(Bloomberg) — Stock markets were hammered by a broad selloff in the world’s biggest technology companies ahead of key central bank decisions. Bonds and gold rose as traders rushed to safe havens amid geopolitical risks. Oil remained lower.

Most Read from Bloomberg

The Israeli military struck Beirut, targeting a Hezbollah commander, in response to a rocket attack Saturday in the Golan Heights that killed 12 people. Most S&P 500 stocks rose, but renewed weakness in technology weighed on the index — with Nvidia Corp. down 6%. After wiping $2.3 trillion from the Nasdaq 100, investors awaited Microsoft Corp.’s earnings amid concerns that companies have yet to see returns from artificial intelligence. Its numbers will set the stage for reports from other heavyweights this week, with markets also bracing for a Federal Reserve decision on Wednesday.

“If the Fed doesn’t signal a rate cut in September, markets could get a bit ugly given recent tech weakness — especially if earnings disappoint,” said Tom Essaye of The Sevens Report.

While the Federal Reserve is expected to keep benchmark interest rates at their highest level in more than two decades, traders will be watching closely for any hints that monetary policy easing is imminent. In the run-up to the announcement, data showed U.S. consumer confidence rose on an improving outlook for the economy and job openings beat expectations.

The S&P 500 fell about 1%. The Nasdaq 100 fell 1.5%. The Magnificent Seven index of large companies fell 2.5%. The Russell 2000 index of small companies was little changed. Microsoft Corp. is investigating an outage of some Office applications and cloud services. CrowdStrike Holdings Inc. fell on a report that Delta Air Lines Inc. hired a lawyer after a technology outage. Procter & Gamble Co. fell on sales failures. JetBlue Airways Corp. rose on a turnaround plan.

The yield on the 10-year US Treasury note fell 3 basis points to 4.14%. West Texas Intermediate crude hovered around $75.

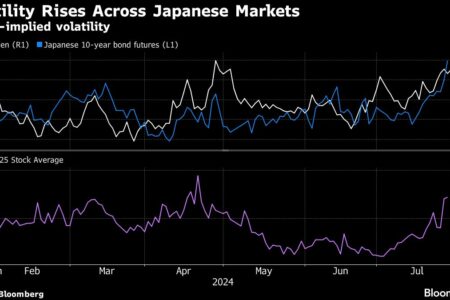

The yen rose. Bank of Japan Governor Kazuo Ueda will come under intense scrutiny on Wednesday when he unveils plans for monetary tightening and announces his decision on interest rates. According to Japan’s newly appointed foreign exchange chief, the yen’s recent weakness has done more harm than good to the Japanese economy.

*BOJ board members discuss raising interest rates to 0.25%: NHK

Whether the stock market’s strong rally this year will continue depends on what the Federal Reserve does and says about interest rates after its two-day meeting wraps up on Wednesday. Since the latest CPI reading showed signs of slowing inflation, traders have been moving away from big tech stocks and toward everything from small-caps to value stocks.

If the Fed is about to start a rate-cutting cycle, history favors bulls. In the past six rate-cut cycles, the S&P 500 has gained an average of 5% a year after the first cut, according to calculations by financial research firm CFRA. The gains have also broadened, with the Russell 2000 index of small companies up 3.2% after 12 months, according to CFRA data.

Goldman Sachs Group Inc. Chief Executive David Solomon said that one or two interest rate cuts by the Federal Reserve later this year are increasingly likely, after just two months ago predicting no rate cuts in 2024.

“One or two rate cuts in the fall seem more likely,” Solomon told CNBC in an interview from Paris on Tuesday. “There is no doubt that there are some shifts in consumer behavior, and the cumulative effect of long-term inflationary pressures, although moderate, is having an impact on consumer habits.”

The S&P 500 has likely already posted the gains it will see this year, but the benchmark still offers broad opportunities for investors, according to Bank of America.

Savita Subramanian of Bank of America says there is potential for strong returns in a few areas, despite being neutral on the index overall: among dividend payers, “old-school” capital spending beneficiaries like infrastructure, construction, manufacturing stocks, and other non-AI themes.

“In mid-2023, sentiment was very negative, and our toolkit indicated that the trend for economic and earnings surprises was more positive than negative,” Subramanian, the firm’s head of U.S. equity and quantitative strategy, told clients in a July 29 note. “Today, sentiment is neutral and positive surprises are easing.”

The company’s most prominent achievements:

-

Pfizer Inc. raised its earnings forecast for this year, citing new cancer drugs as it seeks to break out of a sales hiatus linked to Covid-19.

-

Merck & Co. was hit hard by weak sales of its HPV vaccine Gardasil in China, leading to a decline in profit and quarterly sales that beat Wall Street estimates.

-

SoFi Technologies Inc. raised its earnings and revenue forecasts for this year as the fintech capitalizes on its newer technology businesses and branded lending operations.

-

Archer Daniels Midland Co.’s quarterly profit fell more than expected as the grain trading giant grapples with a slowdown in crop markets.

-

Airbus’ operating profit more than halved in the second quarter after the company booked charges in its space unit, forcing it to cut costs amid lower-than-expected aircraft deliveries.

-

L’Oreal reported slower sales growth in the second quarter, as the world’s largest cosmetics maker suffered from weakness in China.

-

BP Plc maintained its pace of share buybacks and increased its dividend as strong second-quarter profits from crude pumping offset weakness in other parts of the business.

-

Spanish drugmaker Grifols, which has been under attack by short sellers this year, said it overvalued its stake in a Chinese company and reported an accounting adjustment of 457 million euros ($494 million).

Main events this week:

-

Eurozone CPI, Wednesday

-

Bank of Japan Monetary Policy Decision, Wednesday

-

U.S. ADP Employment Change, Wednesday

-

Fed Rate Decision Wednesday

-

Meta Platforms Earnings, Wednesday

-

Eurozone Manufacturing PMI, Unemployment Index, Thursday

-

US Initial Jobless Claims, ISM Manufacturing Index, Thursday

-

Amazon, Apple Earnings Thursday

-

Bank of England interest rate decision, Thursday

-

U.S. Employment, Factory Orders on Friday

Some key movements in the markets:

Stores

-

The S&P 500 was down 0.8% as of 1:23 p.m. ET in New York.

-

The Nasdaq 100 fell 1.6%.

-

The Dow Jones Industrial Average rose 0.2%.

-

MSCI World Index fell 0.5%

-

The Bloomberg Magnificent 7 Total Return Index fell 2.4%.

-

The Russell 2000 Index was little changed.

Currencies

-

The Bloomberg Dollar Index was little changed.

-

The euro was little changed at $1.0817.

-

The pound fell 0.2% to $1.2837.

-

The Japanese yen rose 0.6% to 153.09 yen per dollar.

Cryptocurrencies

-

Bitcoin fell 2.2% to $65,906.04

-

Ether fell 0.9% to $3,292.95.

Bonds

-

The yield on the 10-year US Treasury note fell three basis points to 4.14%.

-

The yield on the 10-year German bond fell by two basis points to 2.34%.

-

The yield on the 10-year UK bond was little changed at 4.04%.

Goods

-

West Texas Intermediate crude fell 1.1% to $74.94 a barrel.

-

Spot gold rose 1% to $2,407.08 an ounce

This story was produced with the help of Bloomberg Automation.

Most Read from Bloomberg Businessweek

©2024 Bloomberg LP