(Bloomberg) — Investors in Super Micro Computer Inc. Two months waiting for the company to submit a plan that would allow it to remain listed on the Nasdaq Stock Exchange. Although the deadline is only a few days away, this plan has not yet been achieved.

Most read from Bloomberg

The server maker has until Monday, November 18 to either file a deferred 10K annual report or file a plan to file the form with the Nasdaq to be compliant with the exchange’s rules. Super Micro’s original deadline to file the plan was Saturday, November 16 but under Nasdaq rules: If the last day of the period is a Saturday, Sunday, or a federal or Nasdaq holiday, the period will continue until the end of the next day. A day that is not one of those days.

“As we previously disclosed, Super Micro intends to take all necessary steps to achieve compliance with Nasdaq’s continued listing requirements as soon as possible,” a Super Micro spokesperson said. Shares of Super Micro rose as much as 2.8% in early trading Friday.

Super Micro delayed its annual filing in August after a damaging report from short-seller Hindenburg Research. The company is also facing an investigation by the US Department of Justice, and its auditor, Ernst & Young LLP, resigned in October, citing concerns about Super Micro’s governance and transparency.

Super Micro this week postponed filing its quarterly Form 10-Q for the period ending September 30. The company also said that a committee set up by its board of directors to review internal controls has concluded its investigations arising from the concerns raised by Ernst & Young, and that while it has “other work in progress,” it expects to complete the review soon.

“Whatever the results are, whatever their plan is” to hire a new auditor and file their financial reports, Wedbush analyst Matt Bryson said by phone. “I wouldn’t be shocked if something comes up in the next couple of days.”

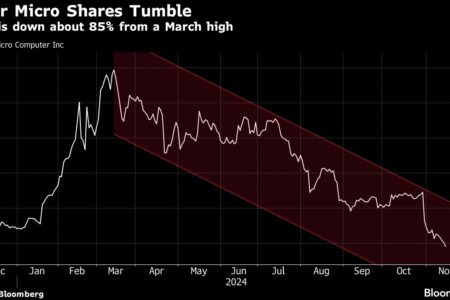

Shares of Super Micro have fallen nearly 70% since it announced it would postpone its annual filing in August. The losses are even steeper when measured from the stock’s record high in March. More than $55 billion in value was wiped out during that period as Super Micro shares fell 85%.

If the company submits a plan approved by Nasdaq, the filing deadline will likely be extended to February. If the plan is not approved, the company can appeal the decision. Nasdaq declined to comment.

The consequences of not meeting the NASDAQ deadline could be severe. If the company is delisted, it would likely mean its removal from the S&P 500, which Super Micro joined this year. It would also likely face early repayment of its $1.725 billion bonds if they were floated on the Nasdaq.

It’s not the first time Super Micro has been omitted from the list. In 2019, shares were pulled from the Nasdaq after the company failed to meet deadlines for filing a 10K and several quarterly reports.

“I’ve never seen a company go through this twice,” Bryson said. “I don’t know how that affects things.”

Super Micro received approval to rejoin the Nasdaq in 2020. The same year, the company resolved an SEC investigation into its accounting by paying a $17.5 million fine. Super Micro neither admitted nor denied the regulator’s allegations as part of its settlement.

This year’s troubles were a reversal for the company’s shares, which rose in the first few months of 2024 amid the AI craze and its addition to the S&P 500.

In its business update in early November, the company gave a weaker-than-expected outlook, saying it expected revenue to range from $5.5 billion to $6.1 billion, well below the $6.8 billion Wall Street had expected.

(Adds stock movement after market open in third paragraph)

Most read from Bloomberg Businessweek

©2024 Bloomberg L.P