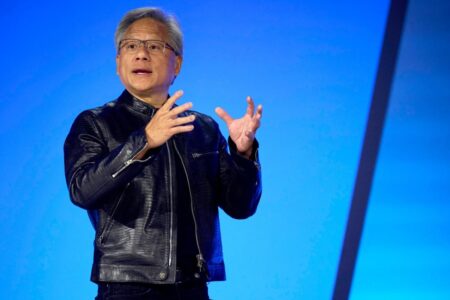

(Bloomberg) — Nvidia Corp. investors have high hopes that CEO Jensen Huang’s speech Monday will spark a new breakout in the chipmaker’s shares, which just finished at their first record close since November.

Most read from Bloomberg

Huang is scheduled to take the stage Monday evening at the closely watched CES trade show in Las Vegas. Nvidia typically uses this event to showcase consumer devices using its chips. However, investors today will focus any commentary on the Blackwell chip, which is seen as Nvidia’s next major growth engine. Despite the strong demand Blackwell has seen, it has faced supply constraints due in part to manufacturing challenges that have slowed its rollout.

“The expectation is that demand for Blackwell remains very strong,” said Matt Cioppa, portfolio manager at Franklin Templeton Equity Group. “This could bring Nvidia’s long-term opportunity back into focus in the market.”

Investors have reasons to be optimistic. Over the past six months, Huang’s comments about chip demand have boosted the stock. In October, he called Blackwell’s order “insane,” and in November he said the chips would ship in the current quarter amid “very strong” demand.

Shares posted a monthly loss in December, but are up 171% in 2024, making them the biggest single driver of the S&P 500’s overall gains. The stock is already up 11% this year, including a 3.4% gain on Monday. With a market value of $3.66 trillion, it is close to surpassing Apple as the largest company; The iPhone market cap is $3.7 trillion.

Disappointment in profits

However, the stock briefly fell after Nvidia’s earnings report on November 20. The company’s revenue forecasts failed to impress Wall Street, which had become accustomed to forecasts that beat average estimates by wider margins.

The calm in stocks came as excitement around AI spending spread to other areas of the semiconductor industry.

Broadcom Inc. shares rose. by more than 30% in the past few weeks after the chipmaker predicted a boom in the market for the artificial intelligence components it designs for data center operators. Shares of Marvell Technology Inc. rose. by more than 20% since it reported better-than-expected earnings based on demand for its custom AI chips.

Morgan Stanley analysts led by Joseph Moore likened the rises in those stocks to a transfer of wealth from Nvidia, whose shares fell for four straight days in the wake of the Broadcom report, resulting in a loss of more than $200 billion in market value.

Nvidia remains a top pick at Morgan Stanley, with analysts arguing the chipmaker will gain market share this year. They are also looking forward to Huang’s keynote being a “positive event.”

“The message should be the same – Blackwell’s demand is exceptional, but supply is constrained,” they wrote in a research note last month. “By mid-year, we will still be comfortable that the focus will remain on Blackwell, which will be the driving force behind revenues” in the second half of the year.

High stakes

Jordan Klein, a technology sector specialist at Mizuho Securities, sees the CES event and Huang’s keynote as tests of near-term sentiment and risk appetite towards technology.

If the stock price declines or declines in the days following Hwang’s comments, it “would be a modest negative in my view through January,” Hwang wrote. Since tech earnings season doesn’t start until later this month, “investors will have little to gauge fundamentals and expectations until then,” he said.

The risks for Nvidia stock could be high, as their rally has heightened valuation concerns. The stock trades at 19 times estimated revenue, making it one of the 10 most expensive components of the Nasdaq 100 by that measure. It also trades at roughly 35 times estimated earnings, compared with about 24 for the Philadelphia Stock Exchange’s semiconductor index.

Emily Rowland, chief investment strategist at John Hancock Investments, remains positive on Nvidia and other big tech stocks, but is bracing for “more volatility” ahead.

“At some point, there will be a ‘show me’ moment in 2025 that will have to reaffirm the story,” she said. “Evaluation is clearly an issue, and it is important to note how far the evaluation extends, even if the AI tailwinds remain intact.”

The most important technology stories

-

Hon Hai Precision Industry Co., Ltd. announced reported faster-than-expected 15% revenue growth after Nvidia’s server colocation partner benefited from continued demand for AI infrastructure.

-

An interview with Sam Altman, co-founder of OpenAI, on ChatGPT’s first two years, and Elon Musk and AI in the era of Trump.

-

Samsung Electronics is expanding its AI efforts with a new set of improvements to its premium TV lineup under the Vision AI brand.

-

TDK Corp., one of the main battery suppliers for Apple Inc.’s iPhones, will this year roll out an improved version of its most advanced product to help mobile devices keep up with the increasing power demands of embedded artificial intelligence.

-

Italy is in advanced talks with Elon Musk’s SpaceX to reach a deal to provide secure communications for the country’s government — the largest project of its kind in Europe, people familiar with the matter said Sunday.

Dividends are due on Monday

(Updates with closing stock price in fifth paragraph)

Most read from Bloomberg Businessweek

©2025 Bloomberg L.P