Market summary

Major US indices continue to add to recent gains overnight (DJIA +0.43%; S&P 500 +0.69%; Nasdaq +0.83%), as further calm in US inflation reflects some degree of success in policy moves so far and provides room for the Fed. (The Federal Reserve) is having some wait and see at the upcoming FOMC meeting. An almost certain 90% possibility of a rate hike this week is being priced in by Fed funds futures, although expectations are still largely tilted towards a 25 basis point upward adjustment in rates in July.

A rise in core inflation of 0.4% from the previous month may be the reason behind this by indicating some flat rates. However, the broader trend of moderate inflation suggests that we are still heading towards the final stretch of the Fed’s tightening cycle, with one-off policy adjustments at best.

With expectations largely pricing for the halting rate scenario, focus will be more on policy makers’ guidance and the new economic outlook to determine what comes next. The more data-driven stance and wording on policy flexibility from the Fed might be seen as less hawkish. On the other hand, if final interest rate expectations are revised higher along with inflation estimates, it could paint higher versus longer rate expectations and reignite hawkish fears.

US Treasury yields were broadly higher, with the two-year yield delivering a fresh three-month high despite an initial pullback. The rise in both nominal and real yields in the US kept downward pressure on gold and silver prices overnight. After the initial move higher, the gains in silver prices quickly reversed on the day, with the formation of a long tailed bearish candle indicating a strong presence of sellers. Prices are struggling to stay above a near-term ascending channel pattern for now, with any failure to defend the channel’s lower trendline support likely paving the way towards the May 2023 low.

Recommended by IG

Forex for beginners

Source: IG Charts

Asian Open Championship

Asian stocks appear set for a positive opening, with Nikkei +0.75%, ASX +0.32% and KOSPI +0.03% at the time of writing. The sudden rate cut on China’s short-term policy suggests that recent economic weakness is worrying the Chinese authorities, which could pave the way for more policy moves to come, with all eyes focused on medium-term one-year lending. Facility (MLF) rate this Thursday. While investors may welcome a further decline in accommodative policies, the bullish reaction may remain muted, with clearer indications of policy success looking to provide greater conviction about a sustainable recovery.

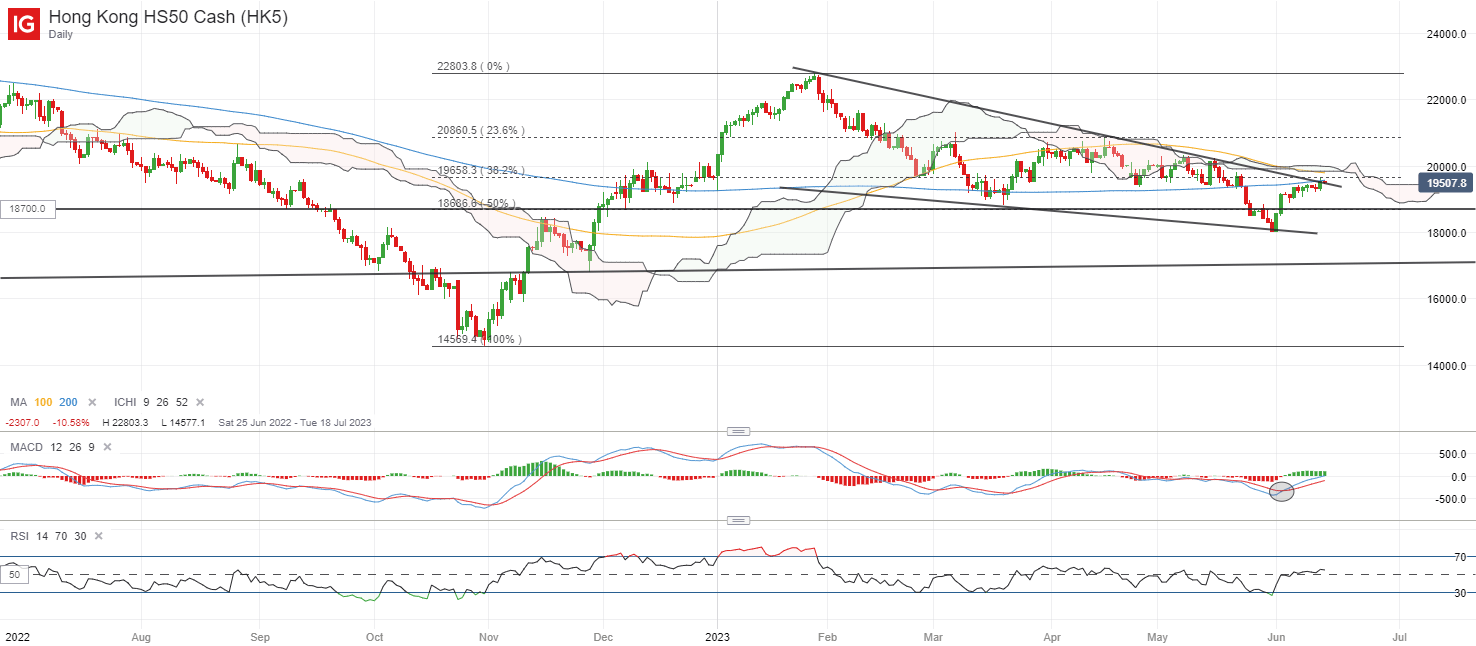

Having been trading in a falling wedge pattern since the beginning of the year, the Hang Seng Index has returned to retest the upper trend line resistance, with gains of 9% month to month on the hope that further stimulus support will start higher growth. However, a series of resistance is still in its way to push the risks of forming a lower top, with 19,600 acting as immediate resistance to overcome. Lots to wait, with the RSI again crossing above the key 50 level but maintaining it will be key for now to keep the buyers in control.

Source: IG Charts

On watch list: GBP/USD at one-month high as hawkish bets mount

The sudden strength in UK jobs numbers translated into gains in the GBP/USD overnight as the Bank of England (BoE) interest rate forecasts were reset to price the central bank’s rate hike during subsequent meetings. Higher vs. Longer rate expectations are the takeaway, with some rates this rate could end up at 6% by the end of this year, another 150 basis point increase from the current 4.5%. This was followed by comments from BoE Governor Andrew Bailey pointing to firmer inflation, reinforcing the need to do more.

The GBP/USD pushed to a fresh one-month high overnight, with a bullish cross on the Moving Average Convergence/Divergence (MACD) and the RSI heading above the key 50 level indicating a bullish bias for the time being. The pair has been trading within a rising wedge pattern since October last year, and further upside is likely to leave the upper wedge trend line at 1.276 pending a retest. Going forward, focus will shift towards the FOMC meeting, leaving any moves in the US dollar as the biggest catalyst in driving the pair. Near-term support might be at 1.248, where the lower wedge trendline stands.

Recommended by IG

How to trade GBP/USD

Source: IG Charts

Tuesday: DJIA +0.43%; S&P 500 +0.69%; Nasdaq +0.83%, DAX +0.83%, FTSE +0.32%