Satoshi Nakamoto is God and Bitcoin’s design is perfect. Or is it? There’s one feature of the protocol that keeps bugging me: the Halvening (halving, whatever). I’m sure Naka thought this over. His first Bitcoin must have had an incremental reduction of the supply per block. But the final design, the one we know, cuts the block reward in half only after every 210,000 blocks (every four years). Obviously, this decision had a tremendous impact on price action, volatility, and adoption. Unfortunately, it’s not the best supply scheme. Let’s explore.

Halvings

Bitcoin, as we know it, has a supply schedule adhering to the following hard coded rule:

For the non-mathies, this is the sum (Σ) of all the new coins supplied per block from launch till 32 halvings into the future. During the first 210,000 blocks (i=0) the block reward was 50 (50/(20) = 50/1 = 50). The first halving follows (i=1) and the block reward for the next 210,000 blocks is cut in half (50/21 = 50/2 = 25). This continues until the 32nd halving cycle has completed around the year 2140 and the total supply maxes out at practically 21 million coins.

This choice of supply schedule has consequences. Because the supply is suddenly reduced by 50% overnight, it shocks the market. As demand remains unchanged, the price adjusts upward, as Bitcoin is now twice as scarce. The rapid price surge leads to a hype cycle, drawing media attention, attracting new adopters.

The halvening is Bitcoin’s in-built media campaign. But it has a cost. Because the price is so volatile, the price surges into a blow-off top, and the rollercoaster dives back into the abyss. This makes Bitcoin not ideal for most where drawdowns of 75-85% are normal.

Bitcoin’s main feature is its store of value (SoV) function, making it really different from other innovations. If you FOMOed in at the top, the store of value function will only be realized four years later. The only way a new hodler will hold on to their Bitcoin is when they thoroughly understand the protocol, trust the code, and know the price will recover and take off after the next halving. This is a level of abstraction and conviction most prospective adopters don’t have. Negative short term price movements heavily detract from its SoV proposition. It takes months to properly understand Bitcoin (and fiat).

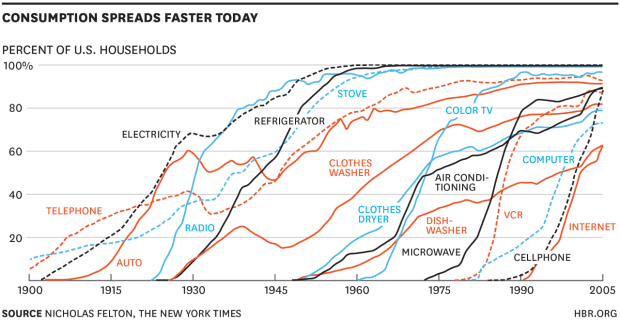

However, with other technologies, the benefits are quite clear after first use. TV, telephone, email, microwave are great examples of innovations where value is perceived within the first minutes.

To stress the impact of perception, look for instance at the adoption of the color TV versus the computer. Television, though earlier, is steeper. Because its value was immediately experienced. The computer was a far more obscure device. So, there are exceptions in the chart countering the trend. It’s important to ask why. Bitcoin can be an outlier too! Value perception plays a large role in the steepness of each individual curve. It’s one of the main drivers of technology diffusion according to Everett Rogers who first studied these curves. This renders adoption narratives like “It’s like the Internet in 1994,” or “innovation adoption curves are getting steeper over time,” less convincing.

Hence, the question: Is the current 4 year supply schedule ideal?

Incremental Supply Reduction

The alternative is simple: ISR. No halvings, but each block will have a slight decrease in the block reward. So block 0 will have 50 BTC. Block 1 will have 49.9999, etc. A linear function is not ideal, but there are other options.

The ISR schedule won’t prevent volatility, but it would surely decrease it, as there are no more pent up shocks to the market. Such a change will turn Bitcoin into a more stable asset, gradually increasing its price over time.

Would the media hype and attention be reduced, then? Possibly. But how many more people would have stayed for the ride? Where’s the optimum point between these two schedules? It’s imaginable that ISR could have improved adoption. The halving cycle might largely obfuscate Bitcoin’s perceived value.

In the future, when we can test Bitcoin out on other planets, or spin up another simulation, we’ll run this experiment. I expect the halving is not the optimal design. Satoshi has made a mistake…in retrospect.

This is a guest post by Bitcoin Graffiti. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.