Canadian Dollar vs US Dollar, British Pound and Euro – Overview:

Recommended by Manish Grady

Basics of breakout trading

The Canadian dollar may have just received a boost to extend its gains against some of its peers, thanks to the strong rally by the Bank of Canada (BOC) on Wednesday.

The Bank of Canada raised the overnight rate to a 22-year high of 4.75%, saying: “Fears have increased that consumer price index inflation could materially falter above the 2% target.” However, the central bank dropped April’s language saying it was “still willing to raise the policy rate further”, making it more data dependent. Markets are pricing in another rate hike in July, with the final interest rate expected to reach 5.15% by the end of the year.

IG customer sentiment

Source: https://www.dailyfx.com/sentiment-report

Technical charts are increasingly supportive of the Canadian dollar against some of its peers.

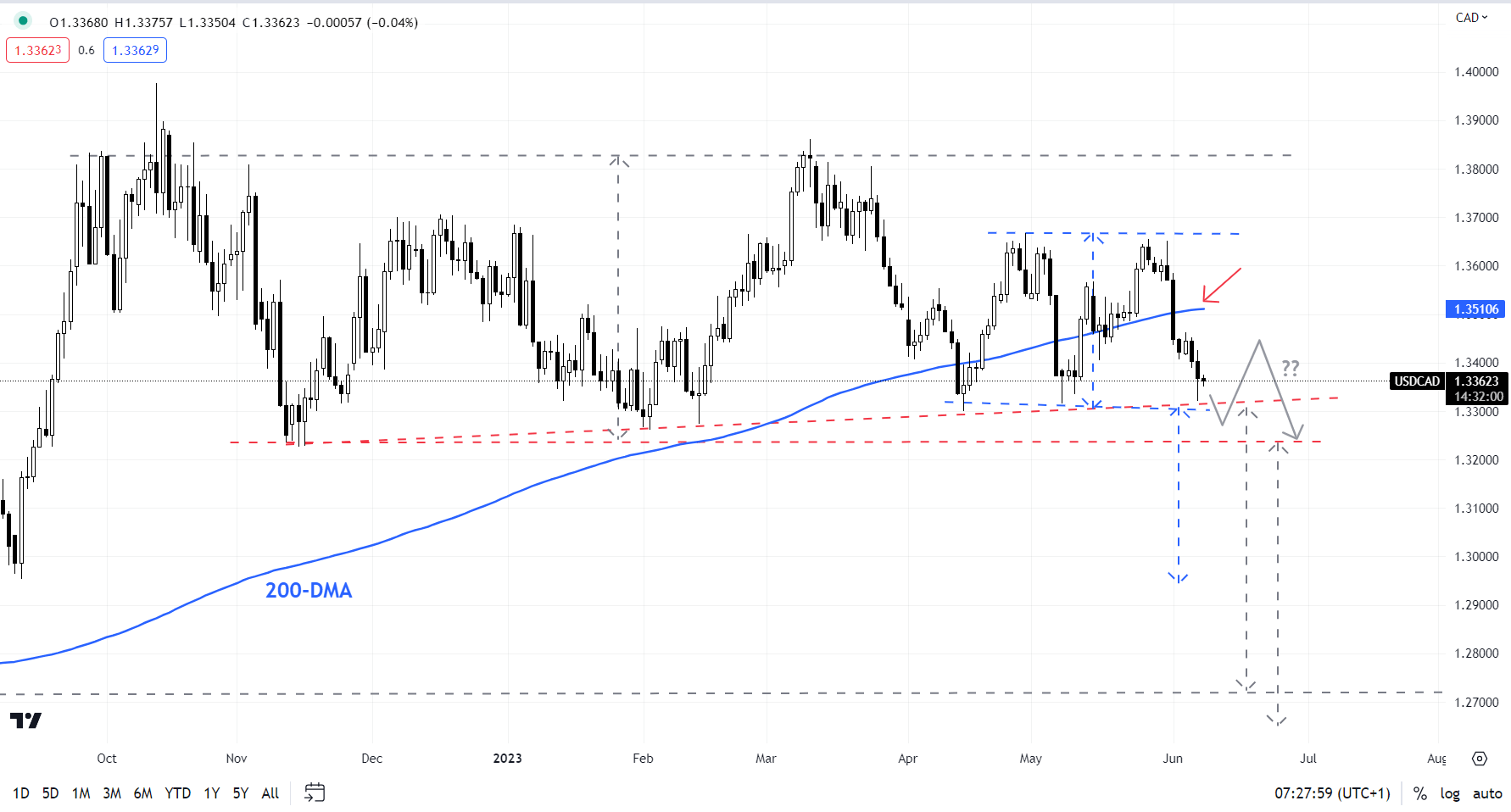

USD/CAD: Imminent bearish breach

USD/CAD has been sideways for months, but conditions may be ripe for a trend. USD/CAD is testing the vital converging support around 1.3220-1.3320, a break below that could pave the way for an initial decline towards the psychological level of 1.3000, and it is likely to head towards the August low at 1.2725.

USD/CAD daily chart

Chart by Manish Gradi using TradingView

Moreover, IG Client Sentiment (IGCS) shows that 70% of retail traders are net long with the long to short ratio at 2.3 to 1. The number of long-term traders is 74% higher than last week. The IGCS data sometimes acts as a contrarian indicator – the fact that traders are net-range reduces the hurdle for USD/CAD to fall.

