(Bloomberg) — Treasuries came under pressure in a holiday-shortened session as investors remained wary of stashing money in U.S. government debt maturing in a decade or more.

Most read from Bloomberg

Long-term debt yields fueled higher moves on Tuesday, adding to the steep trend in the curve that has dominated market trading. Benchmark 10-year yields were trading at 4.62%, up about 3 basis points, with the gap between two-year bonds widening as much as 28 basis points, near their highest levels since 2022. Bonds are trading in a shortened US session, with volumes trading About 50% of the normal rate.

Expectations that the Federal Reserve will end the current easing cycle at a higher level than previously expected and that President-elect Donald Trump’s growth and inflation agenda as well as the possibility of a worsening US fiscal backdrop have weighed on long-term debt. Options traders are betting on those who will benefit if yields move higher.

“We’re now in a rising rate environment, and it’s all really coming from the longer end,” said Tom Di Galloma, head of fixed income at Curvature Securities. “There is a lot of concern about what the next administration will do and how that affects the direction of interest rates. There may be some talk in 2025 about the Fed needing to raise rates, if inflation rebounds sharply.”

The 10-year yield should continue to move up to the next support level at around the 5% level, with the two- to 10-year yield curve potentially hitting 50 basis points sometime next year, Di Galoma said.

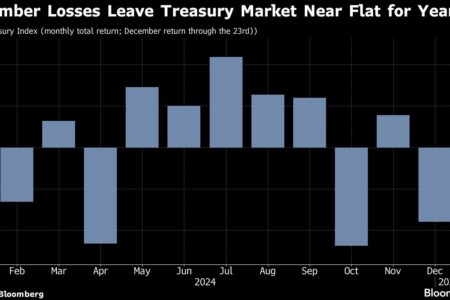

The US Treasury market lost 1.8% this month, trimming this year’s gains to just 0.3%, according to a Bloomberg index through December 23. The complex was up about 4.6% this year through September 17, the day before the Fed. He began his rate-cutting cycle by lowering his policy index by half a percentage point. Last year, Treasuries rose 4.1%, after posting losses of 12.5% in 2022 and 2.3% in 2021.

Treasuries remained lower after the second round of coupon debt offering received good demand. The US Treasury sold $70 billion worth of five-year bonds on Tuesday after its Monday auction of two-year notes was met with strong demand. On Thursday, the Treasury will sell $44 billion in seven-year bonds.

The Securities Industry and Financial Markets Association recommended an early close of the cash bond market on Tuesday at 2pm in New York, before the Christmas holiday on Wednesday.

Swaps traders are pricing in only about 0.33 percentage points of Fed cuts in 2025, less than the quarter-point cuts Fed officials indicated in their latest quarterly interest rate forecasts.

What makes some investors wary of taking big bets now is that even though Republicans control both the US House and Senate, they have small majorities in both, so it’s unclear how much of Trump’s plans will actually come into effect.

“There are a lot of potential paths this could take next year in terms of what policies could be implemented and then how they could impact the economy,” said Julian Potenza, a portfolio manager at Fidelity Investments, which manages $15 trillion in assets. “There’s a lot of uncertainty, kind of uncertainty after uncertainty. Respecting that, we’re not taking any big active bets with respect to the benchmark right now. So our duration and curve positions are very close to home.

– With the assistance of Edward Bolingbroke.

(Updating prices all the time, adding auction results.)

Most read from Bloomberg Businessweek

©2024 Bloomberg L.P