The Reserve Bank of New Zealand left interest rates unchanged at 5.50% for the eighth straight month in July, as expected.

Their official statement indicated that their restrictive monetary policy had succeeded in reducing price pressures enough to allow the committee to forecast a return to its annual inflation target of 1% to 3% later this year.

They explained that the decline in domestic inflation and the decline in prices of imported goods contributed to the decline in consumer price levels, and they also noted that employment growth is slowing due to the growing labor force and cautious hiring by companies.

Link to the Reserve Bank of New Zealand Monetary Policy Statement for July 2024

A summary of their discussions also revealed that policymakers agreed that policy should remain restrictive but that “the extent of this restriction will diminish over time in line with the expected decline in inflation pressures.”

Market reaction

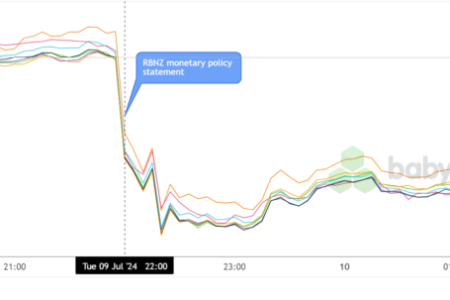

New Zealand Dollar vs Major Currencies: 5 Minutes

US Dollar Overlay Against Major Currencies Chart by TradingView

The New Zealand dollar was trading cautiously in the hours leading up to the official announcement from the Reserve Bank of New Zealand before falling back against its major peers on the decision to “maintain quantitative easing”.

Although the central bank kept its official interest rate unchanged, traders likely paid more attention to changes in its rhetoric, most of which reflected economic concerns and signaled openness to easing if domestic growth and inflation continued to ease.

The New Zealand dollar continued to fall for nearly an hour after the actual statement, before stabilizing and rising slightly to a consolidation stage until the first half of the Asian trading session.