POUND STERLING ANALYSIS & TALKING POINTS

- Weaker dollar today gives pound some relief.

- US GDP report & Fed speak the focal points for today.

- 1.21 provides support for GBP/USD.

Recommended by Warren Venketas

Get Your Free GBP Forecast

GBPUSD FUNDAMENTAL BACKDROP

The British pound remains vulnerable despite a slight pullback this morning as the greenback (DXY) trades marginally lower. Ultra-hawk Neel Kashkari continued his aggressive monetary policy stance on both CNN and Fox Business respectively by citing the potential need for another interest rate hike by the Fed.

From a Bank of England (BoE) perspective, money markets have ‘dovishly’ repriced expectations for 2024 in terms of lesser rate cuts by December 2024 to 25bps. The selloff post-BoE last week may have been slightly exaggerated by market participants considering the vote split between hike and pause was so close. This keeps the door open for subsequent rate hikes which reflect in forecasts shown in the table below. Peak rate estimates are similar between the Fed and BoE at present and could quickly change in favor of the pound should the US show signs of economic weakness while the UK finds some resilience in its economic data.

BANK OF ENGLAND INTEREST RATE PROBABILITIES

Source: Refinitiv

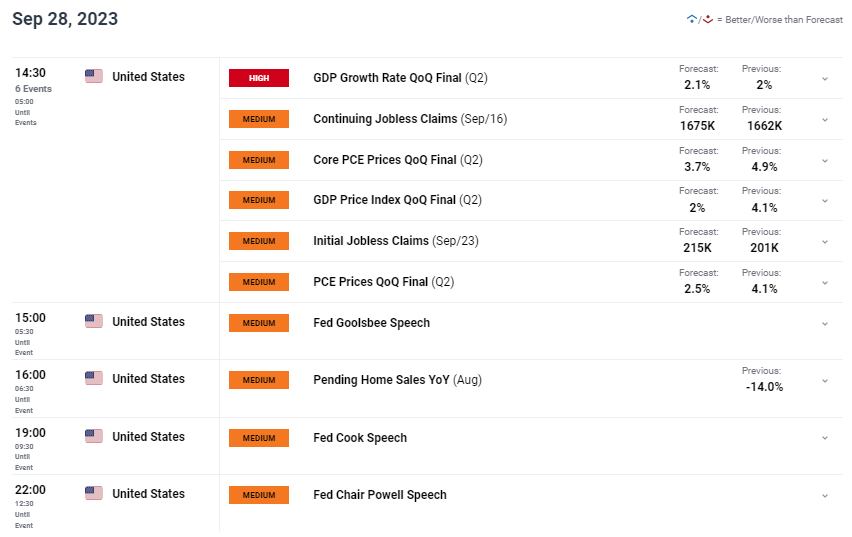

The economic calendar today is squarely focused on US specific factors including US GDP and more Fed speak. GDP is expected marginally higher but other metrics such as the initial jobless claims figure will be crucial as it has been extremely robust of recent. Core PCE is another key release from an inflationary standpoint and the lower forecast could weigh on the dollar. The upcoming Fed speakers including Fed Chair Jerome Powell may give some insight as to whether the hawkish rhetoric set by Neel Kashkari will be maintained or toned down.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

UK ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX Economic Calendar

TECHNICAL ANALYSIS

GBP/USD DAILY CHART

Chart prepared by Warren Venketas, IG

Price action on the daily cable chart above shows bulls defending the 1.2100 psychological handle as the pair trades in extreme oversold territory reflected by the Relative Strength Index (RSI). While there may be a turnaround, this may be short-lived as fundamentals favor the US dollar.

Key resistance levels:

Key support levels:

BULLISH IG CLIENT SENTIMENT (GBP/USD)

IG Client Sentiment Data (IGCS) shows retail traders are currently net LONG on GBP/USD with 71% of traders holding long positions (as of this writing).

Download the latest sentiment guide (below) to see how daily and weekly positional changes affect GBP/USD sentiment and outlook!

Introduction to Technical Analysis

Market Sentiment

Recommended by Warren Venketas

Contact and followWarrenon Twitter:@WVenketas