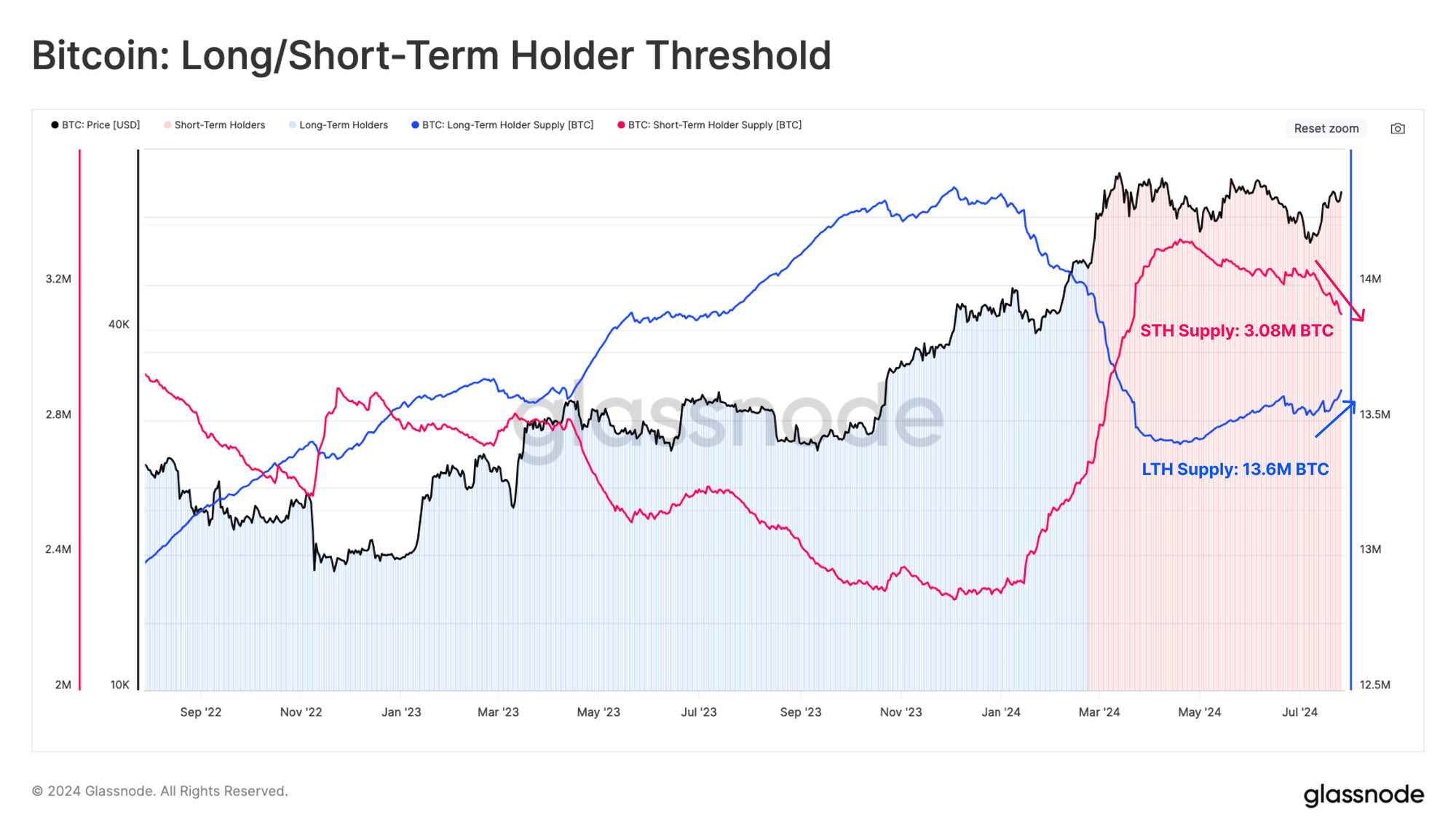

The data for the supplies of the long-term holders and short-term holders | Source: Glassnode's The Week Onchain - Week 31, 2024

Short-term holders (STHs) and long-term holders (LTHs) make up the two main segments of the Bitcoin market based on holding time, with 155 days being the dividing line between the two.

LTH holders are considered to be large holders of the market, and they do not sell their coins easily. But despite their resilience, the rise to an all-time high price earlier in the year was still a good opportunity to take profits even for these diamond holders, so they participated in the large sell-off.

However, the recent increase in LTH supply shows that HODLing behavior has returned to the Bitcoin network, as STHs mature in the pool.

Bitcoin price

Bitcoin has been moving sideways since its drop two days ago as its price is still trading around $66,600.

The price of the coin appears to have taken a notable hit recently | Source: BTCUSD on TradingView

Featured image by Dall-E, Glassnode.com, IntoTheBlock.com, chart by TradingView.com