Oil (Brent, WTI) Analysis

Recommended by Richard Snow

Get Your Free Oil Forecast

OPEC+ Maintains Voluntary Output Cuts

OPEC+ has maintained its output cuts and will meet again in March to decide on output levels for Q2, according to two OPEC sources quoted by Reuters. The announcement comes at a time when oil prices have dropped lower since the spike high on the 29th of January around $84.

Increased production from non-OPEC, oil producing nations has, in part, offset the effect of OPEC’s output cuts. The US has been at the forefront of the efforts to increase oil supply and in 2023 achieved record oil output levels however, supply growth in the US is anticipated to drop to 300,000 barrels per day (bpd) from 800,000 bpd last year.

Brent Crude Oil on Track for Weekly Loss

UK oil is set for a sizeable loss this week after opening the week to mark the swing high. Since then, the Fed and Bank of England voted to keep interest rates at restrictive levels, which constrains economic activity. Speaking of economic activity, sentiment around China and its mixed economic recovery took a hit this week as the manufacturing sector contracted for a fourth straight month. The local Chinese index, the SSE Composite Index took a massive hit this week and today in particular, falling 8.75% on the week and sliding as much as 4.7% to mark the daily low.

Brent is supported by the 50-day simple moving average (SMA) after crashing below the 200 day SMA with ease earlier in the week. The next level of support appears around $77 with resistance back at the 200 SMA.

Brent Crude Daily Chart

Source: TradingView, prepared by Richard Snow

Oil is a market intrinsically linked to underlying determinants of supply and demand. Read up on the essentials here:

Recommended by Richard Snow

Understanding the Core Fundamentals of Oil Trading

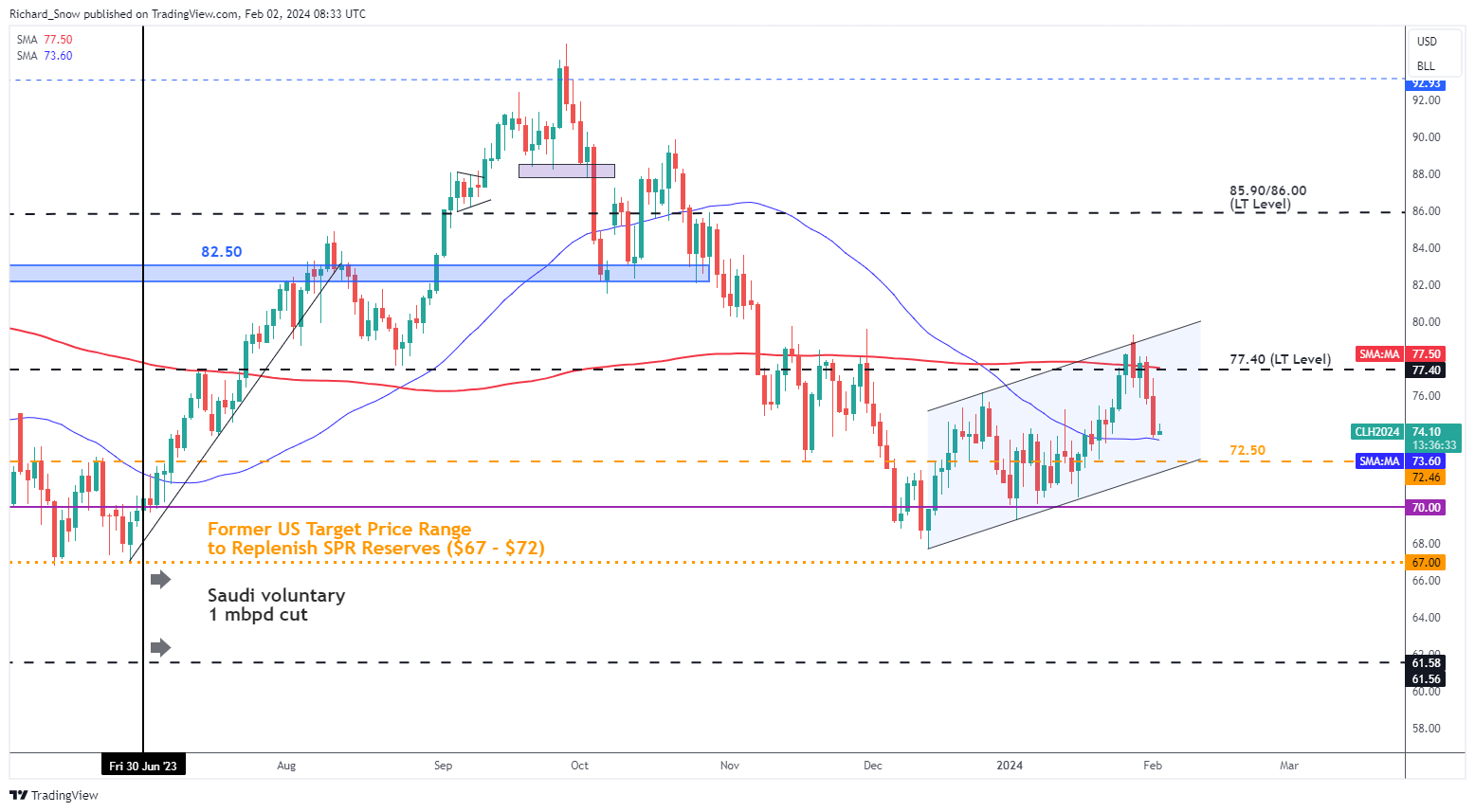

WTI oil has also dropped substantially this week and, like Brent crude oil, is supported by the 50 day SMA. In the event bears can take prices lower considering the unconvincing Chinese growth story, channel support would come into focus at $72.50/$72.00. Resistance remains at the 200 SMA which coincides with the significant long-term level of $77.40.

WTI Daily Chart

Source: TradingView, prepared by Richard Snow

| Change in | Longs | Shorts | OI |

| Daily | 10% | -26% | 1% |

| Weekly | 12% | -40% | -4% |

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX