In an unexpected turn of events, the digital asset investment sphere, particularly Bitcoin, has witnessed a massive influx of funds, marking the most significant weekly gain since July last year. A total of $326 million was injected into digital asset investment products, indicating a resurgence of optimism among investors.

Bitcoin Dominates Market Activity, Attracting 90% of Investment Inflows

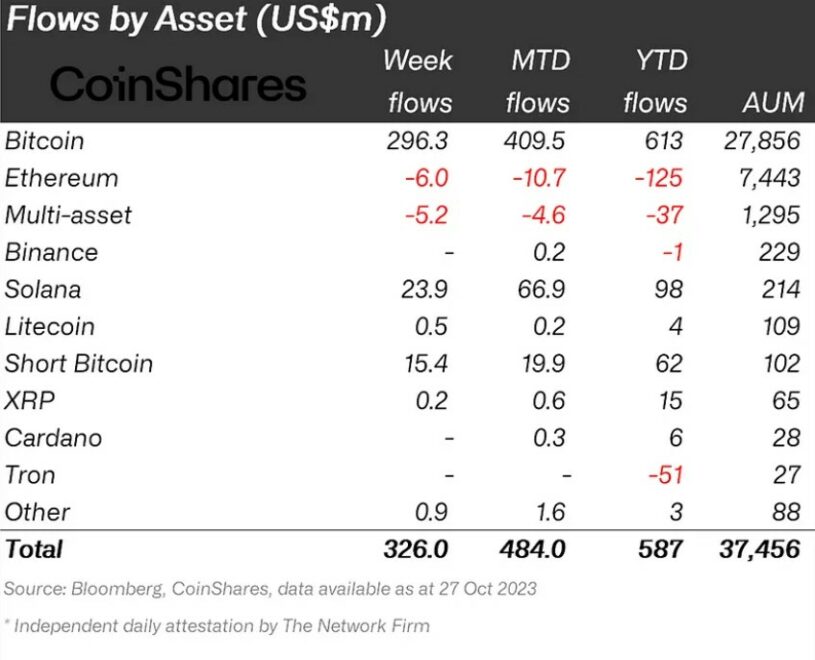

Per a report from asset manager CoinShares, leading the charge, Bitcoin secured a whopping 90% of the total inflows, amounting to $296 million. This significant movement reflects investors’ renewed faith in the cryptocurrency giant despite the simultaneous investment of $15 million in short-Bitcoin products.

These contrasting actions underscore the market’s volatility and the diverse strategies investors adopt. Amidst Bitcoin-centric activities, Solana emerged as a notable player, attracting an impressive $24 million investment.

This surge demonstrates a widening interest and diversification in the cryptocurrency arena, the report noted. However, not all altcoins shared in this week’s prosperity, as the chart below shows.

Diverse Global Participation, Yet Ethereum Faces Outflows

Ethereum faced a setback with an outflow of $6 million, signaling a potential shift in investor sentiment or strategic realignment. Other altcoins, such as XRP, Solana, Litecoin, and Cardano, record a positive performance in capital inflows.

The inflows were not limited to any region, with significant contributions from Canada, Germany, and Switzerland, totaling $134 million, $82 million, and $50 million, respectively.

Even Asia marked its highest weekly inflows at $28 million. Interestingly, only 12% of the investments originated from the U.S., a likely indication of investors biding their time in anticipation of the SEC’s expected approval of a spot-based Bitcoin Exchange Traded Fund (ETF).

Despite these significant inflows, Bitcoin’s weekly gain only ranks 21st in historical records, suggesting that caution still prevails among investors. Nonetheless, the industry is abuzz with the prospect of a regulatory milestone, as a spot-based Bitcoin ETF could mark a transformative step for digital asset investments.

With total assets under management now standing at a robust $37.8 billion, the highest since May 2022, the digital asset domain shows signs of vigor and resilience. The diverse global participation and the influx of funds into various cryptocurrencies reflect a maturing market, albeit one still grappling with volatility and regulatory uncertainties.

The approval of a spot Bitcoin ETF could mitigate the latter and carry the industry into a new era of adoption and legitimacy as an international-level asset class. The world keenly watches the SEC’s next move; the digital asset landscape remains poised for potential significant shifts, promising opportunities, and challenges.

As of this writing, the price of Bitcoin trades at $34,700 with a 14% profit in the last week.

Cover image from Unsplash, chart from Tradingview