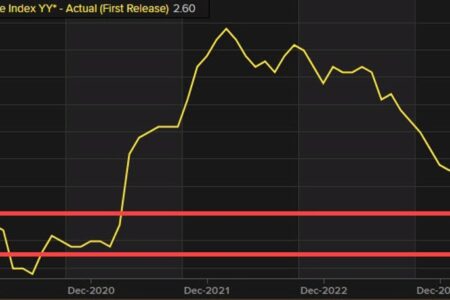

- Core Personal Spending Index in the previous month 2.6%

- Core CPI on a monthly basis was 0.2% vs. 0.1% estimate. The unrounded index was lower than the 0.2% increase at 0.188%

- Baseline PCE in urine last year 2.6% vs. 2.5% estimated. Last month 2.6%

- The monthly CPI was 0.1% vs. 0.1% estimate. The unrounded index was less than 0.1% at 0.0788%

- Personal Spending Index Annual 2.5% vs. 2.5% Estimate and 2.6% Previous

- Personal income rose 0.2% versus estimates of 0.4%. The previous month was revised to 0.4% from 0.5%. Wages and salaries rose 0.3%.

- Personal spending rose 0.2% versus 0.4% the previous month (revised from 0.3%).

- The savings rate reached 3.4% compared to 3.5% last month.

To view the full report from BEA click here

Other views:

- The annual inflation rate for 3 months was 2.3% compared to 2.9% previously.

- 6-month core personal spending annual rate 3.4% vs. 3.3% previously.

Core CPI was slightly higher than expected, in line with the core CPI data released yesterday via the GDP report.

Primary personal expenditure, personal income, and personal consumption

Looking at the markets, returns remain low:

- 2-year yield 4.412%, -3.1bp

- 5-year yield 4.106%, -2.7bps

- 10-year yield 4.221%, -2.5 bps

- 30-year yield 4.465%, principal 0.5bp

A Look at Stock Futures:

- Dow Industrial Average +254 points

- S&P 43.03 points

- Nasdaq rises 200.92 points

The Fed is expected to cut interest rates by 67 basis points by the end of the year, with the cut due in September. That’s not much different from pre-release levels.