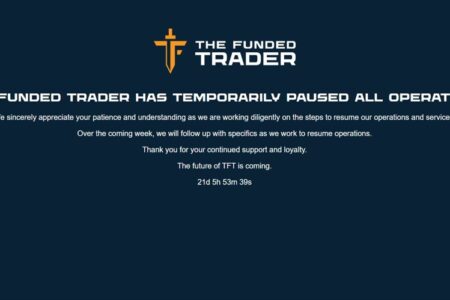

The Funded Trader, a prop trading firm that recently faced an array of complaints for payout denials, has “temporarily paused all operations” with promises of a relaunch.

“Over the coming week, we will follow up with specifics as we work to resume operations,” a notice on the prop trading firm’s website noted with a countdown timer of 21 days. However, it did not clarify if the timer is for its relaunch.

Relaunch Promised, but When?

Angelo Ciaramello, the Chief Executive Officer of The Funded Trader, noted in an announcement: “In pausing our operations, we will be relaunching the brand but with a slightly different look and feel.”

“Over the coming week, we will post updates on what this will look like and how this decision affects everyone involved… The relaunch of TFT is coming, and earning your trust will be difficult, but we know what it takes.”

I wanted to address you all personally. You have been the lifeblood of TFT. You have fought in battle with me day in and day out for years. You have participated in one of the greatest movements in history and have delivered to me what I dreamed of, this community.

Being in the…

— The Funded Trader (@thefundedtrader) March 28, 2024

The company further noted that it will put out a plan for existing customers in the coming weeks. Despite the assurance of the relaunch, pausing the entire operation for a relaunch looks odd.

The Company Faces a Wave of Complaints

The Funded Trader, with over 80,000 accounts, is a part of Easton Consulting Technologies LLC, which operates a number of other prop trading platforms. In the past few weeks, the customers of the prop trading platform took to social media, especially Trustpilot, to complaints about abrupt payout denials and unresponsive customer support.

However, Ciaramello called the complaints “propaganda” against the firm. Subsequently, the prop trading firm confirmed that it suspended all payouts because of a “self-imposed internal audit.”

During a live broadcast on YouTube, Ciaramello presented a graphic suggesting that in the first two months of 2024, TFT paid out over $17 million to clients while blocking withdrawals of just over $2 million during the same period.

“The payments were rejected due to KYC, due to any type of fraud, credit card fraud and any prohibited trading strategies,” the CEO said during the live broadcast. However, he continued to face backlash on social media.

The Funded Trader, a prop trading firm that recently faced an array of complaints for payout denials, has “temporarily paused all operations” with promises of a relaunch.

“Over the coming week, we will follow up with specifics as we work to resume operations,” a notice on the prop trading firm’s website noted with a countdown timer of 21 days. However, it did not clarify if the timer is for its relaunch.

Relaunch Promised, but When?

Angelo Ciaramello, the Chief Executive Officer of The Funded Trader, noted in an announcement: “In pausing our operations, we will be relaunching the brand but with a slightly different look and feel.”

“Over the coming week, we will post updates on what this will look like and how this decision affects everyone involved… The relaunch of TFT is coming, and earning your trust will be difficult, but we know what it takes.”

I wanted to address you all personally. You have been the lifeblood of TFT. You have fought in battle with me day in and day out for years. You have participated in one of the greatest movements in history and have delivered to me what I dreamed of, this community.

Being in the…

— The Funded Trader (@thefundedtrader) March 28, 2024

The company further noted that it will put out a plan for existing customers in the coming weeks. Despite the assurance of the relaunch, pausing the entire operation for a relaunch looks odd.

The Company Faces a Wave of Complaints

The Funded Trader, with over 80,000 accounts, is a part of Easton Consulting Technologies LLC, which operates a number of other prop trading platforms. In the past few weeks, the customers of the prop trading platform took to social media, especially Trustpilot, to complaints about abrupt payout denials and unresponsive customer support.

However, Ciaramello called the complaints “propaganda” against the firm. Subsequently, the prop trading firm confirmed that it suspended all payouts because of a “self-imposed internal audit.”

During a live broadcast on YouTube, Ciaramello presented a graphic suggesting that in the first two months of 2024, TFT paid out over $17 million to clients while blocking withdrawals of just over $2 million during the same period.

“The payments were rejected due to KYC, due to any type of fraud, credit card fraud and any prohibited trading strategies,” the CEO said during the live broadcast. However, he continued to face backlash on social media.