The article below is an excerpt from a recent issue of Bitcoin Magazine PRO, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

Bitcoin equity

One of the most important and innovative features of bitcoin is the hard supply of 21 million.

The total supply is not specifically specified in the code, but is instead derived from the code’s release schedule, which is halved every 210,000 blocks or roughly every four years. This halving event is called the Bitcoin halving (or “halving” in some circles).

When bitcoin miners successfully find a block of transactions that connects a set of new transactions to a previous block of already confirmed transactions, they are rewarded with newly created bitcoins. The newly created bitcoin and awarded to the winning miner with each block is called a block backer. This support along with transaction fees sent by users who pay to confirm their transaction is called block reward. Block and reward support incentivizes the use of computing power to keep the Bitcoin code running.

When bitcoin was first released to the public, the block support was 50 bitcoins. After the first halving in 2012, this number was reduced to 25 bitcoins, and then to 12.5 bitcoins in 2016. Most recently, the bitcoin halving took place on May 11, 2020, with miners currently receiving 6.25 bitcoins for each new block.

The next halving is coming in about one year. The exact date will depend on how much hashing power is joining or leaving the network, as this affects how quickly blocks are found. Estimates for the next halving range from late April to early May 2024. After the next halving, the block support will be reduced to 3.125 bitcoins.

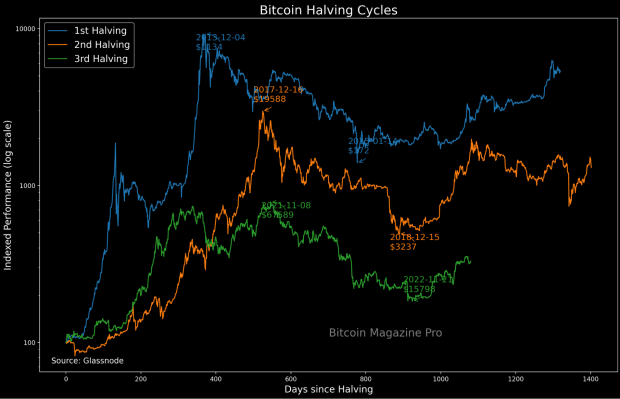

In the past, the price of bitcoin has skyrocketed after halvings, albeit after several months of support cuts. At every halving, there is a discussion about whether or not the halving is priced in. This question takes into account the fact that the halving is a known event and tries to address whether the market will treat that in the Bitcoin exchange rate.

Long-term carrier dynamics

Our basic thesis is that halving leads to a demand-driven event in bitcoin where market participants become acutely aware of bitcoin’s utter digital scarcity. This leads to a rapid phase of exchange rate appreciation. This hypothesis differs somewhat from the main narrative, which is that a supply-driven event incites the exponential increase in price because miners earn less bitcoin for the same amount of energy spent and put less selling pressure in the market.

When we take a closer look at the data, we can see that the supply shock is often already there — the HODL Army has already staked its turf, if you will. On the margin, the reduction in supply hitting the market makes a material difference to the daily clearing rate of the market, but the increase in price is due to a demand-driven phenomenon which strikes totally illiquid supply on the sell side with holders who are forged deep into the bear market unwilling to give up. their bitcoins until the price goes up by about an order of magnitude.

Statistically, long-term coin holders are the least likely to sell their bitcoins and the current supply is held tightly by this group. The people who were buying and holding bitcoin while the exchange rate was down about 80% are now the dominant majority share of the free floating supply.

The halving reinforces the fact that the Bitcoin supply is inflexible in the face of changing demand. As education and understanding about the super monetary properties of Bitcoin continue around the world, there will be an influx of demand while inelastic supply will cause prices to skyrocket. The rate of exchange will only collapse from a frantic rise when a large part of the convicts give up part of their previously dormant stock.

These retention and spending patterns are very well quantifiable, with a completely transparent and immutable ledger documenting it all.

We know that long-term holders are the ones who put the floor in a bear market, but they are also the ones who put the tops in a bull market. Many people view the supply shock of the halving as the driver of the price increase, with miners earning fewer coins while still needing to sell some in order to pay bills that remained the same cost in dollars (or in local currency terms). We can see the net miner position change overlaid with the price of bitcoin and see the effect of their accumulation and selling.

There is clearly a relationship between the price of bitcoin and whether miners accumulate or sell, but correlation does not equal causation and when we include the behavior of long-term coin holders, we can see how much the tide of accumulation and distribution by holders increases miner selling pressure. The graph below shows the same change in the net owner’s position as above, but overlays the net change in the long-term owner’s position, both of which measure the net accumulation and distribution of the two groups over a 30-day period, displayed on the same y-axis. When we compare the two, it’s hard to see the net change in miner’s position (red) in relation to the more significant change in position for long-term holders (blue). While miner selling pressure gets all the press, the real drivers of the bitcoin cycle are its condemned holders, who prepare the ground with accumulation, compressing the proverbial spring for the next wave of incoming demand.

Long-term coin holders tend to spread their coins as bitcoin makes its parabolic high and then starts accumulating after the price correction. We can look at the long-term spending habits of the bearer to see how the change in the long-term bearer supply is what ultimately helps the price to cool off after a parabolic rally.

On-chain data shows that coins that haven’t moved in more than six months now have an average spend price that remains relatively constant throughout the bear market – compared to the market-to-market fluctuation of the exchange rate. What happens during a bear market is simply a rearrangement of the playing cards: UTXOs switch hands from speculator to convict, from the over-indebted to those with free cash flow.

During periods of bullish market frenzy, the inflow of coins from long-term coin holders is much greater than the sum of the daily issuance, while in the depths of a bear the opposite can be true – coin holders absorb much larger amounts of coins. Total new version.

We’ve been in a net accrual regime for two years, eliminating nearly our entire derivatives pool in the process. Today’s long-term coin holders own coins that didn’t budge during the Three Arrows Capital implosion or the FTX fiasco.

To prove how convinced the holders of long-term assets are in this asset, we can observe currencies that have not moved for a year, two or three years. The chart below shows the percentage of UTXOs that remained dormant during these timeframes. We can see that 67.02% of Bitcoin has not been traded in one year, 53.39% in two years, and 39.75% in three years. While these metrics are not perfect for analyzing HODLer behavior, they do show that there is at least a significant amount of total supply being held by people who have little intention of selling these coins anytime soon.

Aside from the difficulty of producing bitcoin on the sidelines, the most likely contribution of the bitcoin halving event is the marketing around it. At this point, the vast majority of the world is familiar with Bitcoin, but few understand the radical concept of absolute scarcity. With each half, the media coverage is bigger and more important.

Bitcoin stands alone with its algorithmic and static monetary policy in a world of arbitrary fiscal policy, lost bureaucracy and an endless stream of debt monetization policies.

The 2024 halving, which is less than 52,000 bitcoin blocks away, will once again reinforce the narrative of supply inelasticity, while the vast majority of circulating supply is held by holders who are completely uninterested in giving up their stake.

Final note:

Despite the impact of the halving in relative terms after each cycle, the upcoming event will act as a reality test for the market, especially for those who are beginning to feel that their exposure to the asset is insufficient. As bitcoin’s automated monetary policy continues to operate exactly as designed, approximately 92% of the final supply is already in circulation, and initiating another supply halving event will only reinforce the apolitical money narrative and bitcoin’s unique digital currency scarcity. It comes into focus more sharply.

This concludes an excerpt from a recent issue of Bitcoin Magazine PRO. subscribe now To receive PRO articles straight to your inbox.