USD/CAD PRICE, CHARTS AND ANALYSIS:

Read More: The Bank of Canada: A Trader’s Guide

USDCAD has been stuck in a range since the beginning of November with the recent drop in Oil Prices coinciding with US Dollar weakness keeping the pair rangebound. Many had hope Canadian inflation may bring the recent malaise in USDCAD to an end but that has unfortunately not materialized.

Recommended by Zain Vawda

Get Your Free Top Trading Opportunities Forecast

CANADIAN CPI, US FED MINUTES

The Bank of Canada received a welcome boost today as Canadian inflation followed its US counterpart in declining more than expected. This is key for the Bank of Canada as since the June low of 2.8% inflation had been edging higher with the August print rising to a high of 4%. This isn’t a surprise given that inflation very seldomly returns to Central Banks targeted rate without hiccups, particularly in the current risk environment.

The annual inflation rate in Canada fell to 3.1% in October of 2023 from 3.8% in the previous month, slightly below market expectations of 3.2%. The result was softer than the Bank of Canada’s forecast that inflation is likely to remain close to 3.5% through the middle of next year, strengthening market bets that the central bank is unlikely to deliver another rate hike.

Canadian consumers are already feeling the pinch of the current rate environment and another hike may have thrown a cat amongst the pigeons. Gas prices once again playing a major role in the drop off while a drop in food price inflation will also be welcomed. From a consumer point of view however, Food price inflation remains uncomfortably high at the current 5.6% while rising bond yields keep mortgage costs high as well. Not the greatest outlook for the Canadian economy and something which could continue to weigh on the loonie moving forward.

Source: Statistics Canada

The US Federal Reserve Minutes had little to no impact on markets earlier as the data since suggests the Fed are making big strides as they look to get inflation back to target. For a full breakdown of the FOMC minutes, click here.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

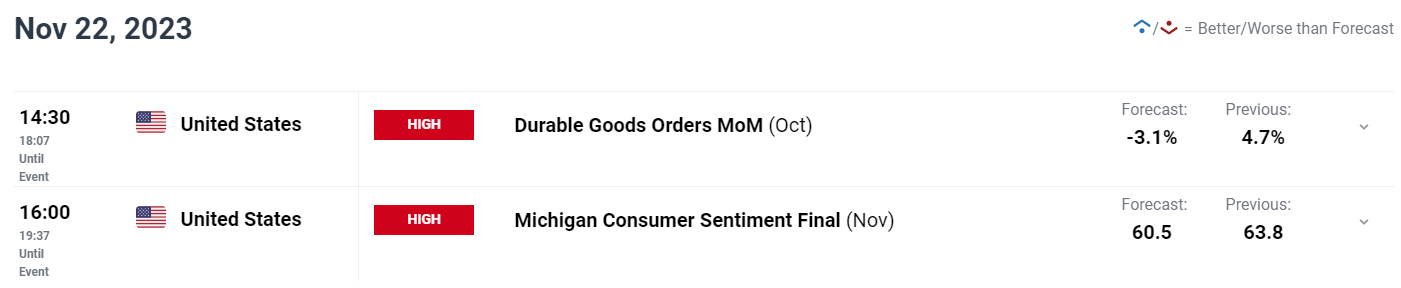

RISK EVENTS AHEAD

Following today’s high impact data there is not a lot left on the Calendar this week. There is some high impact data from the US tomorrow with Durable Goods Orders and the Michigan consumer sentiment final print due as well. Neither of these are expected to have any longer-term impact on the USD and thus USDCAD but rather developments around the Oil price and sentiment around the US Dollar are likely to remain key.

Customize and filter live economic data via our DailyFXeconomic calendar

TECHNICAL ANALYSIS USDCAD

USDCAD failed in its attempts to pierce through the 1.3700 resistance area. Since then, we have seen mixed price action with a lower high followed up by a higher low which is typical during periods of indecision and rangebound trade.

The long-term ascending trendline may come into play if we do push slightly lower and could provide support. There is also the 50-day MA which rests just above the ascending trendline at the recent swing low at 1.3660. A break of the ascending trendline could bring the support area around 1.3550 into play before the 100 and 200-day MA comes into focus.

Alternatively, If the US Dollar stages a recovery the 1.3800 level will provide a stern test for bulls before any attempt at the recent highs around the 1.3900 handle.

Key Levels to Keep an Eye On:

Support levels:

- 1.3660-1.3650

- 1.3600

- 1.3500

Resistance levels:

USD/CAD Daily Chart

Source: TradingView, prepared by Zain Vawda

IG CLIENT SENTIMENT

IG Client Sentiment data tells us that 60% of Traders are currently holding SHORT positions. Given the contrarian view to client sentiment at DailyFX, is USDCAD destined to fall back toward the psychological 1.3500 mark?

For Tips and Tricks on How to use Client Sentiment Data, Get Your Free Guide Below

| Change in | Longs | Shorts | OI |

| Daily | 21% | 2% | 9% |

| Weekly | 39% | 5% | 16% |

— Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda