S&P 500, Nasdaq Quotes, Charts and Analysis:

Recommended by Zain Fouda

Get your free stock forecast

Read more: Crude Oil Weekly Outlook: Oil looks forward to further recovery as recession and demand concerns persist

S and P500, Nasdaq 100 basic background

US stocks remain within the range that has been in place since the rally faded early in the year. The SPX and Nasdaq posted marginal gains yesterday, but continued indecision remains. Last week’s FOMC meeting was seen as providing hope for the long-term direction of US stocks, but with a bit more clarity on interest rates from the Fed, attention has turned to a potential recession.

US earnings have remained strong of late, offsetting any potential losses from ongoing concerns about the US banking crisis as well as a potential recession. Markets are also awaiting highly anticipated talks on the US debt ceiling as concerns about default continue to mount weighing on sentiment. US President Biden is expected to discuss the debt ceiling with Republican House Speaker Kevin McCarthy (first meeting in 3 months), Senate Republican Minority Leader Mitch McConnell and congressional Democrats later today. The hope lies in finding a middle ground as Treasury Secretary Janet Yellen continued to sound the alarm about the repercussions of a default for the US and global economies.

The Nasdaq 100 index continued its rally, hitting a new year-to-date high yesterday. The index was in the longest bear market (143 days) since the 2008 financial crisis until yesterday when the index officially entered bull market territory. The index is now up about 20% from its lows but is still 24% from the record highs it hit in November 2021. Taking a quick look at the previous lows of the NASDAQ 100, we can see that the current iteration ranks positively when compared to the 22.2% decline compared to the financial crisis of 2008 with a print rate of 53.97%.

Trade Smart – Subscribe to the DailyFX newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to the newsletter

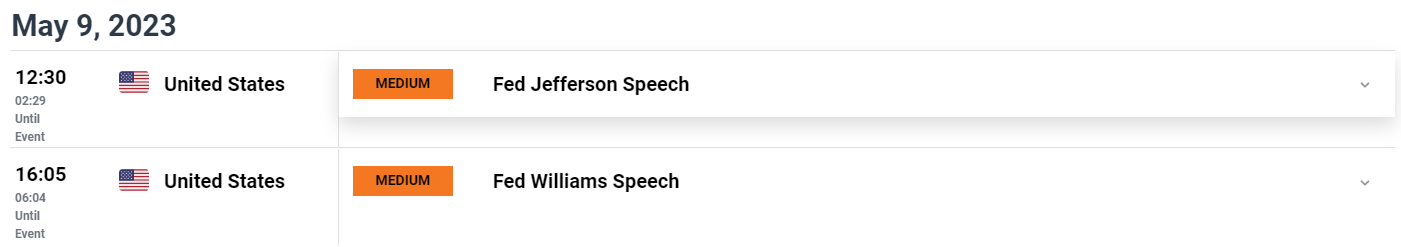

Key economic data ahead

Looking at the rest of the day and the economic calendar it doesn’t look all that exciting. The Fed speakers seem to be the highlight of the day as markets patiently await US CPI data.

For all the economic data and events that move the market, see DailyFX calendar

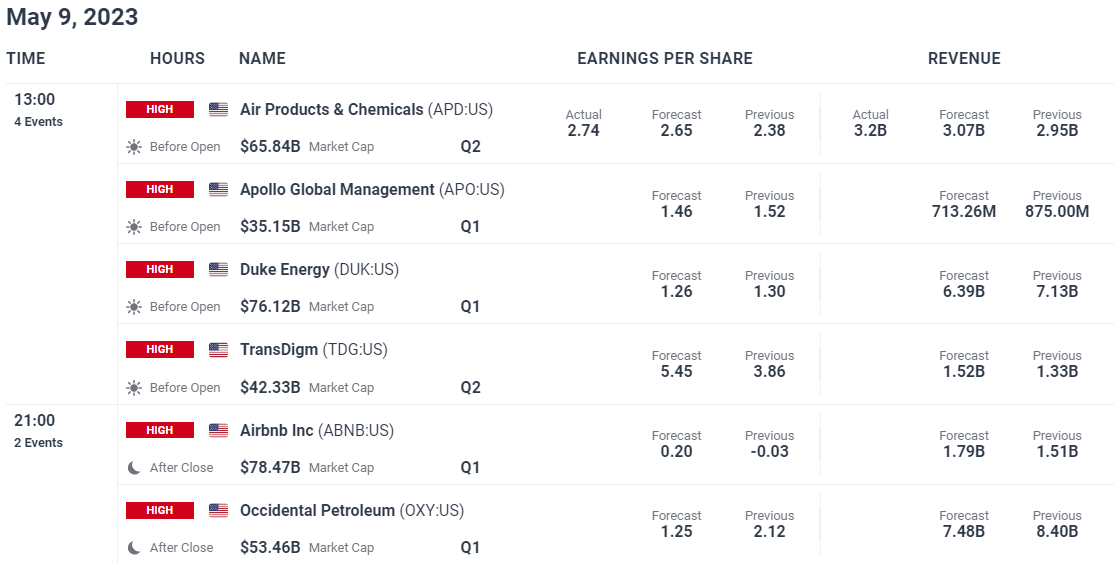

Given the lack of risk events, the earnings calendar will likely play a greater role in price movements ahead of tomorrow’s US CPI. We have a bunch of companies reporting today, the main ones being AirBnB, Apollo Global Management and of course last year’s big winner Occidental Petroleum.

For all the economic data and events that move the market, see DailyFX calendar

Final thoughts and technical outlook

Market participants welcomed the potential end to the Fed’s hiking cycle last week as stock markets have historically benefited from such a move. However, current conditions remain challenging, with the strong jobs data on Friday, the possibility of the Fed raising interest rates for longer continues to grow. Yesterday’s Fed’s quarterly loan survey showed tougher lending standards and weaker credit demand from large and medium-sized companies during the first quarter. A sign that the late effects of the walking cycle are starting to seep into the economy and could further affect US stocks moving forward.

Standard & Poor’s 500 Daily chart – May 9, 2023

Source: TradingView

Looking at the daily time frame on the SPX we can see the indecision reflected in the recent price action. After printing a lower low on April 26th, the price then printed a new higher high before printing a lower low again last week. However, the top around 4200 also happens to be the top of a range that has been holding since August 2022. SPX has been caught in a range between 3800 and 4200 since the beginning of 2023 with no clear breakout in sight. The selling pressure will continue as long as we remain below the 4,200 handle, with a retest of the 100-day EMA at around the 4,000 mark looking more likely. The main support for the day is 4100 and 4050, with resistance around 4147, and of course the 4200 mark.

Nasdaq 100 Daily Chart – May 9, 2023

Source: TradingView

The NASDAQ 100 barely reached a new year-to-date high, before closing as a doji. We have seen the Nasdaq futures drop so far before the US open as we have a potential double top pattern at play as well. Similar to the SPX, the Nasdaq has been stuck in a 450-point range between 12,850 and 13,300 since the beginning of April.

As discussed above, we have technically entered a bull market on the NASDAQ however the downward pressure remains. Range-limited trading opportunities continue to present themselves but the long-term outlook remains murky.

The main intraday support areas are around 13195, 13107, and 12935, while the resistance is around 13300, 13600, and 14000 levels, respectively.

Introduction to technical analysis

Candlestick patterns

Recommended by Zain Fouda

Written by: Zain Fouda, market writer for DailyFX.com

Connect with Zain and follow her on Twitter: @tweet