Key points of the PCE report:

- US consumer spending in April rose 0.8%, well above expectations calling for a 0.4% increase.

- essence PCE Hours rose 0.4% month-over-month, up 4.7% in the past 12 months, and a tenth of a percentage higher than expectations in both cases.

- gold prices Turning lower as sticky inflation reinforces the case for additional Fed increases

Recommended by Diego Coleman

Get free forecasts in US dollars

Most read: NASDAQ 100 Outlook – Bulls in control but pullback looms and bearish signs to watch

This morning, the US Bureau of Economic Analysis released income and expenditure data for the month of April. According to the government agency, personal consumption expenditures, which account for more than two-thirds of the country’s gross domestic product, rose 0.8% last month versus a forecast of 0.3% — a sign that the American consumer remains healthy and has gas in the US. Thanks for keeping the economy afloat.

Elsewhere in the report, price indicators were somewhat disappointing given the slight improvement in trend. However, core personal consumption expenditures rose 0.4% on the month, pushing the annual rate to 4.4% from 4.2% previously. Meanwhile, Core PCE, the Fed’s preferred measure of inflation, delivered 0.4% month-over-month and 4.7% year-over-year, a tenth of a percent above estimates in both cases.

US personal income and PCE data

source: DailyFX calendar

Recommended by Diego Coleman

Get your free gold forecast

Resilient household spending, combined with viscous inflationary pressures, suggests that the Federal Reserve has more work to do in terms of monetary tightening to restore price stability in the economy. In this context, policy makers may hesitate to hit the pause button and may instead go for another quarter point increase at their June meeting, with a rate hike to 5.25%-5.50%.

If interest rate expectations continue to turn in a more hawkish direction, US Treasury yields will face few obstacles to continue their upward journey, thus boosting the recovery of the US dollar in the foreign exchange market. This scenario should be bearish for precious metals and other price-sensitive assets, especially on the back of stabilizing sentiment and reducing recessionary anxiety.

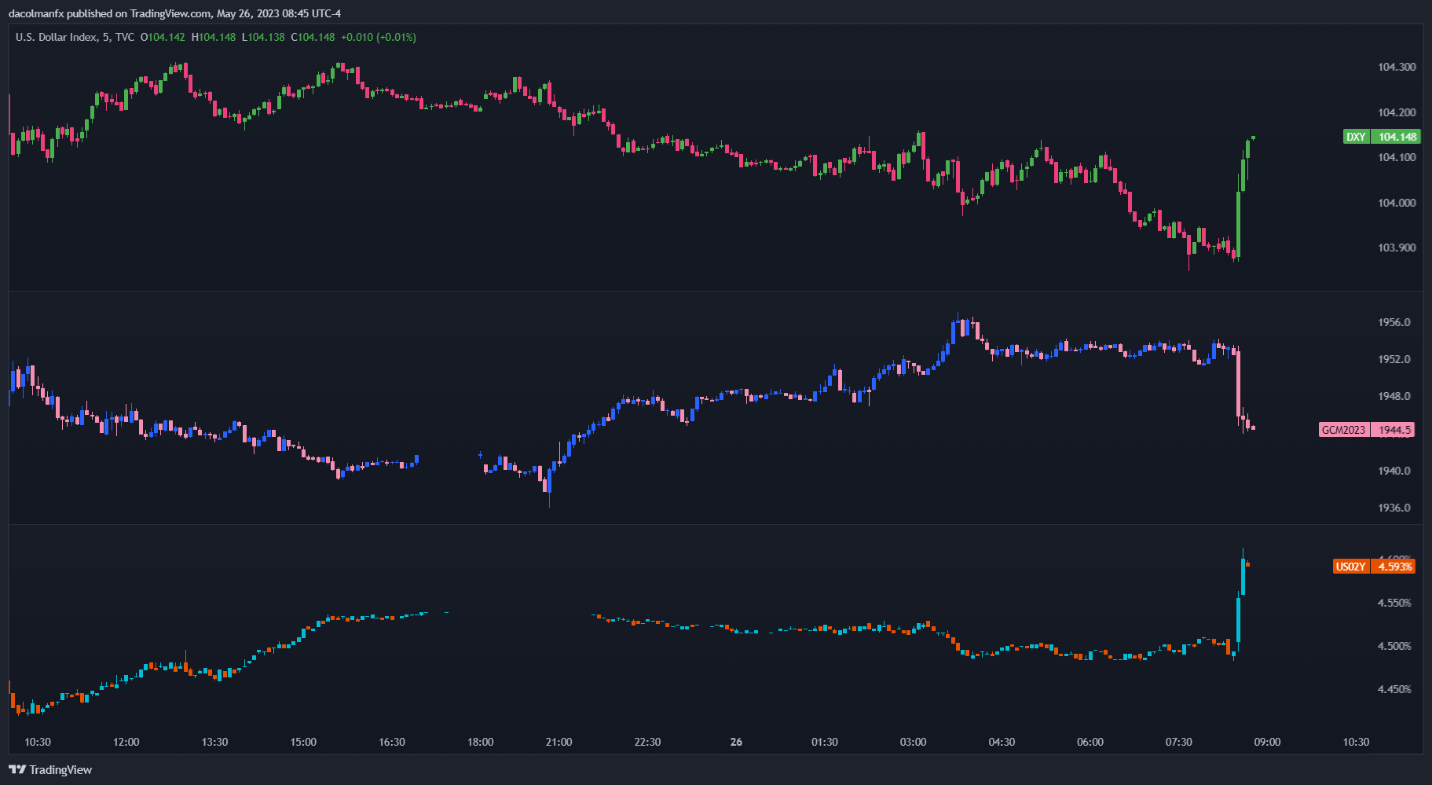

Right after today’s data crossed wires, the US dollar, as measured by the DXY index, rebounded, erasing some of the session’s losses, buoyed by the jump in Treasury rates. For its part, gold took a bearish turn, recouping most of its daily gains to trade near $1945. These moves may continue in the near term.

US dollar (DXY) and gold price chart

source: TradingView