Michael Sailor's recent move indicated to fund more Bitcoin's purchases to a debate about his high level of his high approach. The company, which is now called Microstrategy, has announced that it will always make a always preferred arrow, STRF (“Conflict”), with a 10 % annual profit. While some believe that this is an innovative way to collect more BTC, others warn of the obligations to distribute cash profits that cannot be defended if bitcoin prices decrease.

Could Celor be the next Bitcoin market motivation?

On X, the strategy announced the creation of STRF (STRIFE), which it described as “a always new favorite display, available to institutional investors and the choice of non -institutional investors.” In its statement, the company explained that the returns will go towards the purposes of public companies – including the working capital – “and the acquisition of bitcoin”, although it stressed that this is “subject to the market and other conditions.”

According to the strategy, STRF holds 10 % cumulative profits annually, with the distribution of the first cash profits on June 30, 2025, then each quarter after that. Observers have quickly noticed how such a high payment can go to the company's resources, given that its public budget is very inclined towards Bitcoin instead of traditional revenue flows.

Among the first critics Whalepanda (Whalepanda), a participant host of Youtube Crypto Magical with Riccardo Spagni, Samson Mww, and Carlie Lee. he Argue The profit distributions of 10 %, which may reach $ 50 million in annual payments if the strategy raises $ 500 million, which is very large due to the company's structure:

“I have said that before that Celor will attend the next Bitcoin Bear market. This seems desperate. 10 % profit distributions on $ 500 million translate into $ 50 million annually, and only payment for cash … they do not have this money.”

Another audio critic, Simon Dixon-Dangerian in the previous investment turned into a bitcoin investor known as support platforms like Kraken, BitFinex and Bitstamp-Druze A severe parallel between the bold step of the famous strategy and the long -term capital management (LTCM) in the late 1990s. Although the scenario is not directly equivalent, Dixon has argued that providing high profits of “insufficient dollar revenues” is similar to “the next level of the next level.”

He warned: “The declaration of the strategy on permanent profit distributions of 10 % driven in dollars-despite the absence of revenues and its operation in adequate dollars with the Bitcoin-based public budget-is a risk of the next level.

Not everyone shares terrible expectations. Some industry numbers insist that the Silor record in the BTC reserves for strategic education – and the relative simplicity of its public budget compared to LTCM – a large pillow attachment. David Billy, CEO of BTC Inc, has argued that Silor's personal commitment to Bitcoin should not be deducted: “Silor literally more than leather in the game more than anyone alive … If you do not love inventory, do not buy it, simple.”

He pointed to critics as “uncomfortable”, which confirms how the general invitation to the master and public tapes brought great attention – and great flows – to the bitcoin coin. Bitcoin analyst Dylan Licorier also refused to compare LTCM, describing it as “literally nothing like LTCM”, which means that the BTC's public budget is not the same regular risks to which the hedge fund is largely developed in dealing with derivatives.

Preston Bish, co -founder of the investor podcast network, Display Take more accurate. Although he expressed reservations about the new version – as it is preceded by the non -use of the strategy “the previous preferred version, which contains 8 % profit distributions and a option for joint or cash payments” – was seen as direct similarities to LTCM as “more than laughter”.

PySH has been highlighted for approximate numbers indicating that even if Bitcoin will stumble with 70 % of its current levels, the strategy can theoretically maintain profits and coupon payments for more than a decade. books:

“If the price of bitcoin decreases by 70 % of here, it still has a value of $ 12 billion in bitcoin in the public budget and 115 meters in annual cash payments (profit distributions and coupons combined) that you must pay for nearly 12 years of effort, this is directed to nearly his effort. It is worth, but I think your demand is increasing.”

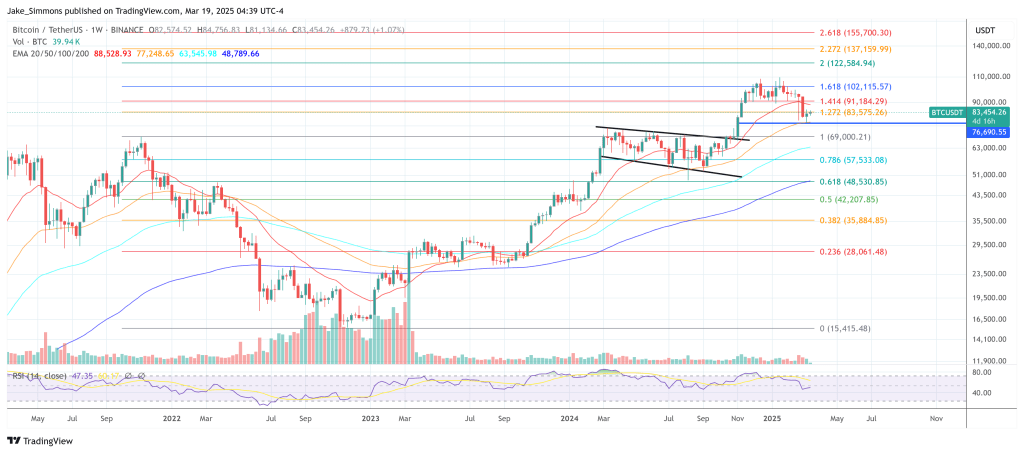

At the time of the press, BTC was traded at $ 83,454.

Distinctive image created with Dall.e, Chart from TradingView.com

Editing process For Bitcoinist, it is focused on providing accurate, accurate and non -biased content. We support strict resource standards, and each page is subject to a diligent review by our team of senior technology experts and experienced editors. This process guarantees the integrity of our content, importance and value of our readers.