If you are in the market for a luxury Swiss watch now might be your best time to buy — just in time for the holidays.

Subdial, a watch industry data provider, reported that its Bloomberg Subdial Watch Index fell again for the month of November, down 3% from the prior month and 10% from a year ago to £26,912, or $33,740 — a new two-year low.

The Bloomberg Subdial Index tracks a basket of the 50 most sought-after watches by value in the secondhand or used market, representing brands like Rolex, Patek Philippe (MC.PA), and Audemars Piguet.

According to the index, the Rolex Submariner with green bezel (the “Kermit”) was the biggest loser, down 4.6% for the month. The yellow gold Rolex Day Date was one of the few gainers, up an index best of 1.3%.

While Subdial noted that the index fell a whopping 40% in the same time period last year, the 10% decline here should not be ignored.

“A 10% decline in a market in the course of a year is significant. While there is relative calm compared to the previous year, to claim that we have stability feels a bit overly optimistic, not to say that it couldn’t be around the corner,” the report said.

Subdial’s insights also reflect what’s happening in the market for new Swiss watches, which had remained strong in 2023. Bloomberg reported Swiss watch exports declined in July for the first time in more than two years, and average growth since then has been trailing the first half of 2023.

That being said, the Subdial team believes there might be a silver lining. Despite falling prices in the secondhand market, there is still volume in terms of transactions, meaning watches are being bought and sold at the same clip — just with declining prices.

This is a far cry from the heady days during and shortly after the pandemic when supply was low — and factors like social media influencers, crypto’s massive rise, and the feeling that life was too short led to frenzied buying in the luxury watch market across the globe.

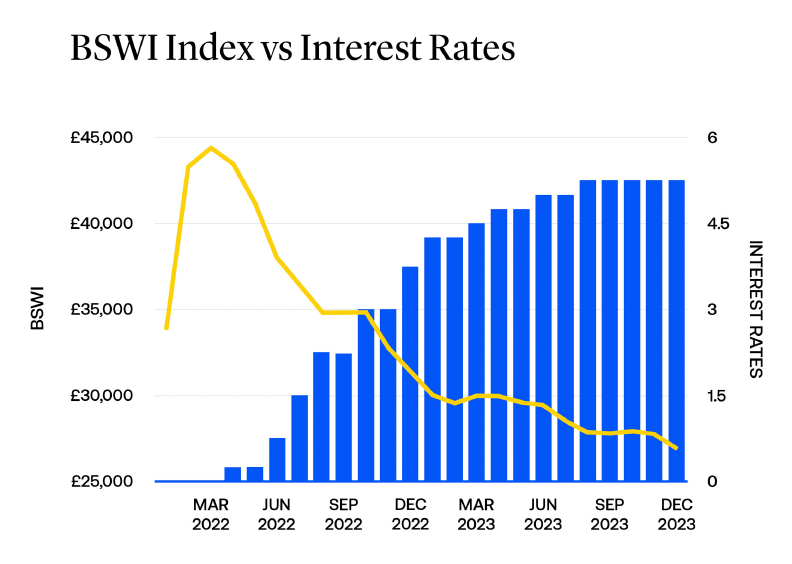

That’s to blame for the Bloomberg Subdial Index dropping 42% from its peak in April 2022.

A potential positive catalyst for the watch market? The future interest rate environment. Subdial found that the slide in the watch market “perfectly” correlated with the Federal Reserve’s rate hikes.

“The period between April and August saw larger rate increases — and steeper declines in the watch market. There was then a brief respite in both before another period of rate increases (and corresponding price declines) going into the end of the year,” Subdial said.

Subdial believes that, with the likelihood of rate hikes in the rearview mirror, there’s “reason for optimism in the market.”

But with traders already pricing in the first Fed rate cut in May of 2024 per Bloomberg, there’s still a long way to go for watch dealers looking for a respite.

For watch buyers, however, it might be time to check in on your local Rolex dealer, even if its watches are likely sold out. You never know: Perhaps there’s a two-tone Rolex Explorer suddenly in stock, because a buyer backed out.

Pras Subramanian is a reporter for Yahoo Finance. You can follow him on Twitter and on Instagram.

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance