US Dollar, British Pound and Euro vs. Japanese Yen – Price Action:

- JPY Under watch for intervention after remarks from senior Japanese currency diplomats.

- Yield Curve Control Adjustment Should Be Discussed – BoJ Summary of Opinions.

- What are the expectations for US dollar / Japanese yenAnd Euro / Japanese YenAnd British pound / Japanese yen?

Recommended by Manish Grady

How to trade the US dollar/Japanese yen

The Japanese yen rose slightly after Japan’s top diplomat said the authorities would respond to excessive moves in the currency market, and after the Bank of Japan governor was quoted as saying the central bank should discuss a review of yield curve control policy at an early stage.

Asked about the chance of intervention in the currency, Japan’s chief currency diplomat Masato Kanda said Monday that he would not rule out any options. USD/JPY is approaching levels that encouraged intervention last year. Separately, the central bank should discuss adjusting the YCC to improve market function and mitigate the “high cost,” a summary of the Bank of Japan’s views at its June policy meeting released on Monday showed.

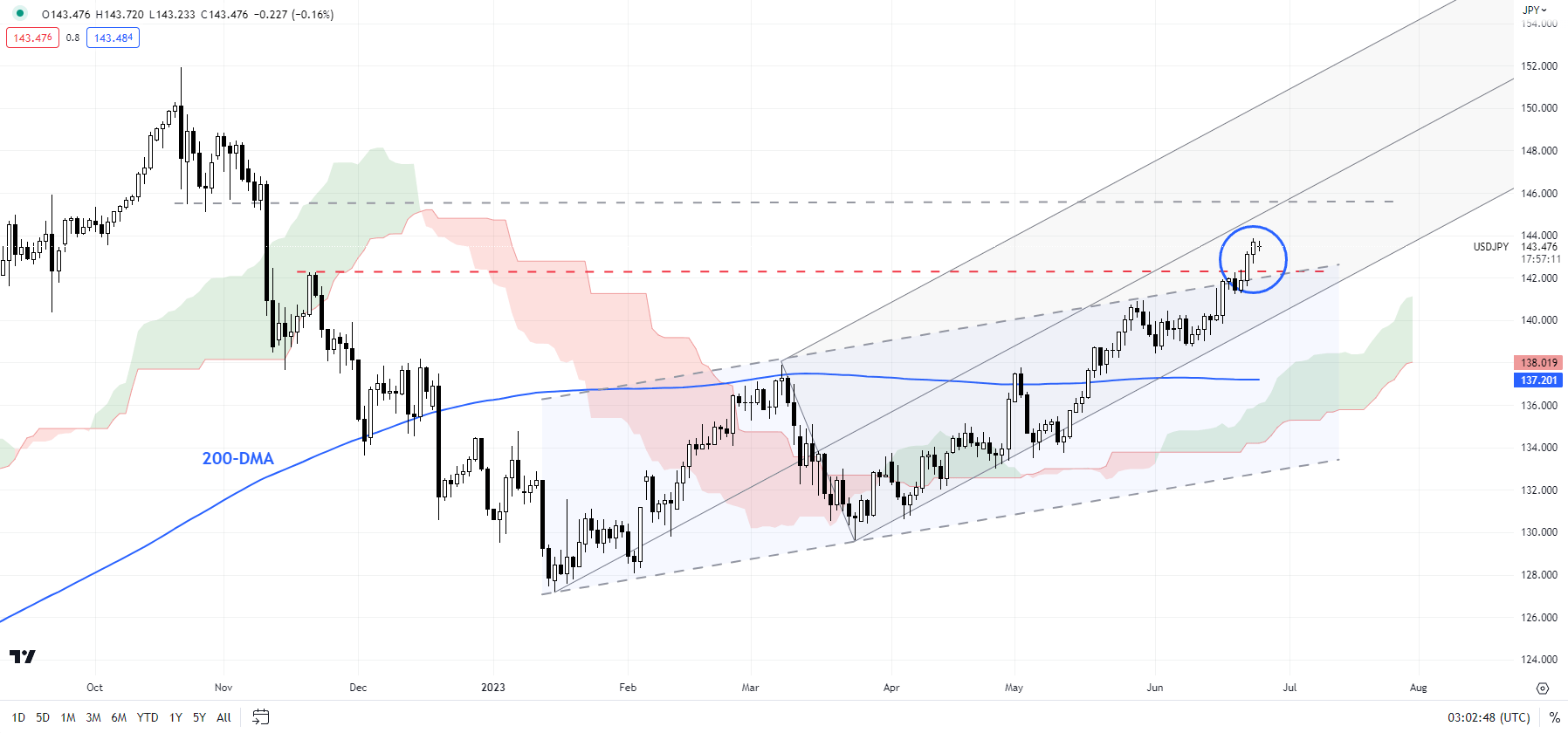

USD/JPY 240 minute chart

Chart by Manish Gradi using TradingView; Refer to the notes at the bottom of the page.

The Bank of Japan left its loose policy settings unchanged earlier this month, particularly the closely watched Yield Curve Control (YCC) policy, in an effort to support the nascent economic recovery and sustainably achieve its inflation target. However, there is a growing perception that YCC could be adjusted as early as July given market distortions on the yield curve. Bank of Japan Governor Kazuo Ueda said the central bank will “patiently” maintain current policy as there is still some way to achieve the 2% inflation target in a stable and sustainable manner.

USD/JPY daily chart

Chart by Manish Gradi using TradingView

USD/JPY: No sign of a reversal

Meanwhile, USD/JPY rose above a very convergent resistance: the upper edge of a rising channel from early 2023, coinciding with the year-end high of 142.25, and is now approaching the mean line of a pitchfork channel from January (at around 143.75). It is showing some signs of losing strength, but there is no sign of a reversal yet – the color-coded candlestick charts indicate that the pair is still in a bullish phase. USD/JPY would need to drop below a major cushion at the end-May low of 141.00 for the immediate bullish pressure to fade.

