A potential strike by 340,000 unionized workers at United Parcel Service Inc. By breaking down progress in addressing two of the biggest stumbling blocks of the American economy in decades: inflation and supply chain disruptions.

Article content

(Bloomberg) — A possible strike by 340,000 unionized workers at United Parcel Service Inc. By breaking down progress in addressing two of the biggest stumbling blocks of the US economy in decades: inflation and supply chain disruptions.

Advertising 2

This ad hasn’t been uploaded yet, but your article continues below.

Article content

In the absence of a business deal by August 1, the walkout of members of the International Brotherhood of Businessmen would hamper shipments of the 19 million packages that UPS moves daily in the United States. It will also enable competitors such as FedEx Corp. From raising prices to help choke off some of the parcels that will flow into their networks.

Article content

Economists say the strike could raise the rate of inflation – which the Federal Reserve has sought to rein in through an aggressive tightening campaign after it hit a four-decade high of 9.1% last year. And if the Teamsters’ demand for much higher wages is met, it could be a harbinger of another huge salary hike, further complicating the Fed’s efforts to get price growth to its 2% annual target.

Advertising 3

This ad hasn’t been uploaded yet, but your article continues below.

Article content

Rising wage costs could prompt consumer products companies to raise prices that have been slowing in recent months, said Cathy Bostancic, chief economist at National Insurance.

Greg Vallier, chief US policy strategist for asset manager AGF Investments Inc. A withdrawal on its own could add as much as 0.2 percentage point to the annual inflation rate.

UPS workers seek relief from pandemic-era spurt in price growth: Current employment decade locked in wage progression from 2018 to 2023.

Article content

Advertising 4

This ad hasn’t been uploaded yet, but your article continues below.

Article content

Teamsters UPS is also seeking critical recognition for service during the pandemic as essential workers.

Union president Sean O’Brien told Teamster members on July 16: “We’re going to get the best contract. This is the biggest collective bargaining agreement in the entire labor movement. So you’re all going to set the tone for the direction of organized labor going forward.”

Talks to renew the five-year contract will resume next week after stalling on July 5. The Teamsters then declined UPS’ offer for a part-time pay increase, which O’Brien called “crumbs”.

He has said that part-time wages should start at over $20 an hour. About 100,000 workers currently employed on this basis, O’Brien said, are paid less than that.

Advertising 5

This ad hasn’t been uploaded yet, but your article continues below.

Article content

Neither party has announced their bids, but the union president said the difference is between $6 and $7 an hour.

UPS workers aren’t the only ones clamoring for more pay. Companies across industries, including railroads, airlines, automakers and even Hollywood filmmakers, are facing huge wage increases as unions seek to restore the purchasing power of their members.

In Canada, a dockworkers’ strike in British Columbia impeded trade from that country’s west coast ports, including Vancouver.

Logistics effect

The supply chain impact of a potential UPS strike is difficult to estimate and the damage will depend on how long it lasts.

Shippers have more alternatives to sending packages than they did during the last UPS strike in 1997.

Advertising 6

This ad hasn’t been uploaded yet, but your article continues below.

Article content

At the time, the package industry moved about 16 million packages per day and UPS accounted for 70% of that volume. About 80% of packages were sent by companies to other companies.

Last year, it handled about 75 million packages per day and UPS shipped nearly 28% of them, according to ShipMatrix, a package industry consulting firm. With the advent of e-commerce, more than half of all packages are now sent to homes.

In the event of a strike, shippers with brick-and-mortar stores may encourage shoppers to pick up items rather than hand them over. It’s possible the companies have already increased their inventory of key parts and supplies to reduce their shipping needs to weather a potential UPS strike, said Mike Skordellis, president of US economics at Truist Wealth.

Advertising 7

This ad hasn’t been uploaded yet, but your article continues below.

Article content

“The business will basically treat it like a hurricane,” Skordellis said. “They prepare beforehand, such as front-loading requests and moving critical components.”

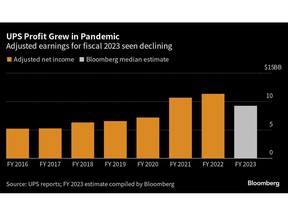

The threat of a strike comes when there is stagnation in the capacity of the parcel industry. Volumes have cooled from pandemic-era highs, when indoor consumers spent some of their stimulus money on goods rather than services.

Amazon.com Inc. expects UPS, the largest customer, saw minimal disruption from the strike, in part because of the summer lull and also because it reduced its dependence on third-party carriers by building its own delivery network.

In 2018, it launched the Delivery Partner Program, which encouraged people to start their own small businesses by hiring drivers and renting trucks to deliver Amazon packages. Globally, there are now more than 3,000 delivery partners with around 275,000 drivers making Amazon deliveries.

Advertising 8

This ad hasn’t been uploaded yet, but your article continues below.

Article content

The retail giant also owns Amazon Flex, an Uber-like app that they can download to earn money delivering Amazon packages in their own cars.

price effects

However, package shipping rates are likely to rise if Teamsters pulls out, with the increases passed on to consumers, said Bart de Moenck, chief industry officer for supply chain data firm Project44 Inc.

FedEx tried to prosecute UPS customers earlier this year. But not many customers accepted the offer because the company wanted long-term commitments on volume.

Changing carriers can be costly for companies because shippers have designed their warehouse processes and systems to align with UPS. They also receive discounts based on volume, which they may lose in the exchange, said Michael McDonagh, Head of Parcels Unit at AFS Logistics LLC.

The timing of the strike may affect back-to-school sales. But the peak season for parcels really starts in November, before the holiday shopping season. Even if there was a strike, it would probably have ended by then.

“If that were to happen, now would be a less impactful time for it to happen,” said Jim Tochler, president of Gift for You LLC in Chicago, whose company size jumps about eightfold during the holiday season.

– With the help of Spencer Super.

comments

Postmedia is committed to maintaining an active and civil forum for discussion and encouraging all readers to share their opinions on our articles. Comments may take up to an hour to be moderated before they appear on the site. We ask that you keep your comments relevant and respectful. We’ve enabled email notifications – you’ll now receive an email if you get a response to your comment, if there’s an update to a comment thread you’re following or if it’s a user you’re following. Visit our Community Guidelines for more information and details on how to adjust your email settings.

Join the conversation