According to one analyst, Tron, a popular smart contract platform and a strong competitor to Ethereum, could be one of the most important layers 1. Based on his assessment, the platform now acts as a transaction layer, similar to Bitcoin.

Tron Leads Peer-to-Peer Stablecoin Transfers

While the network was initially known for hosting decentralized gaming applications in part due to its high scalability and low fees, it has evolved over the years. Speaking about X, the analyst claims that Tron plays a crucial role in providing banking services to the unbanked and underserved in developing economies.

In a post, the analyst said: Notes Tron has been steadily and gradually building its position by prioritizing trustless peer-to-peer (P2P) transaction processing. However, this is a departure from what other platforms, including Solana, Avalanche, and even Ethereum, are doing, which prioritize trading and decentralized finance.

By staying the course and adopting a unique approach, the analyst noted that Tron has now become the leading platform for stablecoin transfers and international money transfers, especially in emerging markets.

This situation is due to Tron’s control over USDT transfers. As of September 18, TronScan data Offers More than $61 billion USDT was held on Tron, not Ethereum and its layer 2 solutions.

Over 95% of Tron users are not traders.

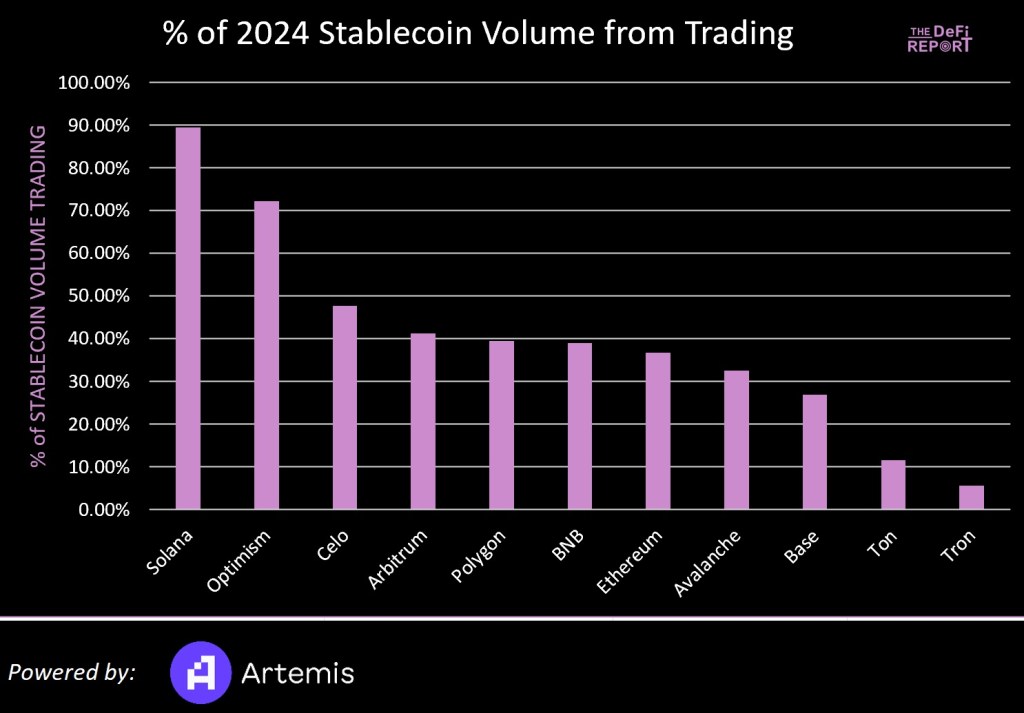

Additionally, while citing Artemis data, the analyst noted that a larger percentage of stablecoin transactions on Ethereum, Ethereum layer 2 networks, Solana, and other layer 1 networks come from trading, but it’s a completely different story on Tron. Here, most USDT and stablecoin transfers are primarily paid for through P2P transactions.

In short, only 5% of stablecoin transfers on Tron over the past year were attributed to malicious Maximum Extractable Value (MEV) bots operating on decentralized or centralized exchanges.

This means that nearly 95% of the USDT and stablecoin transfers made by Tron were genuine P2P transfers. On a deeper level, the analyst notes that the volume of stablecoins made by Tron as of mid-September 2024 was over $3.3 trillion.

When comparing the activity of the Tron stablecoin to that of Solana, the analyst said there is a clear difference. Most of the stablecoin volume on Solana is due to trading activity. While this is not a negative, it does indicate the difference in user cases and business models adopted by the developers of each platform.

Last week, you see a partner In collaboration with Tether and TRM Labs, an agreement was reached to eradicate financial crime on the network. To achieve this goal, the three entities formed the T3 Financial Crimes Unit to assist law enforcement agencies in combating criminals who are improperly exploiting USDT in their activities.

Featured image from Canva, chart from TradingView