US yields are moving higher and this is sending the US dollar back to the upside:

- The two-year yield was 4.064%, up 5.6 basis points.

- The 5-year yield was 3.566%, up 4.7 basis points

- The 10-year yield was 3.448%, up 3.4 basis points

- The 30-year yield is at 3.635%, up 0.9 basis points

Looking at the major currencies:

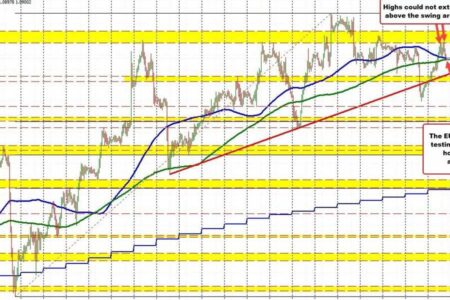

- EURUSD: EURUSD reversed back lower and retested the 100 and 200 hourly moving averages near 1.0898-1.0899. The current price is trading at 1.0900. A return below the moving averages would tilt the short-term bias to the downside. Today’s highs were halted inside the swing zone between 1.0925 and 1.09438.

- USDJPY: USDJPY has moved back above its 100-day moving average of 133.399 and is looking towards the midpoint of the 50% move down from the March high of 133.769. Today’s high has just reached 133,706

- GBPUSD: GBPUSD moved below the 100 and 200 hour moving averages, at 1.24274 and 1.24161 respectively. The buyers got a chance and those buyers tried to hold the support in the US session, but the sellers once again broke the price below the moving average levels tilting the short-term trading bias to the downside.

This article was written by Greg Michalowsky at www.forexlive.com.