Solana has made an impressive recovery, rising more than 14% from recent local lows, and showing resilience after a period of correction. This renewed momentum has reignited investor optimism, putting Solana into prominence in the cryptocurrency market. Key metrics from Glassnode reinforce this sentiment, revealing that Solana has consistently maintained positive net capital inflow since early September 2023. While minor outflows have been observed, the overall trend underscores continued interest and confidence in the project.

Related reading

These capital inflows highlight Solana’s growing adoption and utility, indicating that the blockchain ecosystem continues to attract new participants and capital. As the market evolves, these metrics indicate that Solana is poised for continued growth, supported by strong fundamentals and a thriving developer community.

As its recovery gains momentum, Solana remains a prime contender for investors eyeing projects with strong long-term potential. The continued influx of capital not only reflects market confidence but also paves the way for further expansion in the coming months. Whether through innovative decentralized applications, improved scalability, or increased network activity, Solana’s upward trajectory appears to be far from over, making it a focal point in the broader cryptocurrency landscape.

Solana metrics reveal a growing network

Solana appears poised for a massive rally in the coming year as its network continues to demonstrate sustained growth and resilience. According to an insightful report by Glassnode, Solana has consistently recorded positive net capital inflows since early September 2023. Despite minor outflows during this period, the overall trend highlights the network’s ability to attract liquidity and maintain investor confidence.

One of the most notable findings of the report is the peak daily flow of $776 million in new capital, which confirms the great interest and participation within the ecosystem. This continuous flow of liquidity has not only fueled Solana’s growth, but has also played a pivotal role in supporting price stability and appreciation. Such a steady influx of capital indicates that investors view Solana as a high-potential venture capable of outperforming in the coming months.

Related reading

With strong fundamentals, growing adoption, and increased developer activity, Solana’s upward trajectory is well positioned to continue. If the current trend of capital inflows continues, it could serve as a catalyst for a massive rally, perhaps exceeding previous highs.

As we look ahead to 2025, Solana remains a project to watch, offering investors an opportunity to participate in a blockchain ecosystem that is rapidly gaining importance in the cryptocurrency space.

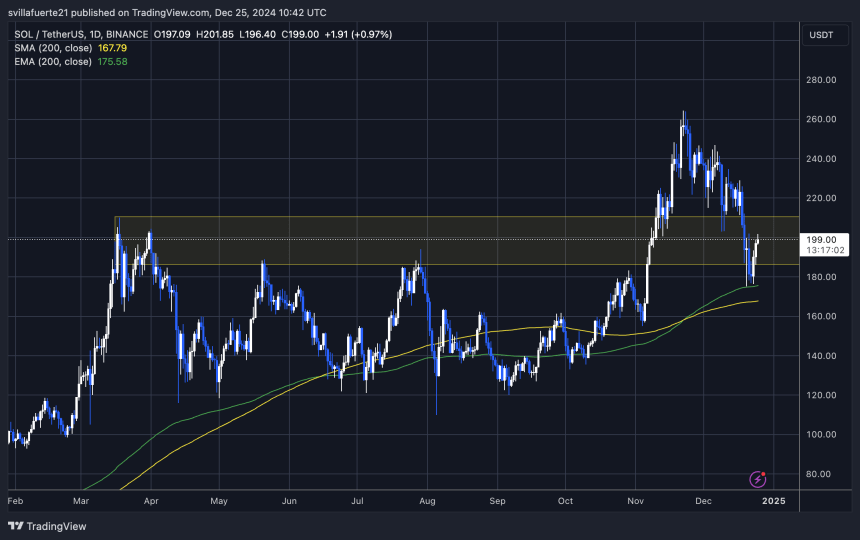

Strong bounce from key demand

Solana (SOL) is currently trading at $199 after successfully bouncing from the $175 level, a critical demand zone that has proven to be a strong support area. This rebound shows Solana’s fundamental strength and its ability to attract buyers at key levels, paving the way for further upward momentum. The $175 mark has historically served as a launching pad for SOL, and this time is no different, with the price now targeting higher levels.

If Solana can break above the $210 resistance in the coming days, a rapid rally will likely follow. A break of this barrier would signal strong bullish momentum, which could push SOL to new highs and reignite investor enthusiasm. However, the market may also see a period of sideways consolidation as traders evaluate current conditions and prepare for the next significant move.

Related reading

Holding above $190 would still be a positive sign, indicating that SOL is building a solid foundation for its next rally. Maintaining strength around these levels is crucial to maintaining the bullish outlook, as any failure to hold could lead to a retest of low demand areas. Right now, all eyes are on Solana as he navigates through key price levels and prepares for his next move.

Featured image by Dall-E, chart from TradingView