Treasuries edged higher in Asian trading Friday while gold climbed to a fresh record after the latest US inflation reading rose at a slightly slower-than-expected pace.

Article content

(Bloomberg) — Treasuries edged higher in Asian trading Friday while gold climbed to a fresh record after the latest US inflation reading rose at a slightly slower-than-expected pace.

Markets are digesting a raft of news from US inflation data to potential for wider conflict in the Middle East, with earnings season also poised to start for American companies. Oil resumed gains as Israel braced for a potential strike by Iran or its proxies.

Advertisement 2

This advertisement has not loaded yet, but your article continues below.

Article content

Article content

“Overall, there’s a lot of uncertainty right now for markets to deal with,” said Vishnu Varathan, chief economist for Asia ex-Japan at Mizuho Bank in Singapore. “Spots of sticky inflation are lingering uncomfortably despite elevated global rates. Geopolitical troubles mean unwelcome energy-led shocks persist.”

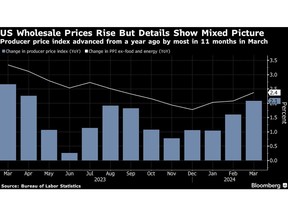

The 10-year Treasury yield fell about three basis points Friday after rising around 22 basis points in the previous two sessions. Data Thursday showed US producer prices in March increased less than forecast, after consumer-price growth came in hotter than expected earlier in the week.

Some sticky inflation readings have prompted market players to slash Federal Reserve rate-cut bets. Swaps traders now see around 43 basis points of cuts from the Fed in 2024 versus roughly 65 basis points before the CPI release.

US corporate earnings are also in focus as several major banks will report on Friday, including JPMorgan Chase & Co., Wells Fargo & Co. and Citigroup Inc.

Wall Street projects S&P 500 members will show 3.8% annual growth in earnings per share for the first-quarter reporting period, data compiled by Bloomberg Intelligence show. Profits for the “Magnificent Seven” cohort — Apple Inc., Microsoft Corp., Alphabet Inc., Amazon.com Inc., Nvidia Corp., Meta Platforms Inc. and Tesla Inc. — are on course to rise 38% in the first quarter, according to BI.

Article content

Advertisement 3

This advertisement has not loaded yet, but your article continues below.

Article content

US futures were steady after the S&P 500 climbed Thursday, while the tech-heavy Nasdaq 100 closed over 1.5% higher. A solid economy is expected to fuel a rise in profit growth for US companies — and strong margins from Big Tech will be a key driver.

“It’s not going to be Federal Reserve rate cuts that drive the market going forward, rather it’s going to be earnings,” said George Ball, chairman of Sanders Morris. “Corporate earnings are much stronger than people have anticipated even in this elevated interest-rate environment.”

Equities in Asia traded mixed. Japanese stocks climbed, while Australian, South Korean and Hong Kong shares traded lower. Chinese counterparts fluctuated.

Traders will continue to monitor the yen after Japanese authorities warned they will consider all options to combat weakness in the currency after it slumped to the weakest level against the dollar since 1990. It was little changed on Friday.

Investors will also be closely watching the offshore yuan after it advanced against the greenback for a fourth time in five trading sessions. The strengthening follows support from the People’s Bank of China on Thursday.

Advertisement 4

This advertisement has not loaded yet, but your article continues below.

Article content

Producer Prices

The 11-month high in US producer prices may have added to worries the economy is still running hot, but did assuage some concerns about the prospect of runaway inflation, according to Quincy Krosby, Chief Global Strategist for LPL Financial.

“The PPI headline number came in a touch lower than estimates, helping markets ease fears of a broad based inflation assault on supply chain prices in addition to consumer prices,” she said.

Fed Bank of New York President John Williams said the central bank has made “tremendous progress” toward better balance on its inflation and employment goals, but added there’s no need to cut in the “very near term.” His Richmond counterpart Thomas Barkin said the US central bank still has work to do to contain price pressures and can take its time before cutting interest rates.

Key events this week:

- China trade, Friday

- US University of Michigan consumer sentiment, Friday

- Citigroup, JPMorgan and Wells Fargo due to report results, Friday.

- San Francisco Fed President Mary Daly speaks, Friday

Some of the main moves in markets:

Advertisement 5

This advertisement has not loaded yet, but your article continues below.

Article content

Stocks

- S&P 500 futures were little changed as of 11:53 a.m. Tokyo time

- Nikkei 225 futures (OSE) rose 0.8%

- Japan’s Topix rose 0.6%

- Australia’s S&P/ASX 200 fell 0.4%

- Hong Kong’s Hang Seng fell 1.6%

- The Shanghai Composite was little changed

- Euro Stoxx 50 futures rose 0.6%

- Nasdaq 100 futures were little changed

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.0727

- The Japanese yen was little changed at 153.15 per dollar

- The offshore yuan was little changed at 7.2551 per dollar

- The Australian dollar was little changed at $0.6539

Cryptocurrencies

- Bitcoin rose 0.3% to $70,714.13

- Ether was little changed at $3,524.58

Bonds

- The yield on 10-year Treasuries declined two basis points to 4.56%

- Japan’s 10-year yield declined two basis points to 0.840%

- Australia’s 10-year yield advanced three basis points to 4.28%

Commodities

- West Texas Intermediate crude rose 0.8% to $85.69 a barrel

- Spot gold rose 0.7% to $2,389.07 an ounce

This story was produced with the assistance of Bloomberg Automation.

Article content