the Ethereum ETFs The start was not entirely ideal, as these funds saw mixed inflows in their first three days of trading. Cryptocurrency research firm 10x Research He provided some answers as to why. Institutional Investors They are not very excited about this money.

Wall Street Doesn’t Fully Understand ETH

10x Suggested Research in Recent report Institutional investors have not been warm to spot Ethereum ETFs because they don’t fully understand what they’re about. These Wall Street investors “don’t typically bet on things they don’t understand,” notes the report by Marcus Thielen.

Interestingly, Bloomberg Analyst Eric Balchunas Pointed out this problem right after. Spot Ethereum ETFs Approved In May. At that time, it was male One of the challenges that issuers of these funds will face is distilling the use case for ETH in an “easy to understand” way, just as Bitcoin is easily referred to as “digital gold.”

10x Research has once again highlighted this issue, pointing out that Spot Ethereum ETF issuers have so far struggled to explain ETH to these traditional investors. The research firm specifically pointed to BlackRock’s description of ETH as a “bet on blockchain technology,” but these investors still aren’t interested.

Additionally, 10x Research noted that Ethereum ETF Issuers None of the investors have made any real effort to create awareness for their own funds, as these funds lack significant marketing campaigns. This lack of an easy-to-understand narrative for Ethereum and the efforts made by Ethereum spot ETF issuers are part of the reason why the research firm remains bearish on Ethereum.

“Ethereum may be the weakest link, as fundamentals (new users, revenue, etc.) have been stagnant or declining,” Thielen said, noting that Ethereum’s usage has been declining in this regard. Market cycle Another reason to be bearish on ETH. 10x Research claims that Solana, especially with its superior coin ecosystem, has stolen the shine from ETH this cycle, which is why SOL is outperforming ETH.

Meanwhile, from a technical perspective, 10x Research highlighted the Stochastic indicator, which indicates that ETH Currently, ETH is overbought. They warned that the cryptocurrency is likely to see significant declines in the near term and stated that “it may make sense to squeeze ETH for a little longer.”

Outflows Hit Ethereum ETFs

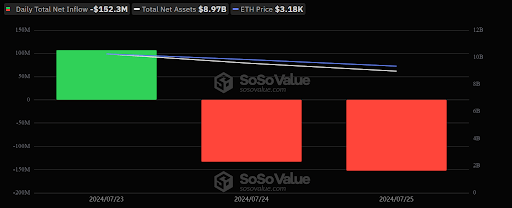

according to Data From the value of SOSO, Ethereum spot ETFs saw net outflows of $152.3 million on July 25 (the third day of trading), with Grayscale Ethereum Fund (ETHE) The single net inflow of $346.22 million was the sole culprit. Other Ethereum spot ETFs also recorded net inflows, but the amount flowing into these ETFs was not enough. Stop the bleeding.

Since it started trading on July 23, this Ethereum ETFs Spot Ethereum ETFs have seen a total net inflow of $178.68 million, with $1.16 billion already flowing out of Ethereum Grayscale in the first three days of trading. Spot Ethereum ETFs enjoyed a stellar first day of trading, with a net inflow of $106.78 million on July 23.

However, they eventually succumbed to outflows from Grayscale’s ETHE, seeing a cumulative net outflow of $133.16 million on the second day of trading and a net outflow of $152.3 million on July 25. The outflows from ETHE are already putting High selling pressure On ETH, which may lead to prices drop For the crypto token in the near term until other Ethereum ETFs start seeing increased demand that could support Grayscale outflows.

Featured image created using Dall.E, chart from Tradingview.com