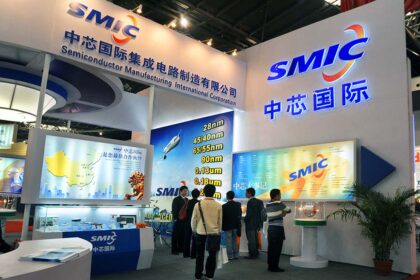

Chinese chipmaker SMIC saw first-quarter revenue drop to $1.46 billion as it continued to contend with chip shortages and US trade sanctions.

Semiconductor Manufacturing International Corporation (SMIC) saw its revenue decline according to the latest quarterly figures. On Friday, the Chinese chipmaker giant reported revenue of $1.46 billion for the first quarter of 2023 amid tough macroeconomic benchmarks. In addition to down 20.6% year-over-year, SMIC’s latest revenue tally marks its first income shortfall in more than three years. The last time the Shanghai-based semiconductor manufacturer saw sales decline was in the third quarter of 2019.

SMIC’s revenue decline also extended to its net profit, which fell 48% year-over-year to $231.1 million. As China’s largest contract chip maker, SMIC hopes to eventually catch up with regional competitors, especially Taiwan Semiconductor Manufacturing Corporation (TSMC). However, SMIC’s ambitions to boost China’s domestic semiconductor industry suffered a setback when the company imposed US sanctions in 2020. At the time, Washington placed SMIC on a trade blacklist called Entity List, effectively isolating the leading East Asian chipmaker. on basic production resources. As a result, SMIC has struggled to competitively manufacture more advanced and modern semiconductors.

Despite production delays from TSMC and Samsung, as well as restrictions from US sanctions, SMIC posted record revenue throughout the past year. In February, the company reported full-year 2022 revenue of $7.2 billion, which is a 34% increase over last year. Furthermore, SMIC experienced a gross margin of 38%, its second year of sales growth above 30%.

SMIC Exec is causing revenue declines due to a global chip shortage which is also affecting other semiconductor players

SMIC executives attributed the recent drop in income to slumping demand due to an ongoing chip shortage. On the earnings call, co-CEO Zhao Haijun admitted that prospects for a recovery in the second half of the year remain unclear. SMIC’s profit decline also came amid revisions to business and operating forecasts by other leading chipmakers such as TSMC and Samsung.

The impact of the global chip glut led TSMC to recently update its 2023 revenue forecast from slight growth to a lower single-digit decline. Meanwhile, US semiconductor maker Intel (NASDAQ: INTC) expects a loss of 4 cents per share in the second quarter of 2023. The bleak outlook for Intel came after the Santa Clara-based company reported its most significant quarterly deficit. Last month. However, Intel CEO Pat Gelsinger remained optimistic at the time by highlighting the bright spots in the chip maker’s agenda. Gelsinger emphasized that Intel’s dismal first-quarter fiscal spending hinted at the company’s steady transformational progress, to explain:

“While we remain cautious about the macroeconomic outlook, we are focused on what we can control as we deliver IDM 2.0: driving consistent execution across our process and product roadmap and developing our plumbing business to best position us to take advantage of the trillion-dollar market opportunity ahead.”

David Zinsner, chief financial officer of Intel, also assessed its performance, stating that it exceeded both the highest and lowest expectations. Moreover, at the time, the CFO added that Intel remained committed to exercising discipline in managing expenses. Zinsner said the tech giant will continue to increase efficiency and cost savings.

the next

Tolu is a cryptocurrency and blockchain enthusiast based in Lagos. He likes to demystify cryptocurrency stories down to the bare essentials so that anyone anywhere can understand without much background knowledge. When not in the depths of cryptocurrency stories, Tolo enjoys music, loves to sing, and is a movie lover.