that it Nvidia‘s (NASDAQ: NVDA) Investors are in for a tough time in 2023 and 2024. At least, that’s the feeling in 2023 and 2024. The chipmaker and leading provider of AI computing infrastructure has surpassed $3 trillion in market cap, making it the third-largest company in the world. And after soaring nearly 3,000% in the past five years, it’s now one of the best-performing stocks of all time, making longtime shareholders incredibly wealthy.

I expect this massive success is coming to an end. No, it has nothing to do with the company’s upcoming earnings release in August 28But it’s a growing competitive landscape that could impact Nvidia’s pricing power in the long run. Here’s why I think Nvidia’s massive stock gains are set to end in the next few years.

Cloud Vertical Integration

NVIDIA’s operating revenue has grown more than 2,000% in the past five years to $48 billion. This growth has come because NVIDIA chips are the leading computing tool for the new AI tools that are dominating the tech industry. As the sole supplier of these leading chips and with a technological advantage over competitors like IntelNvidia has seen a huge increase in revenue and profit margins as it sells these scarce resources at very high prices.

Three of its biggest clients are: Amazon, alphabet (Google) and MicrosoftThese are the big three cloud computing companies that form the backbone of AI algorithms and new software. Together, these three companies are likely to spend more than $10 billion a year, and perhaps $20 billion, on Nvidia chips. And now it appears that Nvidia has angered the cloud hornet’s nest.

In a move that hasn’t been widely followed on Wall Street, cloud providers have announced massive investments in making their own AI chips. Amazon, for example, now makes its own chips called Inferentia and Trainium, which directly compete with Nvidia. Nvidia’s products currently lag behind Nvidia’s in terms of computing power, but with so much money being spent on Nvidia’s chips, it makes sense that Amazon would invest billions of dollars in R&D to try to improve those offerings.

Google has its own processors, and Microsoft has announced investments in in-house chip development. It may take years to scale up those investments, but the offer will only increase competition for Nvidia, not the other way around. Worse, the competition is coming from Nvidia’s own customers.

Competition eliminates pricing power.

Operating margin expansion has been one of the main reasons behind Nvidia’s stock gains over the past two years. From a low of about 15%, Nvidia’s operating margin has grown to about 60% over the past 12 months. This has actually contributed to Nvidia’s earnings growth more than its revenue. Revenue has increased 228% over the past three years, while operating margin has increased by a factor of four from its lows.

Nvidia is able to achieve ridiculous margins because of the minimal competition it currently faces in the AI computer chip space. This leads to pricing power, which accelerates revenue growth and expands margins — a great combination of catalysts for the stock. However, this could reverse if competition increases, as it does with the three largest cloud providers. If it continues to replace more and more Nvidia chips with its own brands, Nvidia’s revenue and earnings growth will suffer.

To be clear, the timeline for this competition is not 2024. It could take several years for Amazon, Microsoft, and Google to make a dent in Nvidia’s AI chip business. But the companies have a huge incentive to do so because of the price increases Nvidia has imposed on them. And the Big Three cloud providers have a lot of money to spend on expanding these divisions. And they’re working on it.

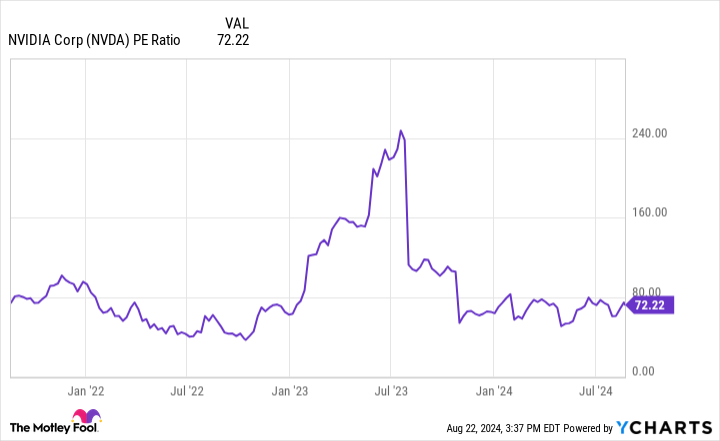

P to NVDA ratio Data by YCharts.

Risks Facing Nvidia Stock

Nvidia stock is on a rollercoaster ride right now. That’s because earnings and revenue are growing at a crazy rate. And the increased supply of AI chips from competitors — whether Amazon or anyone else — could be a double whammy for Nvidia’s finances.

Increased competition means more chips for cloud providers and other buyers of AI chips to buy. The simple law of supply and demand says that prices will fall if supply increases but demand stays the same. That would lead to slower revenues and lower margins, both of which hurt Nvidia’s earnings power.

Today, Nvidia is trading at a price-to-earnings ratio of (price to earnings ratio) of 73, which is nearly three times Standard & Poor’s 500 Average index. This is based on delayed earnings with a very high profit margin of 60%. If pricing power declines, it will impact revenue. and Profit margins. In digital terms, this means that even if Nvidia sells more computer chips in the coming years, profits may actually be much lower.

Stocks with declining earnings are not trading at a P/E ratio of 73. And don’t forget that this ratio would rise to over 100 at its current $3 trillion market cap if profit margins were to fall to “just 40%.” That makes Nvidia incredibly risky, which is why I expect its massive rally to be coming to an end. It’s still a quality company, but it’s not one worth trading at a $3 trillion market cap right now.

Should you invest $1,000 in Nvidia now?

Before you buy shares in Nvidia, keep the following in mind:

the Motley Fool Stock Advisor The team of analysts has just identified what they believe to be Top 10 Stocks There are 10 stocks for investors to buy right now… and Nvidia wasn’t one of them. The 10 stocks that made the list could deliver massive returns in the years ahead.

Think about when Nvidia I made this list on April 15, 2005… If you invested $1,000 at the time of our recommendation, You will have $792,725.!*

Stock Advisor It provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Stock Advisor The service has More than four times S&P 500 Index Return Since 2002*.

*Stock Advisor returns as of August 22, 2024

Susan Frey, CEO of Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Brett Shaffer The Motley Fool has positions in Alphabet and Amazon. The Motley Fool has positions in and recommends Alphabet, Amazon, Microsoft, and Nvidia. The Motley Fool recommends the following options: Buy $395 Jan 2026 Microsoft and Sell $405 Jan 2026 Microsoft. The Motley Fool has Disclosure Policy.

Prediction: This is what will finally end Nvidia’s massive stock gains Originally posted by The Motley Fool