After a blazing start to 2024, led by AI-fueled tech enthusiasm and the Fed’s dovish pivot, U.S. stocks might have further room to run. However, high valuations demand that traders and investors alike become more selective. For equity index traders, this means looking beyond the S&P 500 (SPY) and Nasdaq 100 (QQQ), which are dominated by big tech, for attractive values with strong long-term potential.

One possible idea would be S&P 500 Equal Weight Index, as proxied by the exchange-traded fund RSP (Invesco S&P 500 Equal Weight ETF).

While the SPY and QQQ have rallied 67% and 36% respectively since 2023, RSP is up less than 18%, suggesting room for catch-up. RSP’s equal weighting methodology also mitigates the dominance of mega-cap names, allowing for diversified exposure to a broader spectrum of companies in the U.S. market.

Looking for actionable trading ideas? Download our top trading opportunities guide packed with insightful strategies for the coming months!

Recommended by Diego Colman

Get Your Free Top Trading Opportunities Forecast

SPY, QQQ & RSP Weekly Chart

Source: TradingView, Prepared by Diego Colman

Several factors could propel RSP higher in the second quarter. U.S. economic conditions appear to be stabilizing, with recession fears lessening. This bodes well for risk assets, especially some of the smaller or previously lagging companies that have greater representation within an equal-weight index.

The fact that the Fed will soon transition to a looser stance should also be seen as a positive catalyst. At its March meeting, the U.S. central bank indicated that it remains on track for three rate cuts this year despite slowing progress on disinflation. This signals that policymakers may now be prioritizing economic growth, even if that means tolerating somewhat higher inflation for a while.

The RSP ETF offers a way for investors to gain exposure to the broader S&P 500, potentially uncovering undervalued opportunities. As the economy stabilizes and the Fed’s easing cycle approaches, RSP could be well-positioned for a solid second quarter.

If you’re looking for an in-depth analysis of U.S. equity indices, our Q2 stock market trading forecast is packed with great fundamental and technical insights. Request a free copy now!

Recommended by Diego Colman

Get Your Free Equities Forecast

How to Play the Bullish Strategy?

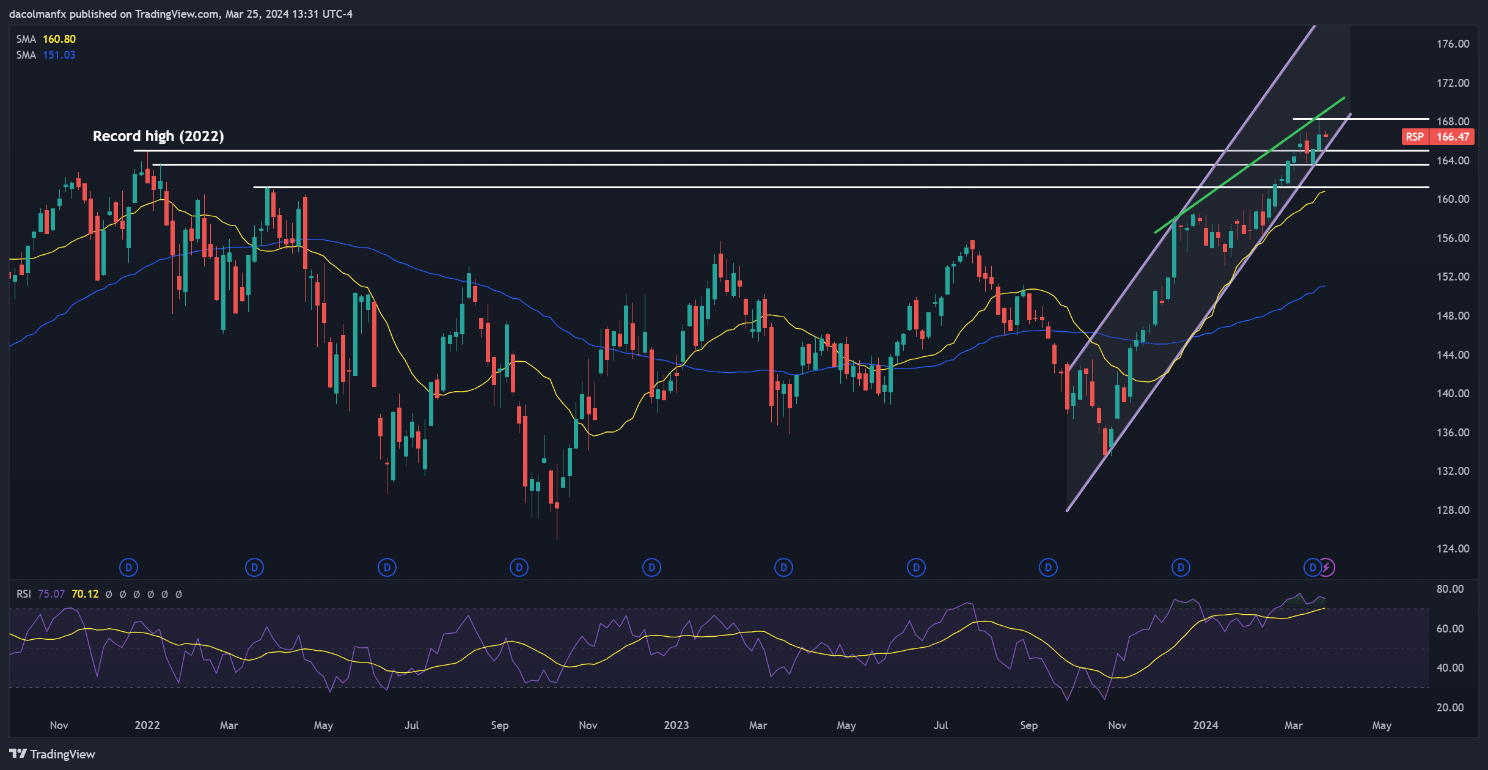

RSP breached its record set in January 2022 this quarter, briefly climbing to a new all-time high above 168.00. An approach to capitalize on this recent breakout could involve awaiting a pullback. If the previous peak near 165.00, which once acted as resistance can be confirmed as support, that could indicate that prices have established a short-term floor from which to initiate the next leg higher. In this scenario, a rally towards 168.00 could be on the horizon. On further strength, all eyes will be on 178.00, the upper boundary of an ascending channel in play since October 2023.

On the flip side, if 165.00 fails to provide support on a retest and prices dip below it decisively, the bullish thesis would be compromised but not entirely invalidated. Under such circumstances, a retracement towards the 50-day simple moving average around 161.10 could potentially unfold before RSP regains a foothold and mounts a comeback. However, if this technical area is also taken out, sellers could stage a resurgence, invalidating the near-term constructive outlook.

RSP Weekly Chart

Source: TradingView, Prepared by Diego Colman