JAPANESE YEN PRICE, CHARTS AND ANALYSIS:

Most Read: FOMC Preview: Hawkish Pause to Reignite the Dollar Index (DXY) Rally?

Download a Free Complimentary Guide for Beginner Traders Below.

Recommended by Zain Vawda

Forex for Beginners

YEN FUNDAMENTAL BACKDROP

The Japanese Yen continues to hover near its YTD lows against counterparts such as the US Dollar, Euro and the GBP. Very little has changed from a Yen perspective with weakness in the Japanese Currency usually met by some form of comments of late from either Government or Bank of Japan (BoJ) officials which seem to keep Yen bears in check.

As we have discussed of late, BoJ Governor Ueda and Government officials appear to be using commentary as a softer approach to actual FX intervention. In sticking with the recent trend, as USDJPY broke above the stubborn resistance around the 148.00 mark in the Asian session we heard comments from FX Diplomat Masato Kanda who stated that they are watching FX moves with a “sense of urgency”. Just a couple of weeks ago we heard from former BoJ officials about the 150.00 mark being seen as key for USDJPY which goes against the official rhetoric of the BoJ which has been targeting volatility rather than FX levels.

The official stance by the BoJ may have something to do with the relationship between Japan and the US. Treasury Secretary Yellen stated that Yen intervention depends on the details of the situation with Kanda confirming that Japan is indeed in contact with US authorities over FX. Secretary Yellen said the US understands the need to smooth out following undue volatility, but not to attempt to influence the level of exchange rates. Markets continue to keep a watchful eye for now but when remains anyone’s guess for now.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

RISK EVENTS AHEAD

Later today we have the US FOMC meeting which with a bullish message could accelerate a potential run towards 150.00 for USDJPY. This could prove intriguing and worth keeping an eye on given the size of the selloff following last year’s intervention. Tomorrow, we have the BoE rate decision and in light of a slowdown in UK inflation we could be in for a pause.

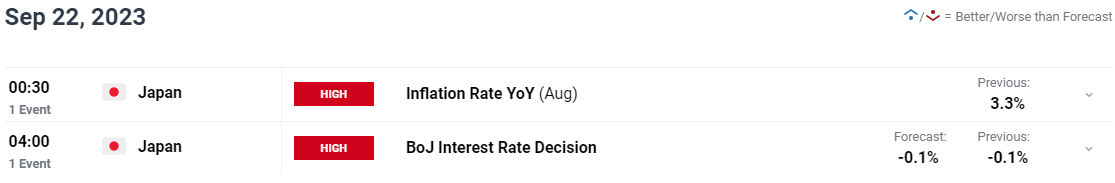

We will end the week with Japanese inflation and the BoJ interest rate meeting. There isn’t any expectation of a further tweak in policy on Friday but as the Japanese Central Bank have shown of late, don’t expect a warning.

For all market-moving economic releases and events, see the DailyFX Calendar

PRICE ACTION AND POTENTIAL SETUPS

EURJPY

EURJPY has kept up with the trend in Yen pairs of late, with selling pressure proving to be short-lived thus far. As is evident on the Daily chart below where I had a potential head and shoulders pattern in play, the break of the neckline proved short-lived with n follow through.

EURJPY has since found support with the 50-day MA and rallying higher today, up around 100 pips (0.27%) on the day. The 160.00 psychological level has thus far held firm. The recent weakness experienced by the Euro no doubt also hampering the ability of a breakout.

For now, rangebound opportunities may remain in play with the BoJ likely to focus on USDJPY when determining its FX intervention strategy. The only cautious word I have is for would be longs in keeping their risk management in check in case of a USDJPY rally around tonight’s FOMC meeting which could trigger the BoJ into action.

EURJPY Daily Chart

Source: TradingView, prepared by Zain Vawda

Key Levels to Keep an Eye On:

Support levels:

- 157.40 (50-day MA)

- 155.90

- 154.73 (100-day MA)

Resistance levels:

- 159.00

- 160.00 (psychological level)

USDJPY

USD/JPY Daily Chart

Source: TradingView, prepared by Zain Vawda

From a technical perspective, USD/JPY has been confined to a tight range on the daily timeframe. As you can see on the chart below (pink block) price has been confined between the 146.50 and 147.90 handles since September 4. We did have a brief pop lower on September 11 but failed to close below the support level of 146.50.

Today’s daily candle is on curse for a shooting star close but could change dramatically following the FOMC meeting. I would say that it may be wise to await a daily candle close today before getting any FOMO about missing opportunities. Any break above 148.00 and acceleration closer to the 150.00 handle has to deal with the impending threat of intervention. Which begs the question is the smarter play being long or short at this stage?

Key Levels to Keep an Eye On:

Support levels:

- 146.50

- 145.00

- 143.60 (50-Day MA)

Resistance levels:

- 147.90

- 150.00 (Psychological level)

Taking a quick look at the IG Client Sentiment Data which shows retail traders are 77% net-short on USDJPY.

For a more in-depth look at USD/JPY sentiment, download the free guide below.

| Change in | Longs | Shorts | OI |

| Daily | 4% | -1% | 0% |

| Weekly | -12% | 2% | -2% |

— Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda