piranka/E+ via Getty Images

The Selected Industry (XLI) sector was back in the red for the week ending May 26 (-1.44%), briefly halting the 3-week slide by posting gains in the previous week. Meanwhile, the SPDR S&P 500 Trust ETF (SPY(was in green for the second week in a row)+0.33%).

The five biggest gainers in the industrial sector (stocks with a market cap of more than $2 billion) have gained more than +6% each week this week. To date, 4 of these 5 stocks are in the green.

Vertif (New York Stock Exchange: VRT) +26.86%. The Ohio-based company, which provides infrastructure and services for data centers, saw its stock surge Thursday (+13.98%).

VRT has a quantitative SA rating – which takes into account factors such as momentum, profitability and valuation among others – for comment. The stock has a factor grade of A- for growth and C- for profitability. The average Wall Street analyst rating varies with Buy, with 6 out of 10 analysts seeing the stock as a Strong Buy. Year-to-date, shares are up +44.51%the most among the five biggest gainers this week.

EnerSys (ENS) +14.73%. The stored energy solutions provider’s results in the fourth quarter beat estimates that led to higher inventory +14.44% Thursday.

The quantitative rating for SA on ENS is Buy with an A+ for momentum but a D+ for the rating. Meanwhile, the average Wall Street analyst rating is Strong Buy, with 3 out of 3 analysts citing the stock as such. YTD, + 33.22%.

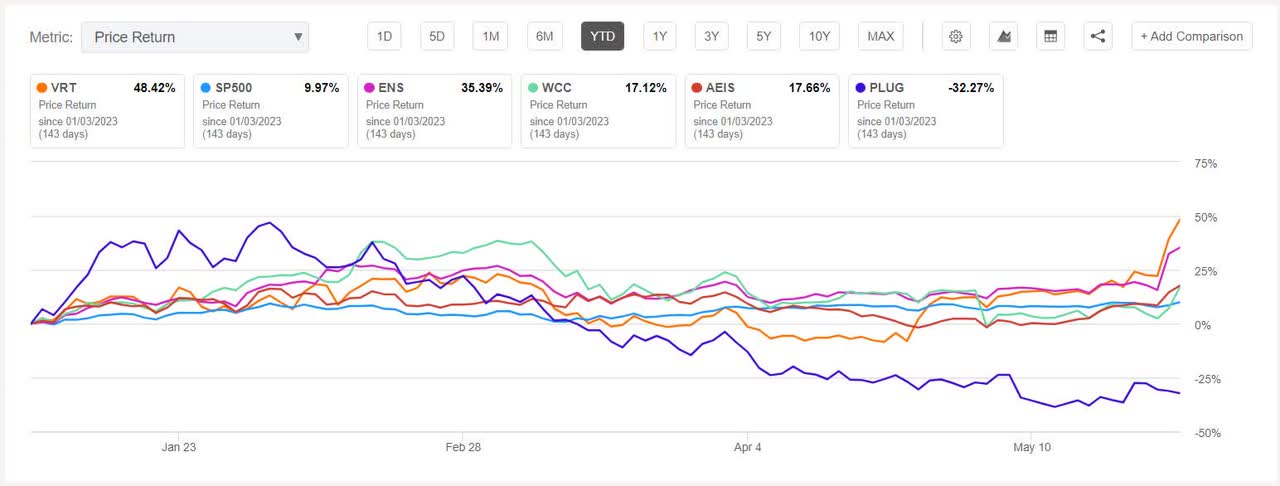

The chart below shows the year-to-date price-return performance of the five biggest gainers and the SP500:

WESCO International (WCC) +8.84%. The Pittsburgh-based provider of business-to-business logistics and supply chain solutions announced an expanded suite of services on Wednesday.

WCC has a quantitative SA rating for retention factor of A+ for growth and C for momentum. This rating contrasts with the Wall Street analysts’ average rating of Strong Buy, with 9 out of 12 analysts seeing the stock as such. YTD, +16.68%.

Advanced Energy Industries (AEIS) +8.49%. Denver-based Advanced Energy rose the most on Thursday (+5.53%). Year-to-date, shares are up +17.34%. SA’s quantitative rating on the AEIS is Hold, which differs from Wall Street’s average rating of Buy.

conduction power (conduction) +6.73%. On Monday, stocks rose +14.23% After the company said it had closed three deals in Europe for green hydrogen-producing electrolyzers with a capacity of 5 megawatts. However, the stock pared its gains while remaining in the red for the next four days.

Year-to-date, shares have fallen -33.31%, and PLUG is the only stock among the five biggest gainers this week that is in the red for this period. Wall Street analysts’ average rating is Buy, which contrasts starkly with the quantitative rating of Strong Sell in South Africa.

The five biggest losers this week among industrial stocks (market capitalization over $2 billion) lost more than -6% all. Year-to-date, only one of these five stocks is in the red.

Kanzhun (NASDAQ:BZ) -17.99%. Shares of the Beijing-based online recruitment platform fell -9.29% On Wednesday though, first-quarter results beat analysts’ expectations. The stock also saw a significant drop on Thursday as well (-8.48%). However, Kanzhun saw Barclays upgrade the stock to Overweight from Equal Weight on an attractive valuation and return potential.

Year-to-date, shares have fallen -29.95%, the only one among the five worst losers this week who is in the red for this period. The company’s stock has seen volatility in 2022. SA’s quantitative rating on BZ carries a B factor score for profitability and growth, both. Wall Street’s average rating varies with a Strong Buy, with 10 out of 14 analysts seeing the stock as a Strong Buy.

AeroVironment (OPEN) -13.33%. Shares of the Arlington, Virginia company fell -15.51% Thursday after the Jump 20 drone was not selected by the US Army to move forward with its Future Tactical Unmanned Aircraft System program.

The SA’s quantitative rating on AVAV is maintained with a factor grade of B for Momentum and C- for Rating. This rating contrasts with Wall Street analysts’ average rating of Buy, with 2 out of 6 analysts indicating the stock as a Strong Buy. YTD, +7.77%.

The chart below shows the year-to-date price-return performance of the five worst losers and XLI:

HEICO (hello) -9.99%. The aerospace product maker’s second-quarter results beat analyst expectations, but the stock fell on Tuesday (-7.89%).

SA’s quantitative rating on HEI is outstanding, with a grade of B+ for profitability and B- for growth. The average Wall Street analyst disagrees with the Buy rating, with 4 out of 11 analysts seeing the stock as a Strong Buy. YTD, +3.68%.

BWX Technologies (BWXT) -6.83%. Shares of the nuclear component manufacturer fell over the course of the week. To date, the stock has gained +6.11%. SA’s quantitative rating on BWXT is Hold, which contrasts with Wall Street’s average rating of Buy.

Canada Pacific Kansas City (CP) -6.72%. Freight Trains got a Buy equivalent rating from analyst Allison Poleynic-Kuzek who noted that the company is “uniquely positioned for long-term growth.”

Year-to-date, the stock is up +3.30%. SA’s quantitative rating over CP is Hold, which varies with Wall Street’s average rating of Buy.