(Bloomberg) – The Wall Street merchants were not concerned about the possible effects of American definitions on inflation did not get many economic data that only confirmed fears of price pressures, which enhances speculation that the federal reserve will not promote to reduce interest rates.

Most of them read from Bloomberg

The stocks erase this week, as the S&P 500 decreased about 1 %. President Donald Trump said he will announce the mutual fees next week in the escalation of his commercial war. The United States Steel Corp. He also referred to Nippon Steel Corp. Think about investing in the company instead of an explicit purchase. The stocks were pressed after the data showed a chip in the consumer morale amid anxiety about inflation. The mixed jobs numbers highlighted the moderate labor market – but the health – a wage lease. The bonds fell. MEGACAPS slides in a disappointing look at Amazon.com Inc.

The latest economic readings help to clarify the reason for reference to policy makers that they are not in a hurry to reduce borrowing costs after three price discounts last year. Although merchants are still betting that the next step will be a reduction, they only seek completely in September.

Sima Shah said in the main asset management: “The broader image is still a picture of the flexibility of the labor market and the pressures of the ongoing wages,” Sima Shah said in the main asset management. “This simply gives the Federal Reserve a little reason to reduce policy prices immediately.”

Nasdak 100 lost 1.3 %. Dow Jones Industrial Mediterranean slipped 1 %. The “Great Seven” Meter sank 2 %. Rasell 2000 1.2 % decreased. Amazon fell about 4 %. Roblox Corp. It is part of an active investigation by the American Securities and Exchange Committee, according to the information obtained by Bloomberg News.

The yield on the treasury bonds for 10 years is provided for five years, five basis points to 4.49 %. The Bloomberg index in dollars increased by 0.2 %.

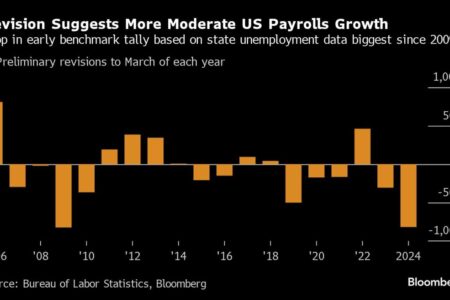

Non -agricultural salaries increased by 143,000 last month after upward reviews to the previous two months. Other reviews that were implemented once a year were not as he thought once – the average job gains reached 166,000 a month in the past year, and it slowed the pace of 186,000 at first.

The unemployment rate was 4.0 % – the survey used to produce the integrated number is separate reviews to reflect the estimate of the new population at the beginning of the year, making the number not disturbable since the previous months. Meanwhile, wages rose 0.5 %.

“The growth of strong wages is useful for workers and must be seen as a positive spending on consumers,” said Brett Kinwell in Itoro. “However, Wall Street has seen this scale closely over the past few years, with anxiety that very strong wages growth can push inflation up.”

He said he was out of the stubborn result, the latest job report is not a cause of warning.

“While some investors may worry about the effects of inflation or price discounts, they do not make mistakes: it is better to have a strong economy and the labor market from a deteriorating environment. Remember that stocks tend to achieve good performance amid light enlargement.”

For Neil Dutta in Renaissance Research, the fixed -income reaction to the data is an opportunity to clarify the asset category.

“In the end, the Federal Reserve will need to reduce prices because many things do not work with higher rates,” Dutta said. “Given the same data, the periodic areas of the labor market are slow. The goods produced for soft labor and total hours in the manufacturing sector.”

However, Dutta also notes that the low -unemployment level probably keeps the Federal Reserve on the margin.

He said: “The federal reserve is not in a tolerant mood now.” “They are looking for reasons to wait and give them today’s report.”

It is appropriate to maintain the standard interest rate of the Federal Reserve coach, as it was for some time, given the stable labor market, limited rights to inflation in recent months and uncertainty about financial and commercial policy expectations. Meanwhile, the President of the Minneapolis, Neil Kackari, told CNBC that he is expected to continue to calm down to a goal of 2 %, allowing political makers to reduce interest rates “modestly” by the end of the year.

The federal reserve is likely to be very careful not to read a lot in today’s report, “says Lindsay Rosner at Goldman Sac have a federal reserve that is likely to be very careful in reading in today’s report.

“In both cases, the Federal Reserve should feel the seizure of the rest of the winter, knowing that the right decision was to hit the temporary suspension button on price discounts,” said Charlie Ribli at Allianz Management.

The Federal Reserve has already removed expectations to reduce the following price, and the job report may justify this approach – if it does not pay them to pay expectations further, according to Jason Braid in Gllingide.

“The federal reserve has another round of inflation and employment data to Mull before the next announced announcement on March 19,” said Mark Hamrik at Bankraate. “The remaining patient is seen before another step to the interest rate after she recently chose to stand on Bat.”

Next week, the US consumer price index in January is likely to prove a mixed bag for anti -inflation, while retail sales may slow down, according to Bloomberg’s Economic Bloomberg.

“Core Core CPI surprised calm in January 13 of 14 years, when the revenues increased on 6 of February 7,” said Gente Dharingra at BNP Paribas. “However, this year we can see an inconsistency towards the lower returns – a upside down head print may be seen as” usual “deformation in January, but negative printing is seen as good news.”

The most prominent companies:

-

Amazon.com warned. Investors that they may face restrictions on capabilities in the cloud computing department despite their plans to invest about $ 100 billion this year, as most funds are moving towards databases, local chips and other equipment to provide artificial intelligence services.

-

Apple Inc. plans. To reveal a comprehensive reform of iPhone SE in the coming days, a step that will update its low -cost style in an attempt to stimulate growth and lure consumers by switching from other brands.

-

Pinterest Inc. Strong revenues in the quarter and provided optimistic expectations for sales in the current period, which is a sign that its advertising work continues to grow despite increasing competition from much larger competitors in the social media space.

-

CLODFLARE Inc. It is a software company, on the results of the fourth quarter that won the expectations.

-

Expedia Group Inc. Better total reservations than expected in the last months of 2024, which reflects a flexible demand for travel during the winter holiday season.

-

Nikola Corp explores a potential bankruptcy deposit, according to people familiar with this issue, in the wake of a loud period in which the electric truck maker between the stock darling and the scandal institution may swing.

Some of the main moves in the markets:

Shares

-

S&P 500 decreased by 0.95 % from 4 pm New York time

-

NASDAQ 100 % decreased by 1.3 %

-

Dow Jones Industrial Average decreased 1 %

-

The MSCI World Index decreased by 0.8 %

-

The total Bloomberg Blueberg Index Index decreased 2 %

-

The Russssell 2000 index decreased by 1.2 %

Currency

-

The Bloomberg Index in dollars increased by 0.2 %

-

The euro decreased by 0.5 % to $ 1.0329

-

The British pound decreased by 0.2 % to $ 1.2409

-

The Japanese yen did not change a little at 151.29 per dollar

Cross currencies

-

Bitcoin fell 0.9 % to 95,923.59 dollars

-

Al -Atheer decreased by 4 % to $ 2,601.22

Bonds

-

The return on the treasury bonds is offered for a period of 10 years five basis points to 4.49 %

-

Germany’s return has not changed for a little bit for 2.37 %

-

Britain’s return has not changed for a few years a little at 4.48 %

Commodity

-

West Texas Intermediate crude increased by 0.5 % to $ 70.95 a barrel

-

Gold rose 0.2 % to 2,861.96 ounces

This story was produced with the help of Bloomberg’s Option.

-With the help of Lin Thomason, Alegra Catley and Robert Brand.

Most of them read from Bloomberg Business Week

© 2025 Bloomberg LP