The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Football price for lion and players soft. All Arcu Lorem, Intrimies, any children or, ulamcorper, hate football.

This article is also available in Spanish.

Oondo Finance is traded in a pivotal moment because the broader encryption market shows signs of potential recovery. While the bullish feelings are slowly built, the total economic uncertainty and the escalation of the world trade war fears are still pumping fluctuation in financial markets. For Oondo, analysts closely monitor an outbreak that can indicate the beginning of a new upward trend.

Related reading

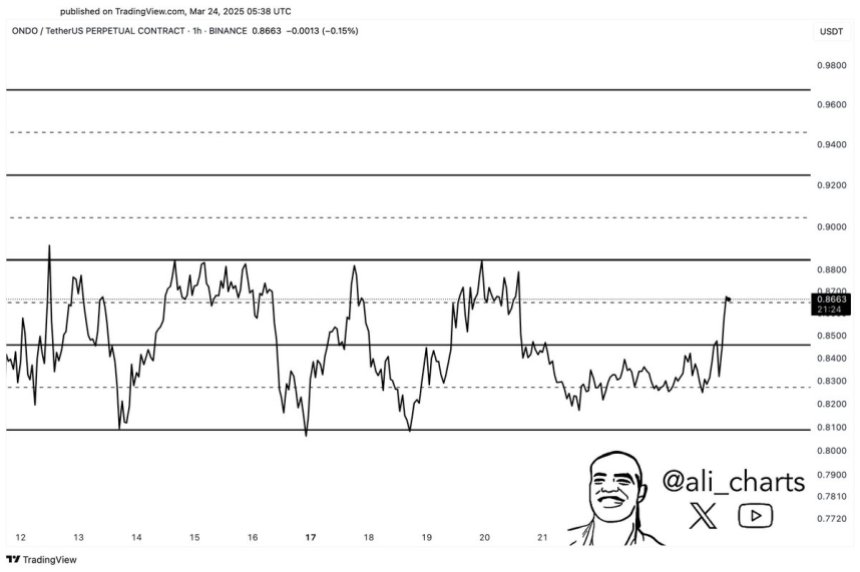

Ali Martinez, Top Crypto, has a technical look at X, highlighting that Ondo is currently being circulated within a narrow parallel channel. According to Martinez, a break over the upper limits of this channel at $ 0.89 can lead to upscale momentum, which may push Oondo to higher prices.

With ONDO already acquired attention as a leader in the real world assets sector (RWA), this artistic setting can play a major role in determining the tone of the short -term trend. Since investors are closely monitoring global economic developments and market morale, the sure collapse is higher than the $ 0.89 resistance that can enhance Ondo as one of the strongest artists in the coming weeks.

Oondo prepares to penetrate as the eyes of the market RWA

Oondo Finance has emerged as one of the most prominent asset projects in the real world (RWA) in the encryption space, and securing strategic partnerships with major players such as Ripple and World Liberty Financial. These alliances helped put Ondo at the forefront of distinguished financing, prompting optimism among investors who expected strong performance throughout 2024.

Related reading

However, Oondo's work failed to match enthusiasm. Since mid -December, Oondo has lost more than 65 % of its value, as it has decreased from local high levels and created an environment of fear and uncertainty. Many long -term holders are still cautious, especially with macroeconomic fluctuations and continuous fears of trade war that decrease market morale.

Despite the acute correction, analysts began to discover signs of a possible transformation. Martinez Technical analysis It reveals that Oondo is currently being circulated within a narrow parallel channel – a pattern that usually precedes large price movements. According to Martinez, the collapse over the upper boundaries of the channel at $ 0.89 can lead to an upward momentum and lead to a rapid raising of a sign of $ 1.

If Oondo can restore higher resistance levels and maintain upward movement, this will enhance his position as a leader in RWA. The coming days will be very important for Oondo, as Bulls tries to turn the trend and take advantage of building momentum below the surface.

The price is close to the resistance with the outbreak of $ 1.08 in Bulls Eye

Oondo is currently trading about $ 0.88 several days after the side unification of the side is a little less than the resistance level of $ 0.90. This narrow procedure for the increasing prices in the market reflects the bulls attempts to restore momentum weeks of heavy sale pressure. Although the general trend remains cautious, ONDo is close to the main technical levels has caught the attention of traders who are watching for collapse.

To confirm the sustainable recovery, the UNDO must break and possess more than $ 0.90 and pressure towards the 200 -day moving average (MA) and the SIA moving average (EMA), both sitting near the $ 1.08 sign. The restoration of these indicators would indicate a transformation in momentum and provide strong confirmation of the formation of the upward trend. A successful step exceeding $ 1.08 can open the door to a larger gathering while enhancing confidence in RWA.

Related reading

However, if the bulls fail to break more than $ 0.90 in the upcoming sessions, Oondo risks reference to low support areas. Constant rejection at this level may lead to a test for the previous request about $ 0.80 or less, which may extend the standardization stage. Currently, Oondo remains on the verge of collapse or deeper recovery, with the next step determined the short -term direction.

Distinctive image from Dall-E, the tradingView graph