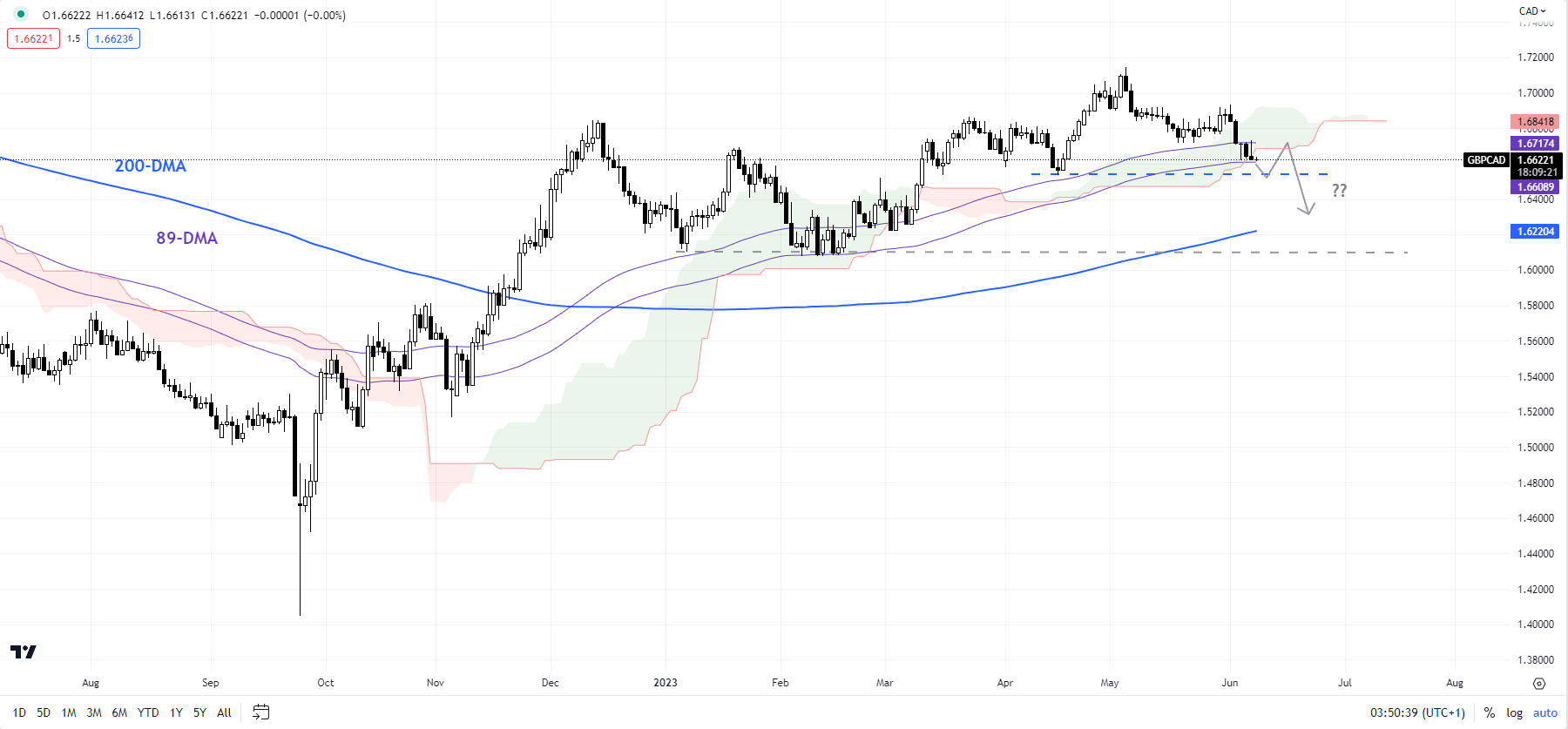

GBP/CAD daily chart

Chart by Manish Gradi using TradingView; Notes at the bottom of the page

GBP/CAD: There is a downside risk towards the 200-DMA

GBP/CAD failed to rise decisively after the year-end high of 1.6850, just above key resistance at the 200-week moving average, and points to fatigue in the nine-month rally. The cross is testing a decisive convergence low, including the April low of 1.6535, coinciding with the 89-period moving average. While a slight bounce cannot be ruled out given the importance of the support, the broader bias remains bearish, perhaps towards the 200 day moving average (now at around 1.6225).

EUR/CAD weekly chart

Chart created using TradingView

EUR/CAD: Slight Pause on the Cards?

EUR/CAD is approaching a major converging cushion on the 200-day moving average and the horizontal trend line from January at around 1.4235. Oversold conditions suggest a slight bounce, but it may not last for long given the recent decline below the 89-day moving average and the Ichimoku cloud on the daily chart. Any break below 1.4235 could present risks of a drop towards 1.4000. On the upside, the late May high of 1.4650 will be difficult to break.

Trade Smart – Subscribe to the DailyFX newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to the newsletter

– Posted by Manish Grady, Strategist for DailyFX.com

Connect with Jaradi and follow her on Twitter: @JaradiManish