(Bloomberg) – The American Securities and Stock Exchange Committee has started the new year in a shift, and cleans the list of enforcement enforcement work and converted what was previously a hostile scene of digital assets into a possible haven.

Most of them read from Bloomberg

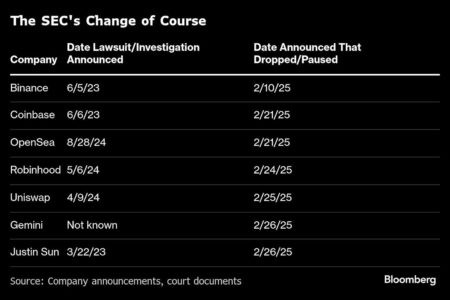

Last month alone, it refused to monitor securities or stop at at least eight cases against encryption companies, including those that targeted some of the most prominent sector faces. The proceeds of running include high-level claims against Crypto Exchange Coinbase Global Inc and Binance Holdings Ltd.-who were prosecuted within one day from each other in mid-2013-as well as legal action threats against Robinhood Market Inc. And uniswap labs and opensea.

“It is a multi -faceted demolition for the most successful SEC enforcement program in history,” said John Reed Stark, a former SEC enforcement lawyer and the advisor now. In the wake of President Donald Trump's election, Stark said that the agency's message to the world was: “We will determine the screaming every aspect of the SEC enforcement enforcement program that is not only unprecedented and unusual, it goes beyond imagination.”

The agency's authors came to the face quickly after the departure of former President Gary Ginsner, who moved away in late January. It is expected that it will be replaced by former SEC Commissioner Paul Atkins, where Mark Oida is working in this role while Atkins is waiting for confirmation. A SEC spokesman rejected the comment.

At the campaign's path, Trump pledged to shoot Jinsler on his first day in his post because he was not popular in encryption circles – one of the many promises that were made on the industry that generates the return of the Republican Party to the authority of the majority. Bitcoin support, the most valuable assets in Crypto, to the highest level ever on the day of its inauguration, although subsequent policy decisions on the customs tariff may send it by 25 % of the peak.

As the list of abandoned cases grows, executives, analysts and friendly organizers expect that innovation will flourish.

“There, as we think, are the reasons for long -term joy,” said Alex Sonders, a research expert at Citigroup. “It should provide clarity on organizing more opportunities to innovate, build confidence and improve the user experience.”

American call

Under the Biden Administration, the CEO of the encryption considered that the American market represents a lost opportunity. Many spoke frankly against Jinsler and its approach to organizing the area, which the industry considered to be used to implement securities laws against the sector.

Companies such as Coinbase and Ripple increased employment efforts quickly abroad as a result, as they look at other judicial states such as Europe, the Middle East and Asia more friendly towards their business strategies. Now some of these decisions are reversed, with Ripple 75 % of its open roles on the American soil in January.

“It seems that the Supreme Education Council on a whim that can wake up on the wrong side of the bed and decides to provide enforcement or providing Wales notice, or calling information. Cathy Yun, General Adviser at the Wormhole Foundation, an organization that supports Blockchain's development:“ This fear seems to have disappeared, especially in light of these separation operations. ”

Since the agency seizes on January 21, the changes under Uyeda were immediate. Within one month, SEC fully replaced the encryption section of the new Internet and Emergi Technologies Unit, and launched a “encryptive business squad” devoted to developing the bases for the sector along with industry advisers. The conclusions of the future business group are already an integral part of how the agency works, as it is used as a basis for SEC's request to stay against Binance last month.

Meanwhile, the intensity of the arguments has decreased on whether the encryption was security or a commodity in the eyes of American law has decreased with the fading threat of enforcement. Experiences such as Robinhood, which have already deleted the distinctive symbols like Solana and Cardano following the SEC claims that you call as possible securities, quickly reactivated to American customers after Trump's victory. The agency was also more open to the requests for boxes circulating on the stock exchange associated with these digital assets.

On Thursday, SEC explained that Memecoins – symbols that embody the Internet joke or a viral moment without any interest – are not considered securities in the eyes of their employees. Trump launched himself Mimikoen in January, and its current value of $ 15 billion before the collapse of more than 80 %. His family is also closely related to the unlimited unlimited coding platform, which sold more than a billion dollars of symbols.

Those who were the main supporters of Trump and his companies also saw their issues that were emptied by the Supreme Education Council. The agency's attorneys and Justin Sun, an encrypted businessman who has invested 75 million dollars in the world, has joint freedom, jointly to establish organizational procedures against him on Thursday. Crypto Excination Gemini Trust Co, whose billionaire owners tried to donate a million dollars in the Bitcoin campaign for Trump's campaign last year, a day before the Supreme Education Council closed its case against business without any action.

SEC's new encoding approach does not mean a free market for everyone. Joe Castelluccio, the Mayer Brown partner, said that the SEC electronic technology enforcement units include ensuring that retail investors are not obtained in encrypted fraud.

C. Christopher Giancarlo, the former head of the future trading committee for goods that now recommends many encryption work: “They are looking for industry to return to a more traditional American spirit of the Internet, which is building things and breaking things, do not ask for permission, and ask forgiveness.” “There is one major warning for that, and this does not cheat people.”

He added that CFTC – which has been a long -time Crypto organizer – may increase activity in this new environment. “When it comes to fraud, manipulation and market misconduct, it will continue to see a very strong enforcement activity,” he said. “It may be more powerful because it will be less dispersed by following companies because of technical violations.”

The problem continued to spread encryption, the last of which was the $ 1.5 billion theft of Crypto Exchange bybit. Last month, Argentine President Javier Millie found himself at the Chefir scandal center, after Mimikoen, who described him, led to the losses of an estimated $ 251 million to investors.

“Say what you want about Gary – maybe he stood on the path of progress, but he also stood on the way of the crime season,” said Dan Hughes, founder of Blockchain Radix DLT LTD.

-With the help of Nicolasm White and Autula.

(He adds that SEC refused to comment in the fourth paragraph.)

Most of them read from Bloomberg Business Week

© 2025 Bloomberg LP