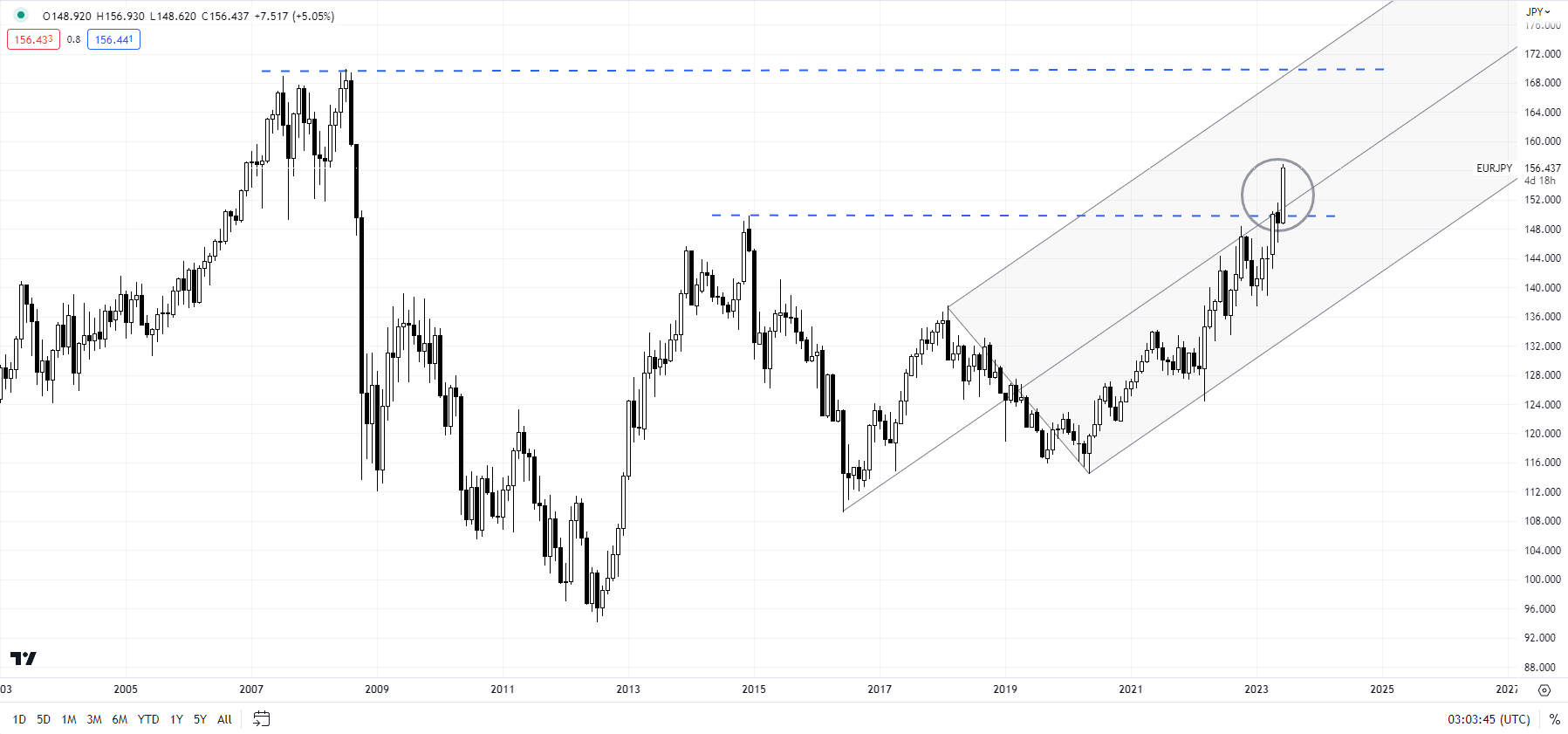

EUR/JPY monthly chart

Chart by Manish Gradi using TradingView

EUR/JPY: Has it breached the resistance?

EUR/JPY rose above the vital convergent barrier at the 2014 high of 149.75, coinciding with the median line of the pitchfork channel from 2016. A decisive break (two monthly closes) above could open the door towards the 2008 high of 170.00 . If the cross could close this month above the resistance level, that would raise the odds. However, a weak close (eg if the crosses regain a large portion of this month’s gains) should lift the odds of a false breakout to the upside.

GBP/JPY monthly chart

Chart by Manish Gradi using TradingView

GBP/JPY: Strong bullish momentum

GBP/JPY looks like it is heading towards 2022 high at 172.15 after breaking above the mean line of the pitchfork channel since February. For further discussion, see “JPY Falls Post-FOMC: Rate Settings in USD/JPY, AUD/JPY, GBP/JPY,” posted on June 15.

Note: The above color-coded chart(s) are (are) based on trend/momentum indicators to reduce subjective biases in trend identification. It is an attempt to separate the bullish and bearish phases, and consolidate within a trend-versus-trend reversal. The blue candles represent a bullish stage. Red candles represent a bearish phase. Gray candlesticks act as consolidation phases (during a bullish or bearish phase), but they sometimes tend to form at the end of a trend. Candle colors are not predictive – they only indicate the current trend. In fact, the color of the candle can change in the next bar. False patterns can occur around the 200-period moving average, around support/resistance and/or in a sideways/volatile market. The author does not guarantee the accuracy of the information. Past performance is not indicative of future performance. Users of the information do so at their own risk.

Trade Smart – Subscribe to the DailyFX newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to the newsletter

– Posted by Manish Grady, Strategist for DailyFX.com

Connect with Jaradi and follow her on Twitter: @JaradiManish