Short EUR/GBP: Candid BoE report and price action support further downside.

Sterling has been on a tear lately, even before the 50bp surprise on June 22nd. The euro itself has enjoyed some resurgence recently with EURGBP bouncing as the pair is trading around 0.8593 at the time of writing.

The Bank of England (BoE) saw the odds of a rate hike increase after the huge inflation reading in May. On the other hand, the ECB has been sticking to its hawkish rhetoric, however it seems to be starting to lose ground somewhat as economic conditions continue to be a concern. Given that the UK economy is exceeding expectations as stated by both Chancellor Hunt and Prime Minister Sunak following the BoE meeting in June, I would expect the UK and rate hike path to be more realistic than the ECB’s.

Inflation also remains higher in the UK than in the Eurozone, providing another form of confirmation that the Bank of England may need to be more aggressive than the ECB in its progress in the third quarter.

Headline inflation in the UK versus the Eurozone in 2023

Source: MS Word, Excel. Created by Zain Fouda

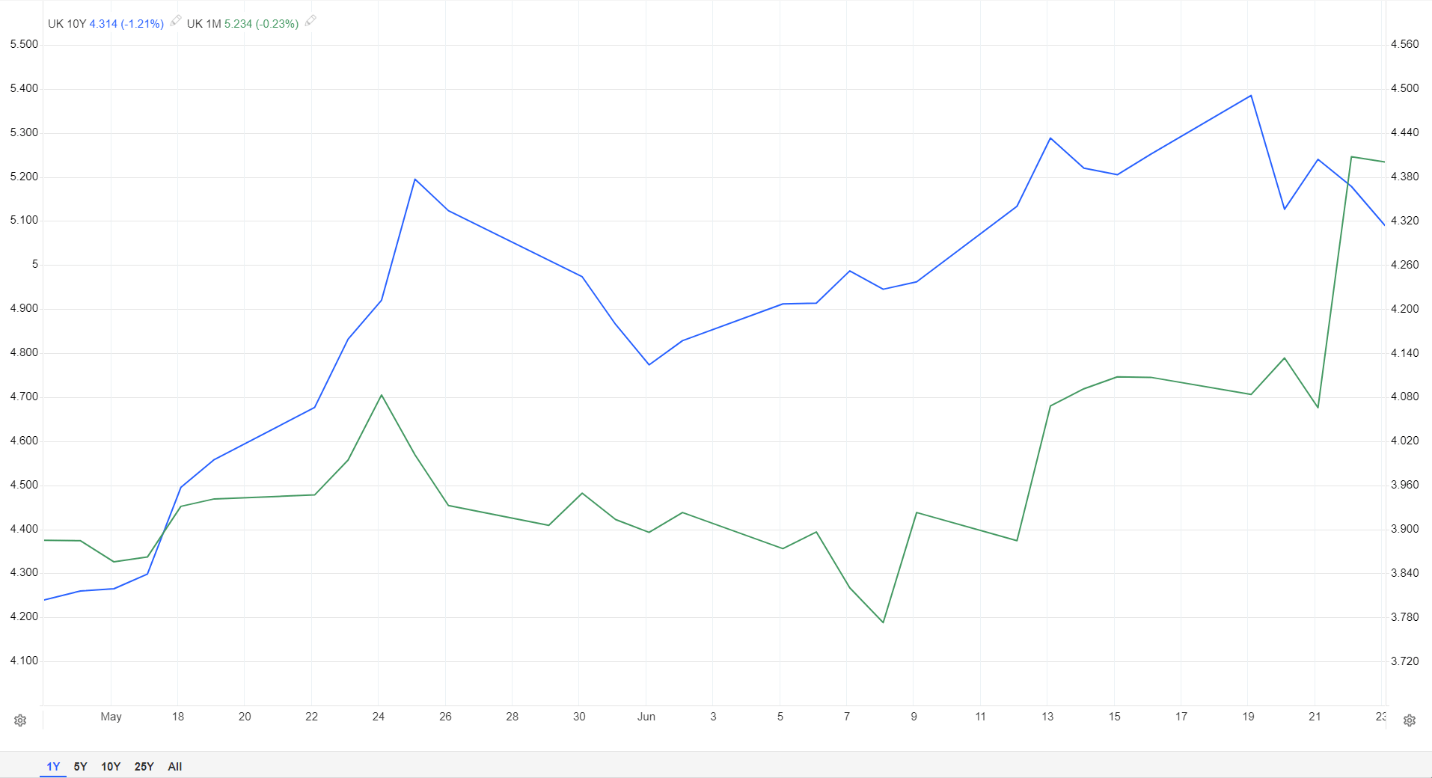

This may be the first time you are hearing this but for once the inverted yield curve may be positive at least as far as the GBP is concerned. An inverted yield curve could theoretically work in favor of a reserve currency like the British pound, with a similar story seeming to be happening with regard to the US dollar. Just another reason why I think the pound will remain supported in the third quarter and gain against many of its peers in the G10.

UK returns 10 years for 1 million

Source: TradingEconomics, prepared by Zain Fouda

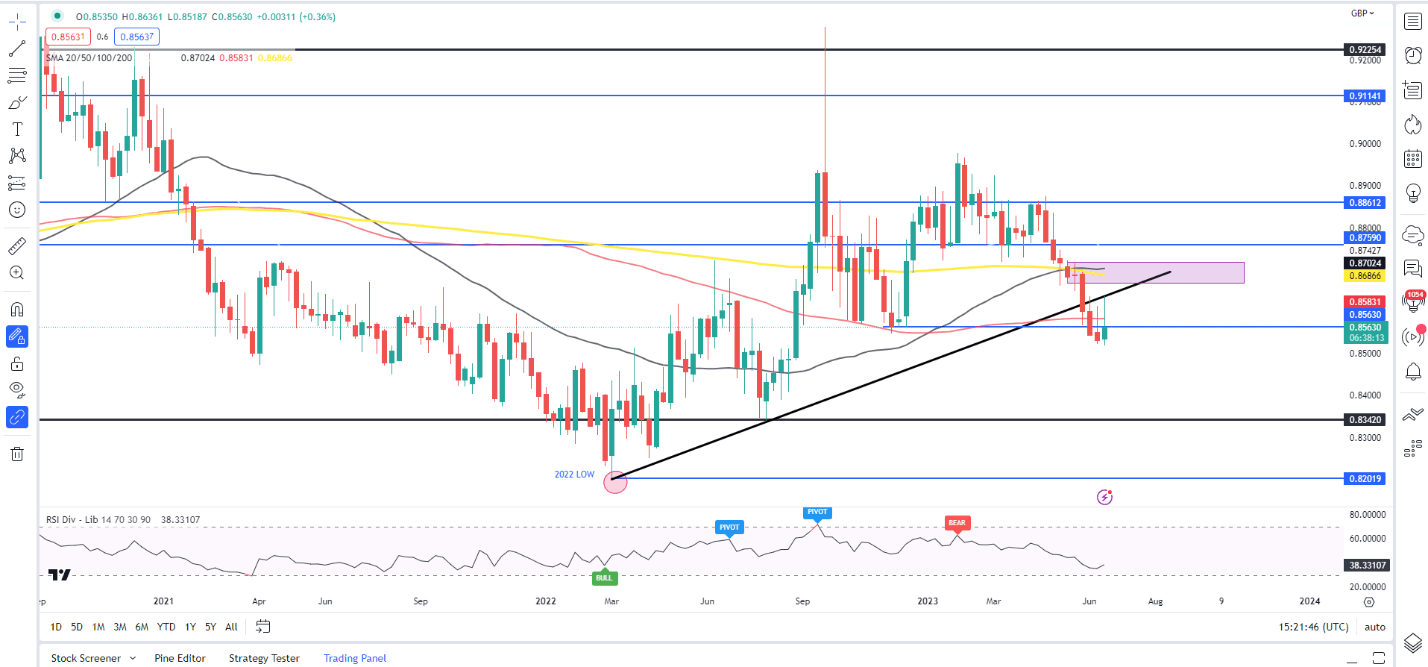

Technical Analysis

From a technical perspective, looking at the market structure on the weekly time frame and we have just broken the general bullish trend that was valid since March 2022 lows. The breakout and closing of the weekly candlestick below 0.8560 confirms a change in the structure to bearish while at the same time breaking the bullish trend line.

The current weekly candle retested this week’s trend line before rejecting with the 100 day moving average also providing resistance. The weekly candle is on its way to close as the inverted hammer candle indicates more bullishness in the coming week, preferably towards 0.8700-0.8800. The general bearish trend will remain as it is without a weekly candlestick closing above the 0.8862 handle.

EUR/GBP Weekly planner

Chart by Zain Vawda, TradingView

Now looking at what the price action on the weekly time frame is telling us, a deeper bounce at this point cannot be ruled out as the 0.8700 level looks particularly attractive with a bunch of confluence there.

On the daily chart we also have a death cross formation forming as the 100 day EMA is about to cross below the 200 day EMA, which is another sign of bearish momentum at play. If we look at the daily chart below, I would favor a pullback towards the 0.8700 mark as that would provide a better risk reward opportunity for potential short positions. Downside targets will settle around 0.8342 mark and below that at 2022 low around 0.8200 handle.

EUR/GBP daily planner

Chart by Zain Vawda, TradingView

Connect with Zain and follow her on Twitter @employee