Japanese Yen (USD/JPY) Analysis

Recommended by Richard Snow

Get Your Free JPY Forecast

Japanese Yen Fails to Appreciate Ahead of Crucial CPI Data and Wage Negotiations

The Japanese Yen has eased once more, as the urgency for a policy pivot from the Bank of Japan (BoJ) wanes. A Tokyo based CPI report earlier this month pointed towards inflation rising at a slower rate for data collected in December – a sign that the country wide measure may also show signs of cooling. Japanese CPI is due late on Thursday evening (23:30 UK time)

The constructed proxy for Japanese Yen performance (equal-weighted average of selected currencies) created below, reveals the recent struggles behind the yen’s lack of bullish impetus.

Japanese Index (GBP/JPY, USD/JPY, EUR/JPY, AUD/JPY)

Source: TradingView, prepared by Richard Snow

USD/JPY Advances Ahead of US Retail Sales, Japanese CPI

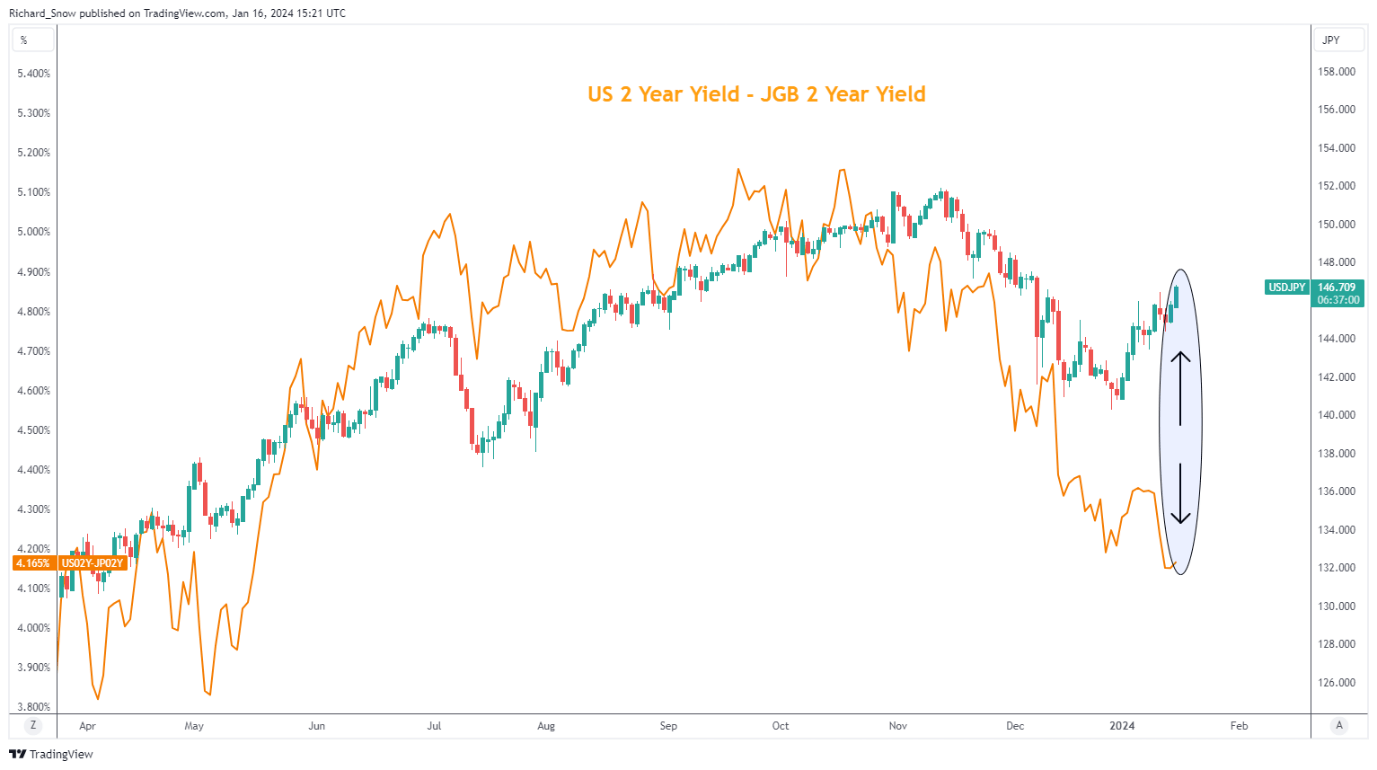

USD/JPY diverges from the US-Japan yield spread as can be seen below. The two had previously trended together but recent JPY dynamics have seen the pair trade higher despite the yield spread remaining at suppressed levels. US retail sales could boost the greenback’s attractiveness if spending in the festive December period brought with it increased activity.

USD/JPY Shown Alongside US-Japan 2-Year Yield Spreads

Source: TradingView, prepared by Richard Snow

USD/JPY now tests resistance at 146.50 after surpassing the 50-day simple moving average (SMA). The 50 SMA acted as dynamic support when the pair was trending higher and has now come into play once again after the pullback. 150 stands as the major level of resistance, a level many would have thought was left in the rearview mirror in the latter stages of last year.

A stronger dollar is rather unusual at a time when markets expect rate cuts as soon as March and inflation is falling at an acceptable pace. However, with the conflict around the Red Sea, the dollar may be benefitting from a safe haven bid – something that has been visible in gold lately (safe haven asset).

Nevertheless, it is still imaginable that after Japanese wage negotiation shave concluded around mid-March, the BoJ may be persuaded to withdraw from negative interest rates. The country’s largest business lobby Keidanren called for wage hikes in excess of inflation this year. Keep in mind that inflation is the other piece to the puzzle, with the bank needing to be convinced that price pressures will exceed the 2% mark consistently and in a stable manner.

USD/JPY Daily Chart

Source: TradingView, prepared by Richard Snow

| Change in | Longs | Shorts | OI |

| Daily | -15% | 12% | 3% |

| Weekly | -14% | 13% | 4% |

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX